- Miscellaneous

- January 6, 2026

Table of Contents

The forex market moves fast, and for beginners, automated trading bots, or Expert Advisors (EAs), seem like a shortcut to easy profits. But as their popularity has grown, so have forex trading bot scams in 2026. Scammers now exploit beginners’ trust in technology, promising effortless returns while stealing deposits. Learning how these scams operate is the first step toward protecting your money.

They are designed to scan the market, analyze price movements, and execute trades automatically. They’re marketed as the easiest way to make consistent profits, even if you have zero trading experience. And that’s exactly why scammers love them.

In recent years, fake forex bots have multiplied, using bold promises like “risk-free income” or “guaranteed daily returns.” They target beginners who trust technology more than their own financial instincts. Unfortunately, most of these bots don’t trade at all, and victims lose their entire investment. Understanding how these scams work is the first step toward protecting yourself and your money.

In this blog, we will learn about what forex trading bots are, how forex trading bot scams work, how to spot them, and how to avoid these scams. Before we dive into the scams, let’s look at what trading bots are and why they appeal to investors.

What are Forex Trading Bots & Why are They Attractive?

Forex trading bots, often called Expert Advisors (EAs), are automated software programs. These are designed to analyze prices, spot opportunities, and place trades on behalf of the user. They rely on algorithmic trading, meaning decisions come from rules and market signals rather than human impulses.

When used properly on a regulated trading platform, legit trading bots offer some real benefits:

- They trade 24/7, even when you’re asleep

- They react faster than humans during market swings

- They eliminate emotional mistakes like fear or greed

- They can back-test strategies using real data before going live

Those advantages are exactly why trading bots have exploded in popularity, especially among beginners looking for easy profits.

But that demand has also become a goldmine for scammers. They exploit trust in automation, selling bots that claim guaranteed returns and faking profitable dashboards. Also, operating on unregulated platforms where withdrawals suddenly stop. The promise sounds perfect until the money disappears.

Expert Advisors can work, but only when the bot, the broker, and the strategy are real. Understanding the difference between legitimate algorithmic trading and a scam is the key to staying safe. Unfortunately, not all bots are created equal. These advantages make bots attractive, and that’s exactly why scammers have jumped on the trend. Let’s see how some bots are used to trick investors.

What is a Forex Trading Bot Scam & How Does it Work?

A forex trading bot scam is when fraudsters create software that pretends to trade automatically on your behalf. But never actually uses any real strategy or algorithmic logic. These fake bots often come with glossy dashboards, fabricated performance charts, and customer reviews that look professional but are entirely made up. Their goal is simple: convince you to deposit money into a platform they control.

Here’s how the scam usually works. You’re shown screenshots of “successful” trades or past performance claims that promise steady, risk-free profits. Once you sign up and deposit funds, the bot either doesn’t trade at all or executes random trades designed to wipe out your balance. In some cases, the scammers don’t bother running any trades; they simply block withdrawals or disappear with your money.

Most fake trading bots rely on automation hype. Scammers know that many new traders want an easy, hands-free way to earn. They use terms like “AI-powered trading,” “guaranteed profit algorithm,” or “expert advisor with 95% accuracy” to make the software sound advanced and trustworthy when it’s just a fake interface designed to steal deposits. To understand the danger, it helps to see the common tactics scammers use behind the scenes.

Tactics & Mechanics of Forex Trading Bot Scams

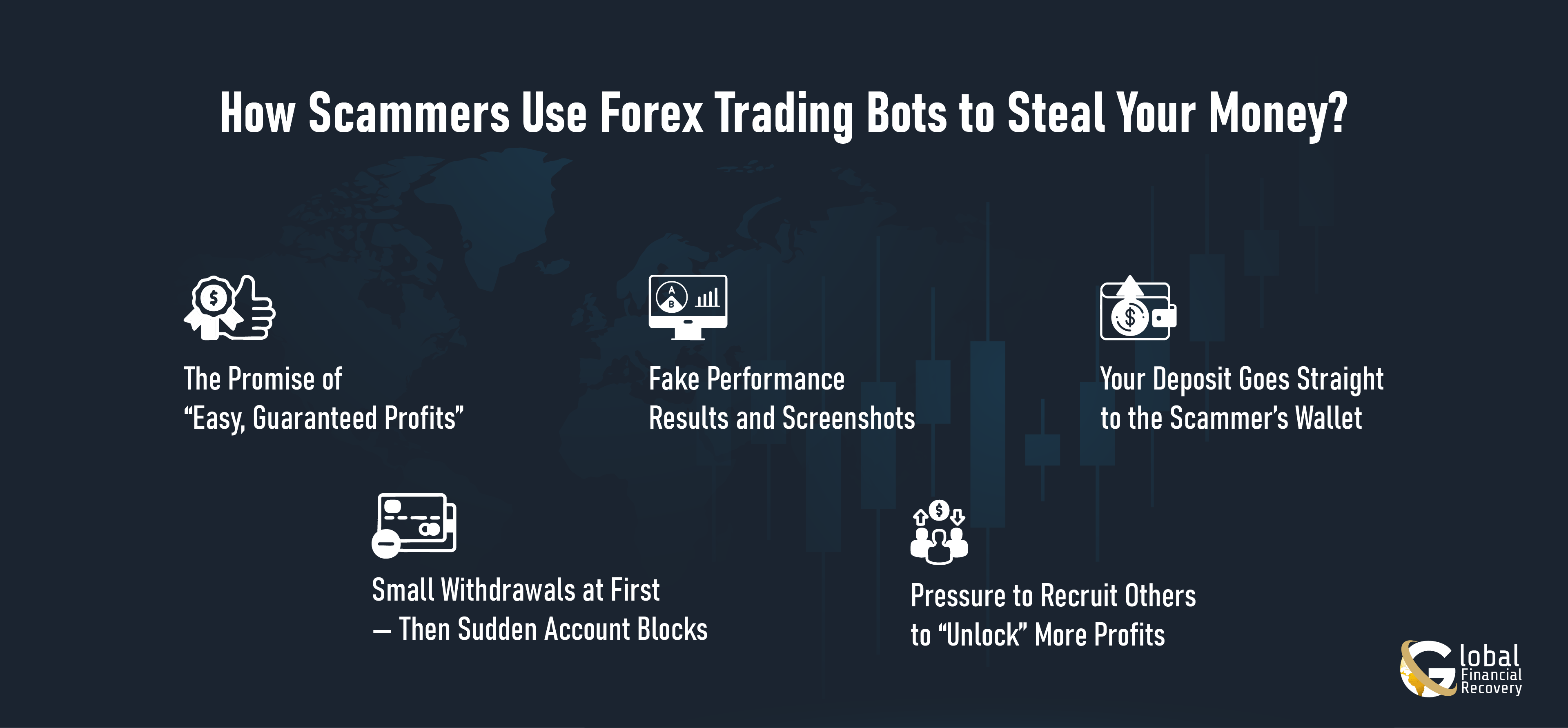

Scammers behind fake forex trading bots follow a predictable pattern, but they hide it well. Their first tactic is to manufacture trust. They build polished websites, show off fake certificates, and use phrases like “AI-driven trading” or “guaranteed returns” to make the bot sound advanced. Most victims don’t realize that none of this technology actually exists.

Once you deposit money, the mechanics shift. The scammers control the entire trading environment. They can manipulate dashboards, show fake profit spikes, or delay live prices to convince you the bot is performing well. This illusion keeps you depositing more.

When you finally try to withdraw, the scam becomes clear. You may be asked to pay “taxes,” “upgrade fees,” or KYC charges, none of which are real. Others simply lock your account or close the website altogether. Behind the scenes, no real trading ever happened. The entire system is built to take deposits and prevent withdrawals. Fortunately, most of these tricks follow a predictable pattern. Knowing the red flags can save you from losing your investment in a forex trading scam.

How to Spot Forex Trading Bot Scams?

Scammers rely on flashy dashboards, fancy terms, and bold promises to lure traders. But spotting a fake forex trading bot is easier than you think if you know what to look for.

|

Red Flags |

What It Looks Like |

What It Really Means |

|

Guaranteed returns |

5% daily profit, no losses! |

The bot isn’t trading. Profits are fabricated to lure deposits. |

|

Secret trading strategy |

Advanced confidential AI cannot reveal the algorithm. |

There is no real strategy, and they want to avoid scrutiny. |

|

Fake dashboards / perfect charts |

Live profits are always going up with zero dips |

Results are simulated to make you believe the system works. |

|

Withdrawal delays or sudden fees |

Extra taxes, AML charges, and account reviews |

The scam has been activated. Your money is already gone. |

|

Crypto-only payments |

Deposit with Bitcoin, USDT, gift cards |

Funds will be untraceable; scammers avoid bank regulation. |

|

Pressure to top-up |

Upgrade to a premium bot, and deposit more immediately |

Losses are manufactured on purpose to force more deposits. |

|

No regulation proof |

Offshore licenses, fake certificates |

No legal oversight = no protection and no accountability. |

|

Hype-filled Telegram or influencer promo |

Screenshots of others “earning big.” |

Fake social proof staged to trigger FOMO. |

|

Anonymous or hidden founders |

No team profiles, no address |

The people behind it plan to disappear with your funds. |

|

Referral rewards |

Earn by recruiting new investors |

The bot profits from new victims, not real trading. |

The moment you see bold claims like “risk-free income,” or you face excuses when trying to withdraw, stop. Scammers thrive on pressure. Don’t let them rush you. Pause, investigate, and make sure your money stays in your control.

How to Protect Yourself From Trading Bot Fraud?

Protecting yourself from forex bot scams isn’t complicated; it just requires slowing down, asking the right questions, and not rushing into anything that seems too good to be true. Here’s how you can stay one step ahead of the scammers without needing to become a trading expert.

-

Research the Bot and the Team Behind It

Before trusting any bot, take a few minutes to look it up outside its website. Most scams fall apart the moment you start searching for real user experiences.

If you find nothing but paid reviews, repeated comments, or overly polished testimonials, that’s usually a sign you’re dealing with a manufactured reputation. A genuine expert advisor has genuine discussions about it, whether good, bad, or mixed.

-

Demand Full Transparency on How the Bot Works

Legitimate trading bots don’t hide behind vague phrases like “secret algorithm,” “AI-powered precision,” or “exclusive market logic.”

If the creators can’t explain the basic idea behind the strategy, or if they dodge questions about backtesting results, they’re telling you everything you need to know: the bot isn’t real. A real developer will happily explain how the system trades, what risks it carries, and what users should expect.

-

Verify Which Broker or Platform the Bot Is Connected To

One of the easiest ways to spot a scam is to see which broker the bot forces you to use.

If it only works with some offshore broker no one has heard of, that’s a serious warning sign. Regulated brokers don’t hide; they publish license numbers you can verify in a few seconds. Scambots, on the other hand, typically push users toward unregulated platforms where money disappears without a trace.

-

Start Small or Test With a Demo Account First

You don’t need to invest big to see whether a bot behaves normally.

Start with a demo if they offer one, or use the smallest possible deposit. See how the bot reacts when the market gets volatile or when major news breaks. Scam bots look perfect when things are calm, but fall apart the moment real pressure hits. Small testing protects you from losing real money while still letting you see what the system actually does.

-

Treat "Guaranteed Profits" as a Red Flag

Whenever you see fixed profits, zero-risk claims, or daily return guarantees, assume the opposite is true.

No trading system, not even those run by professional quant teams, can promise that kind of consistency. These lines are designed to pull in beginners who haven’t learned how unpredictable the markets really are.

Real bots might make money, they might lose money, but they never promise perfection.

-

Keep Your Trading Accounts and API Keys Secure

Your trading API is basically a master key to your funds, so don’t hand it over lightly.

If a bot asks for permissions that allow it to withdraw money or bypass security settings, that’s your cue to walk away immediately. Limit access, enable two-factor authentication everywhere, and check your account activity regularly. Small habits can stop a scam from turning into a big loss.

-

Stay Alert — Scammers Constantly Change Tactics

Trading bot scams shift all the time. What worked for scammers two years ago looks different today.

Following the updated warnings, reading about new tactics, or simply keeping an eye on regulatory alerts can save you a lot of trouble. The more informed you are, the less likely you are to fall for something that “looks legitimate” at first glance. Even if you fall for these scams, consult forex scam recovery experts to get back your money as fast as possible.

Build a Secure Trading Strategy You Can Trust

Automated trading can be helpful, but the industry is flooded with bots that look professional on the surface and operate like traps underneath. If something feels too perfect, too consistent, or too secretive, it’s almost always a scam. Trust your instincts, do your homework, and never hand your money to a system you barely know.

If you’ve already paid into a suspicious forex bot or an unregulated broker is blocking your withdrawals, you don’t have to deal with it alone. We help victims untangle what happened and explore real recovery options.

If you suspect a trading bot scammed you, contact Global Financial Recovery for a free consultation.

FAQs (Frequently Asked Questions)

A legitimate bot can help automate trading, but no bot can guarantee profits in a market as unpredictable as Forex. If a bot promises fixed daily or weekly returns, that’s almost always a scam. Real trading involves wins and losses, no matter how smart the algorithm is.

Scammers know results are the first thing investors ask for. So they create:

- Fake MT4/MT5 statements

- Photoshopped Myfxbook links

- Simulated charts instead of real trades

Unless the performance is independently verified and linked to a regulated broker, assume the results are fabricated.

Because their money isn’t coming from trading, it’s coming from you and new recruits.

When they say things like, “Earn 10% every time a friend invests!” It means the system depends on pyramid-style funding, which collapses once new deposits stop.

They often impersonate regulated brokers (cloned broker scams) and provide a fake trading dashboard that looks authentic. Everything, charts, profits, and balances are just UI animations. Always check the broker’s legal domain and registration number on the regulator’s website.

Not necessarily. “AI-powered” has become a marketing trick. Many scams slap the AI label on simple preset scripts. Real AI trading systems come with:

- Transparent data sources

- Risk metrics

- Audited trading logic

If none are provided, it’s a scam pitch, not artificial intelligence.