- Cryptocurrency

- November 4, 2025

Table of Contents

Smart contracts are a core part of the cryptocurrency and DeFi ecosystem. They allow transactions to run automatically without banks or intermediaries. However, the same technology has also created new risks for investors.

Fraudsters are now designing smart contract scams, includingrug pulls, honeypot scams, and flash loan attacks, to trick users and steal funds. These schemes often appear legitimate but are built with hidden code that gives scammers full control.

DeFi fraud and rug pulls have become increasingly common, putting investors at risk of large financial losses. Understanding how these scams work is the first step in prevention.

This article explains the various types of smartcontract fraud, how to identify red flags, and best practices for protecting your crypto investments from these threats.

What Are Smart Contract Scams?

Smart contract scams occur when the code inside a blockchain program is misused to steal or lock funds. A smart contract is designed to run automatically, but if it contains smart contract vulnerabilities or is built with hidden malicious functions, it can lead to serious smart contract fraud.

Vulnerabilities vs. Deliberate Fraud

- Smart contract vulnerabilities: Unintended coding flaws that hackers can exploit, such as weak access controls or unsafe external calls.

- Deliberate fraud: Malicious code written to trick users, including hidden backdoors or rug-pull functions.

In the fast-growing DeFi space, both errors and deliberate scams contribute to billions lost through DeFi fraud each year.

Common Types of Smart Contract Scams

Smart contract scams appear in many forms. Here’s what you need to know:

|

Type of Scam |

How It Works |

Impact on Investors |

|

DeFi Rug Pulls |

Developers hype a token or project, attract liquidity, then suddenly withdraw all funds. |

Investors are left with worthless tokens; billions lost in DeFi scams. |

|

Honeypot Scams |

Tokens can be bought but not sold due to hidden contract restrictions. |

Buyers get trapped, attackers exit with profits. |

|

Flash Loan Attacks |

Attackers borrow funds instantly, exploit vulnerabilities, manipulate markets, and repay loans in one transaction. |

Millions stolen in seconds; major cause of DeFi hacks. |

|

Fake or Malicious Smart Contracts |

Contracts include hidden backdoors, minting loopholes, or admin controls. |

Scammers seize funds, mint tokens, or shut down projects at will. |

|

Phishing + Smart Contract Traps |

Fake websites or dApps trick users into signing malicious contracts. |

Scammers drain wallets once permissions are granted. |

While the table shows the types, understanding how these scams operate in practice is crucial. For example, a rug pull can turn a seemingly promising token worthless overnight. A honeypot scam may look like an active market, but selling your tokens is impossible. Understanding these scams is key, but knowing how to spot them early can save your funds.

How to Spot Smart Contract Scams?

Smart contract scams are becoming more common in DeFi. Most of them show warning signs before they happen. By knowing what to look for, you can avoid risky projects and protect your crypto.

-

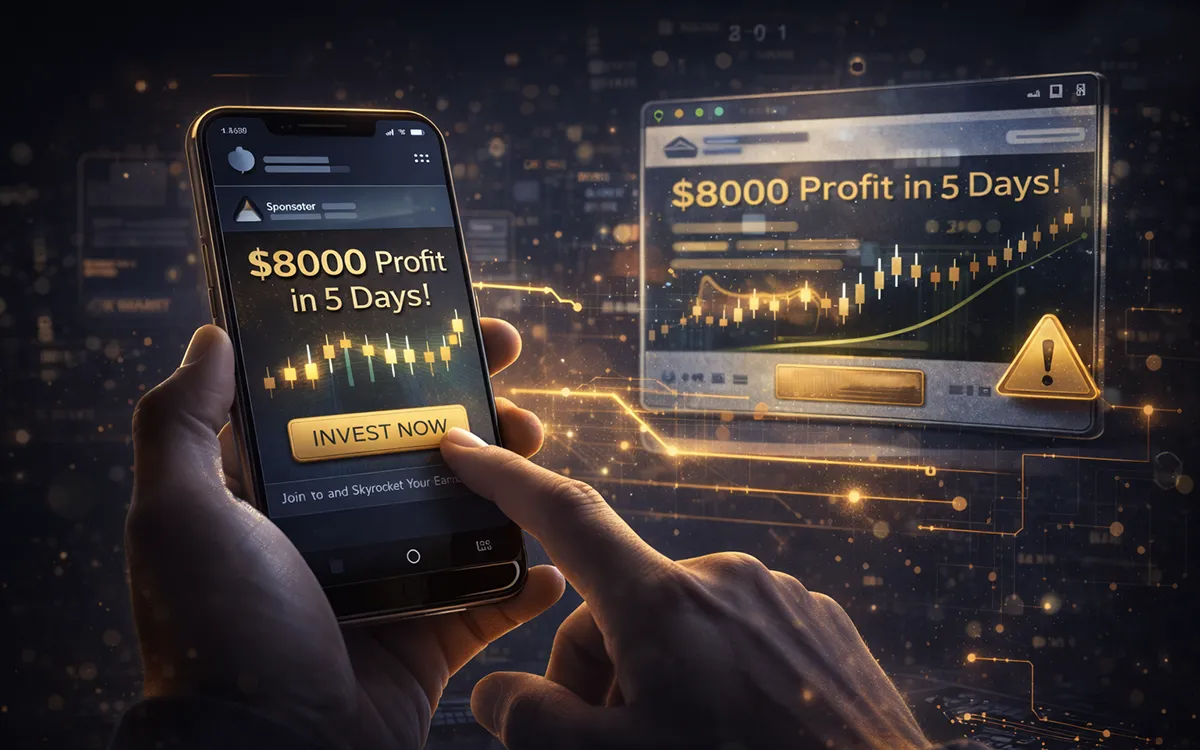

Unrealistic Returns

If a project promises guaranteed profits or high returns in a very short time, it’s a red flag. Real investments always involve some level of risk. Scammers use these promises to lure people in and then disappear with the funds. Spotting this early can help you avoid rug pulls before they happen. For example, a new token promising 100% returns in a week is probably a scam.

-

No Security Audits

Reputable projects usually go through an independent audit. These reviews help you check the code for mistakes or smart contract vulnerabilities that could be abused. If a project has no audit or only shows a weak one, it’s safer to stay away. Choosing audited projects reduces the chances of falling victim to smart contract fraud.

-

Anonymous or Hidden Teams

When developers don’t reveal who they are or provide no background information, it's a red flag. It’s often because they don’t want to be held accountable. Without a known team, there’s no one to turn to if things go wrong. Doing a quick background check on the team can help you filter out fake DeFi projects.

-

Suspicious Smart Contract Functions

Some contracts include hidden tricks in the code, like unlimited minting, wallet-draining permissions, or functions such as setApprovalForAll. These can give developers control over your tokens without you realizing it. Therefore, using tools like Etherscan to check contracts is a simple way to detect smart contract scams before you connect your wallet.

-

Confusing or Hard-to-Read Code

Malicious projects sometimes make the code overly complex, so investors won’t notice what it really does. If the contract is hard to read or understand, that’s a sign it could be hiding something dangerous. Treat unclear code as a warning to stay away and protect your crypto from smart contract exploits.

-

No Transparency or Community Presence

A project is usually promising if it has an active community, regular updates, and easy-to-understand documentation. If you can't find readily available information or the team avoids your questions, there should be concern. Generally, checking forums, Telegram groups, or Discord groups can quickly reveal if a project is legitimate.

Staying cautious and doing a bit of extra research goes a long way in keeping your funds safe from DeFi fraud.

How to Avoid Smart Contract Scams?

Being safe in DeFi comes from small habits that protect your investments each time..

Start by looking for audited projects. An audit shows that experts reviewed the code for bugs or hidden traps. It’s not a full guarantee, but it makes the project more trustworthy.

Where you invest also matters. Trusted exchanges and DeFi platforms are less likely to list scams. Fake platforms often skip security checks, making them a hotspot for fraud.

Before connecting your wallet, always check the contract. Sites like Etherscan or BscScan let you see what permissions the contract asks for. If you notice unlimited spending rights or strange functions, that’s a red flag. You can also use CertiK or Token Sniffer to find risky contracts automatically.

Always be security-focused with your wallet usage. Use 2FA and a hardware wallet, when possible, and keep your private keys somewhere safe and offline. These are ways to invest in some insurance against making an accidental dumb mistake.

Lastly, avoid putting all your money in one place. Distributing your funds across projects means one faulty contract won't decimate everything.

Protecting your crypto is about caution and using trusted platforms, in addition to layering security. All of these habits make it much more difficult for smart contract scams to catch you.

What to Do If You’ve Been Scammed?

If you discover you’ve been caught in a smart contract scam, act quickly. Taking immediate steps can reduce further losses.

- Secure your wallet right away: Disconnect from the suspicious contract and move any remaining funds to a safe wallet you fully control. This is the first step in smart contract scam recovery.

- Revoke hidden approvals: Many scams rely on unlimited token access. Use Etherscan, BSCScan, or other on-chain scam detection tools to cut off the scam’s control before more funds disappear.

- File a report of the scam: Alert the exchange, platform, or your local police department. Reporting is important to raise awareness, so it will be easy to protect your crypto in the future.

- Reach out for expert help: Trusted crypto scam recovery services can trace stolen funds on the blockchain and guide you through recovery options. While success isn’t guaranteed, professional support increases your chances.

Acting fast and following these steps can reduce losses and put you on the path to recovery.

How to Stay Safe from Smart Contract Scams?

Scams associated with smart contracts are an increasing trend that is starting to emerge withinDeFi. Many scams may appear real enough that they can lead to a loss of your funds, but if you take some basic precautions, you should remain safe from these scams.

Only invest in projects that are audited, and always check the smart contracts prior to connecting your wallet to a service or the platform. Always make sure you are only dealing with the project or system's official site. If something appears to be off, it probably is.

If you are actually scammed, then act fast. Always revoke any approvals you made to the scam platform, send your funds to a safe wallet, and contact a professional recovery service for crypto scam recovery. They can help you find your stolen funds and take you through the entire recovery process.

FAQs (Frequently Asked Questions)

Yes. Even if a platform itself is legitimate, scammers can still launch fake tokens or malicious contracts on it. Always double-check contract addresses from official sources before investing or trading.

It’s when a crypto project uses hidden or bad code to steal money. The contract might let developers drain wallets, block selling, or pull out all funds suddenly.

Yes. Strange gas fees can sometimes signal a malicious contract. Watch out for:

- Unusually high gas fees for simple transactions (a sign of hidden functions running in the background).

- Zero or very low gas fees in cases where fees should apply (possible fake transaction or approval).

- Constant “out of gas” errors even when you increase limits (the contract may be coded to fail on purpose).

If you notice these issues, avoid confirming the transaction—it could be a scam.

If the contract has “upgrade” or “admin” functions coded in, then yes, the developers may be able to change it later. This is why reviewing permissions and checking whether a contract is truly immutable is important before you connect your wallet.

Always check what permissions the contract is asking for. Many scams rely on unlimited spending approvals that give them full control of your tokens. Using tools like Etherscan or BscScan to review permissions before signing can stop most scams before they even start.