- Cryptocurrency

- January 19, 2026

Table of Contents

Advance fee scams are making a strong comeback in 2026, especially online. You may have seen messages promising “instant loans,” “guaranteed prizes,” or “approved jobs, all asking for a small processing fee to unlock. That tiny upfront payment is exactly how scammers trap people. These scams target anyone stressed about money or looking for a quick yes. They promise big rewards but ask you to pay first.

The truth is, these advance fee scams and upfront payment scams are designed to look official, with fake emails, fake agents, fake documents, and nothing behind them is real. In this guide, we’ll walk you through how these scams work, why they fool so many people, and the red flags you should spot before you send even a single rupee or dollar.

What Does Advance Fee Scam Mean?

When we talk about advance fee scams, we’re referring to any situation where a scammer convinces you to pay something before you receive whatever they promised. That “something” might be a processing fee, a verification charge, a tax, a courier fee, or any other excuse that sounds reasonable in the moment.

At the core, the scammer’s goal is simple: Get the upfront payment, then disappear.

These scams show up in many forms, such as

- guaranteed loan approvals

- fake job offers that require a “registration fee.”

- surprise lottery winnings

- inheritance notifications

- Online sellers asking for deposits

- romance scammers charging “customs fees” or “package clearance.”

- real estate listings demanding advance deposits

No matter what story they tell, the pattern is always the same:

There’s a promise, there’s a fee, and after you pay, the scammer vanishes.

Fraud by advance money is highly effective, as cheaters often sound confident, provide them with fake documents, and make everything appear genuine. They are aware of how to keep you distracted with the reward so that you do not pay attention to the red flags. Knowing this easy scam, pay first, get nothing, will make you see the scam early, no matter how official it appears.

How Scammers Trick Victims with Advance Fee Scams?

Most advance fee scams follow the same predictable pattern. Scammers use confidence, fake paperwork, and a strong sense of urgency to push you into paying an upfront fee. Here’s how it usually unfolds:

-

A tempting offer appears

It could be a loan, job offer, investment return, gift package, or inheritance. The reward looks real and valuable.

-

The scammer gains your trust

They send emails, documents, IDs, or certificates to appear legitimate. This is how many people fall for advance fee fraud.

-

A small advance payment is requested

They may refer to it as a service fee, tax fee, processing charge, or release fee. Regardless of the label, the fee is the primary target of the advance payment scam.

-

No reward ever arrives

After you send the money, the scammer delays, asks for another fee, or disappears completely. You never receive what was promised.

This is the core of every upfront payment scam: you pay first for something that never existed at all.

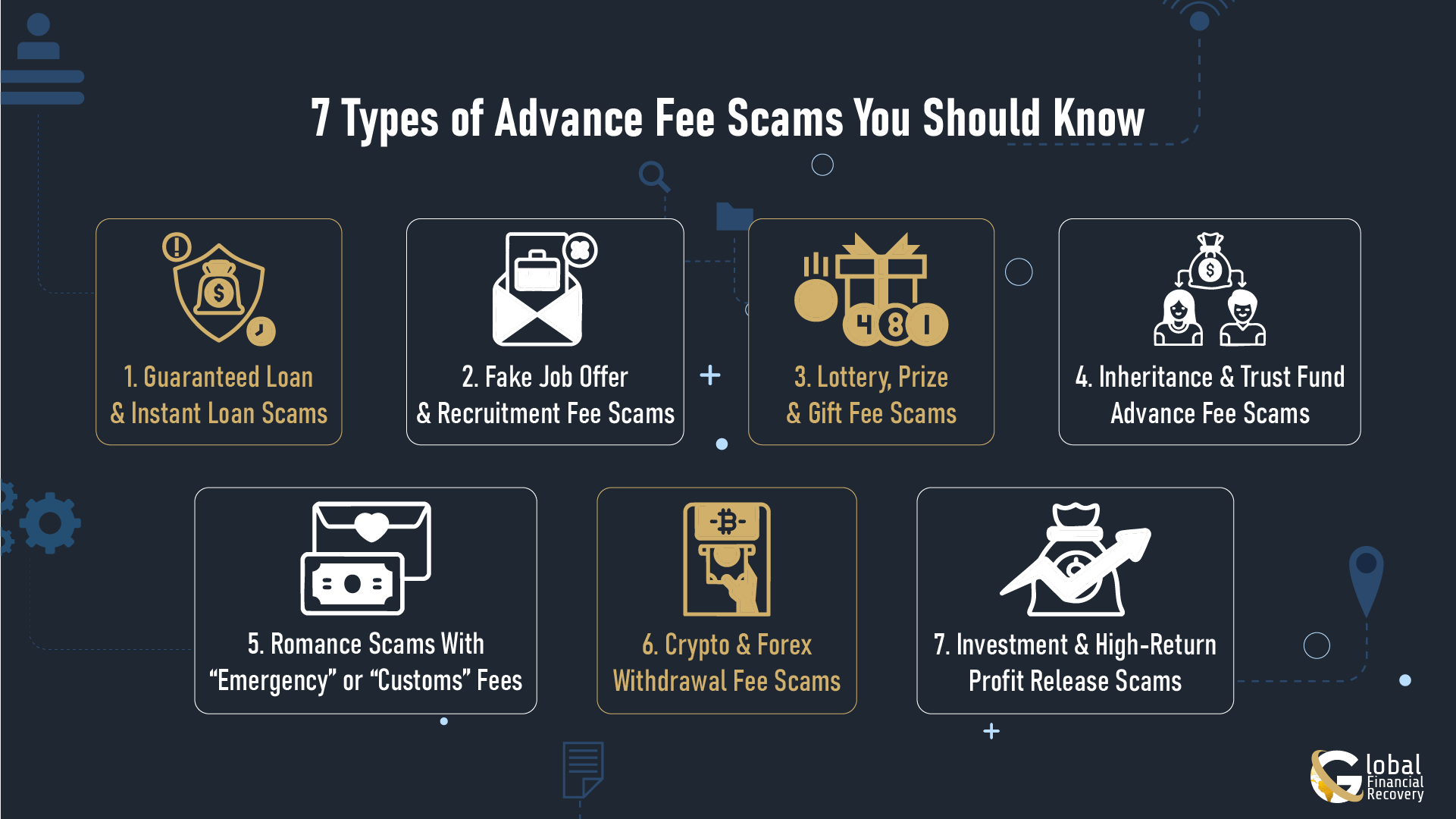

7 Types of Advance Fee Scams

Scammers don’t just stick to one script. They switch tactics depending on who they’re targeting. These are the main types you should watch out for.

1. Guaranteed Loan & Instant Loan Scams

These are everywhere in 2025. Scammers promise “instant approval,” “no credit check loans,” or “guaranteed personal loans,” but they always ask for a processing fee, verification charge, or insurance amount upfront. Once you pay, the loan never arrives.

2. Fake Job Offer & Recruitment Fee Scams

This is one of the most painful advance fee scams because people fall for it during job searches. Scammers send convincing job offers and then ask for registration fees, training fees, document verification fees, or even visa processing charges.

The moment you pay, the “HR” stops replying.

3. Lottery, Prize & Gift Fee Scams

If you ever get a message saying “You’ve won!” but must pay taxes, customs fees, or processing charges, it’s an advance fee scam. These scams work because the prize looks real and the payment looks small, but the prize never exists.

4. Inheritance & Trust Fund Advance Fee Scams

These scammers usually send long emails claiming you’ve inherited a large sum from a distant relative or foreign diplomat. To claim it, they ask for transfer fees, legal charges, or tax payments. Victims pay multiple times before realizing the inheritance was fake.

5. Romance Scams With “Emergency” or “Customs” Fees

Romance scammers often introduce fake emergencies. They might claim they’re stuck at the airport, need money for medical bills, or must pay customs charges for a package they sent you. These emotional pressure tactics are designed to make you send “just one small fee.”

6. Crypto & Forex Withdrawal Fee Scams

This withdrawal fee scam is exploding right now. Fake crypto platforms or unregulated forex brokers show you fake profits on a dashboard, but when you try to withdraw, they ask for tax clearance, unlocking fees, wallet verification charges, or liquidity release fees. After paying, you still can’t withdraw.

7. Investment & High-Return Profit Release Scams

These scams promise huge returns from trading, mining, or investment projects. Once you’re convinced, they ask for a profit release fee, regulatory fee, or unlocking charge before you can “receive your earnings.” The profits never existed; only the fee does.

Understanding these scam types gives you an advantage. Here’s how to recognize them early and avoid getting caught.

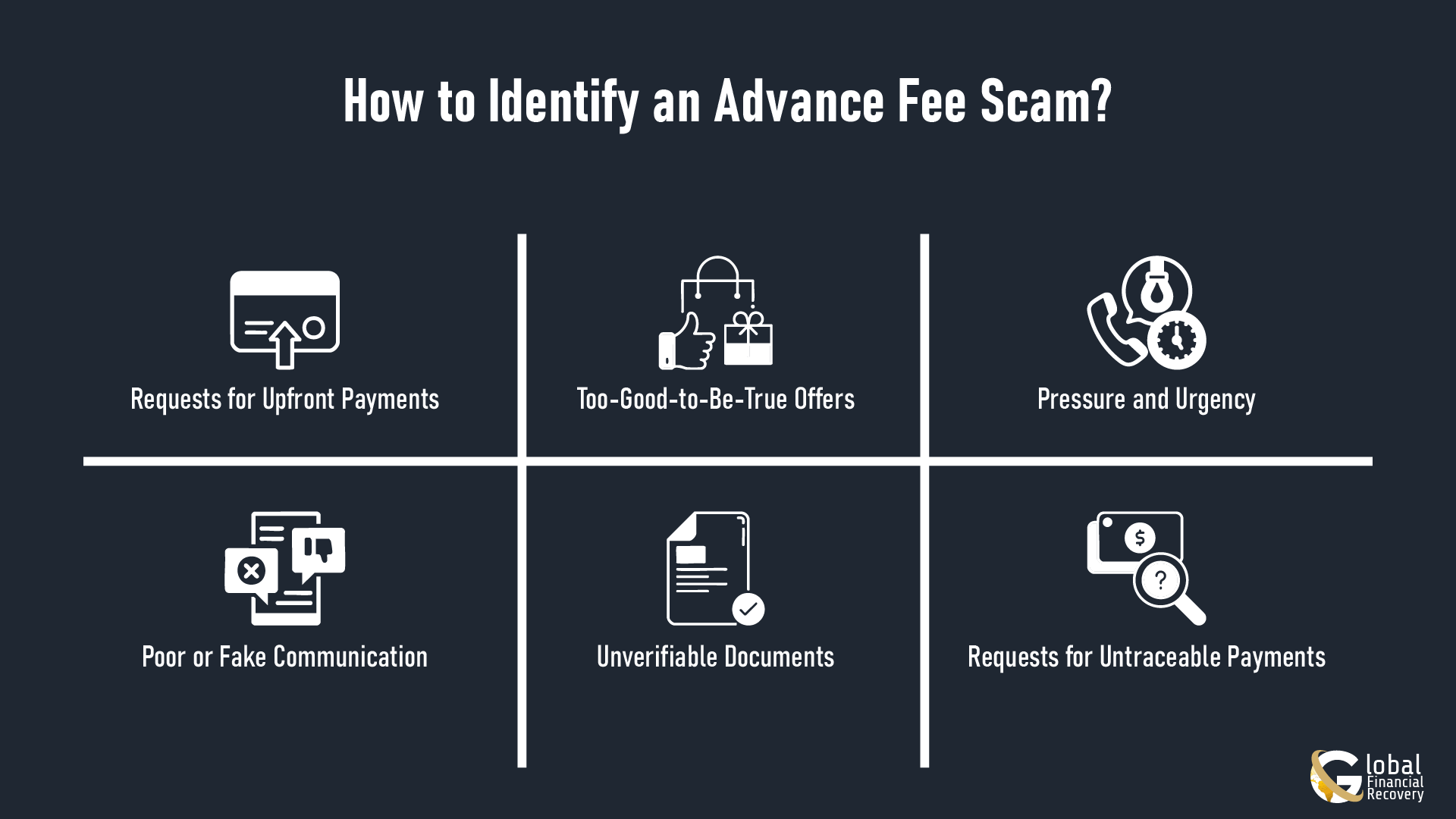

How to Spot an Advance Fee Scam?

Advance fee scams can be tricky, but most follow a predictable pattern. Knowing the warning signs before you send any money can save you from losing hundreds or thousands of rupees. Here’s how to catch these scams early.

-

Requests for Upfront Payments

Any time someone asks you to pay a processing fee, tax, courier charge, or verification fee before receiving a service, prize, or loan, that’s a red flag. Legitimate companies don’t ask for payment before delivering what they promised.

-

Too-Good-to-Be-True Offers

Offers that seem unusually generous, like “instant loan approval,” “guaranteed lottery prize,” or “high-return investment,” are almost always scams. If it sounds too good to be true, it probably is.

-

Pressure and Urgency

Scammers often create a sense of urgency: “Pay now or lose the opportunity!” Real businesses give you time to review and confirm. Urgency is a manipulation tactic.

-

Poor or Fake Communication

Check email addresses, phone numbers, and websites carefully. Scammers often use free email services, misspellings, or fake logos to appear real. If the contact info is hard to verify, it’s a warning sign.

-

Unverifiable Documents

Scammers provide fake documents, contracts, certificates, or bank slips to gain your trust. Always verify documents through official sources.

-

Requests for Untraceable Payments

If they ask for gift cards, crypto transfers, or wire transfers to unknown accounts, it’s almost always a scam. Legitimate companies allow traceable payments through banks or regulated platforms.

Now that you know how advance fee scammers operate, let’s look at the most effective ways to shut them down before they can steal anything.

How to Avoid Advance Fee Scams?

Advance fee scams trick people by making rewards seem close: “Just pay this one small fee.” Don’t fall for it.

- Never pay upfront for loans, winnings, job offers, or inheritance paperwork.

- Verify websites, emails, and names before you trust anyone.

- Walk away from urgency; real businesses don’t pressure you.

- Avoid untraceable payments like gift cards, crypto, or wire transfers.

- Keep your personal info private until the organization is fully verified.

Already paid or shared information? Take action now.

Contact a reliable investment scam recovery service immediately. Theycan guide you through recovering funds lost to advance fee scams.

What Every Advance Fee Scam Has in Common

Advance-fee scams succeed by selling victims false hope. They make the reward feel real, but the only thing that truly exists is the demand for payment.

No matter how convincing the story, paying first for something that hasn’t happened yet is the clearest warning sign. Trust your instincts, take your time, and verify everything before sending money.

And if you’ve already paid someone and feel stuck, you don’t need to handle it alone. Reach out to Global Financial Recovery for guidance on the next steps and support in trying to recover your funds.

FAQs (Frequently Asked Questions)

The clearest sign is simple: you’re being asked to pay before you get anything. Real companies don’t hide behind excuses like “processing charges” or “clearance fees.” If someone wants money up front and keeps assuring you the reward is “guaranteed,” that’s your cue to step back. In real life, nothing guaranteed comes with a fee attached.

These scams do not attack your intelligence; therefore, they attack your situation. Whenever one is stressed over money, needs to get a job, or is optimistic about loan approval, then he or she is more likely to believe an enticing message. Fraudsters have a better understanding of emotions than average individuals anticipate. It is not about being careless but rather about being a human.

When it comes to loans, job offers, prize claims, or investment withdrawals, yes. Legitimate organizations deduct charges from your final payout; they don’t make you pay first. If someone says you must “unlock,” “release,” or “verify” funds with an advance payment, it’s a fabricated barrier designed to extract money from you.

It depends on how fast you act and how the payment was made. Bank transfers and UPI payments can sometimes be escalated if you report them early. Crypto and gift card payments are harder, but not hopeless, if you have enough evidence. The key is to keep every screenshot, stop further contact, and seek proper guidance on the recovery process instead of trying random online “refund agents.”

- Do a 60-second reality check.

- Can you find their company online?

- Does the email look professional, not like a personal Gmail?

- Do their claims match something you actually applied for?

- Are they refusing video calls or pushing you to pay instantly?

If two or more of these feel wrong, the “opportunity” is almost certainly manufactured.