- Cryptocurrency

- August 8, 2025

Table of Contents

Getting scammed is hard. But for many people, what follows can be even worse.

After losing money to crypto or online fraud, victims often start searching for help. That’s when another danger appears: fake recovery firms. These are companies that claim they can help you get your money back. In reality, many of them are part of another scam.

This is known as a recovery firm scam, and it's targeting thousands of people across the country. According to the Canadian Anti-Fraud Centre, recovery scams more than doubled in 2023, with over $1.6 million in reported losses just in Canada alone.

These firms know you're vulnerable. They promise quick results, expert support, or legal connections. They may sound professional and even use official-looking websites or documents. But in most cases, they demand upfront fees, ask for personal information, and then disappear. The truth is simple: if you’ve been scammed once, you’re at higher risk of being scammed again, this time by someone pretending to help.

This guide will help you recognize the warning signs, protect your personal information, and avoid falling for another lie. Knowing how to spot a fake recovery firm could save you more money, stress, and time.

What Are Recovery Firm Scams?

After falling victim to an investment or cryptocurrency scam, many people, especially older adults or senior citizens, seek help to recover their lost money. That’s when another trap often appears: fake recovery firms.

These scams are run by fraudulent recovery agents who promise to “help you recover your funds.” They say all the right things: “We work with legal experts,” “Your money is traceable,” or “We just need a small fee to start.” But in reality, it’s all part of a second scam, known as a refund recovery scam. Recovery firm scams, also known as "recovery room scams" or "second-chance scams," target individuals who have previously lost money to fraud.

These fake firms often impersonate law offices, cybersecurity teams, or financial recovery services. They may even use stolen logos, fake contracts, and impressive-sounding language to seem trustworthy. But once you pay, they vanish or keep asking for more.

These scams don’t just steal more money; they steal your trust, time, and peace of mind. If a company promises fast results or guaranteed refunds, especially for an upfront fee, that’s a major red flag.

How Do Recovery Scammers Find Their Victims?

You might wonder, “How did this recovery company even know I was scammed?” The answer is unsettling because you’ve already been marked as a target.

Once you've been scammed, especially online, your name often doesn’t just vanish into thin air. It gets added to something criminals call a “victim list.” These lists are passed around like merchandise among scam groups. And that’s where recovery scammers step in. They know who you are, they know what you lost, and they know you’re desperate to get it back.

A Second Wave of Exploitation

This is what makes recovery scam targeting so effective and so cruel. These fake firms come into the picture after the damage is done, promising to fix everything. But their goal is to take more, not help you heal.

Real Case Study Example: After losing $20,000 to a fake crypto site, a retired teacher received a call from someone claiming to be from a “blockchain recovery task force.” They had details of her original loss and used that to earn her trust. She sent another $5,000 before realizing it was another scam.

Where Do They Get Your Information?

- The Original Scammer – Sometimes, the same people who stole from you come back pretending to help.

- Data Breaches – Fake platforms often collect personal data and leak it, accidentally or on purpose.

- Scammer Networks – Fraudsters sell “hot leads” (real victims) to recovery scams.

- Phishing and Fake Forms – Victims who search for help online may unknowingly give away info again.

These scammers are professionals. They know how to sound helpful, how to mirror concern, and how to manipulate victims already going through emotional stress.

Victim Identification Tactics They Use:

- Emails with phrases like “We’ve located your stolen crypto”

- WhatsApp or Telegram messages using your full name and fake credentials

- “Case numbers” or file references to look official

- Pressure to act fast before “the funds vanish forever”

If someone reaches out to you first, especially after a scam, take it as a warning sign. Legitimate and genuine recovery firms, like Global Financial Recovery, don't buy victim lists or contact you out of the blue.

How Recovery Firm Scams Work?

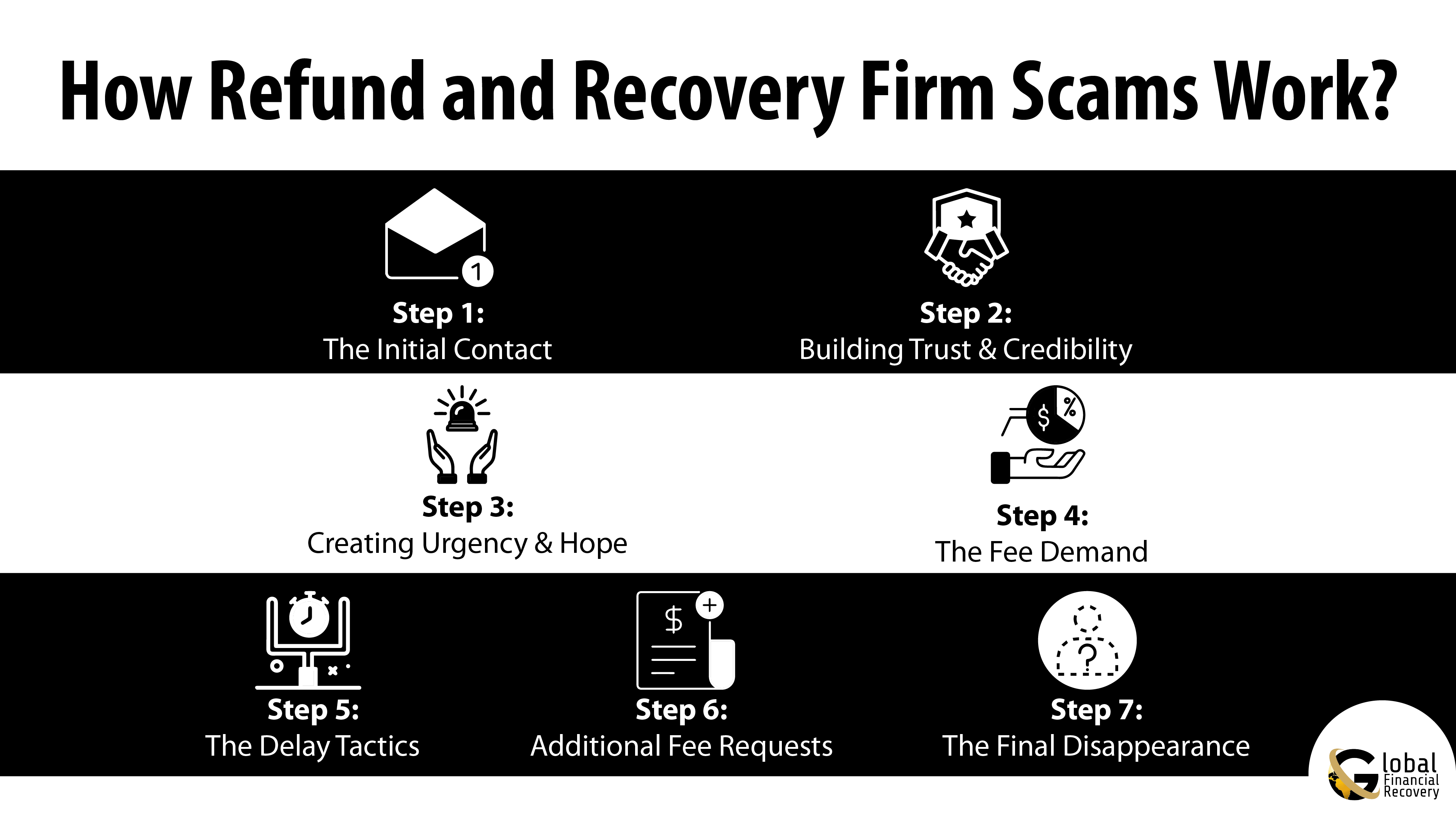

Recovery firm scams follow a predictable pattern that's designed to exploit your emotions and desperation. Understanding how these fake recovery operations work can help you spot them before you become their next victim.

-

The Initial Contact

This starts with the scammer contacting you out of the blue with a phone call, email, or message saying they can help you get your money back. The phrase they often use is "We have been investigating your case" or "We have good news about your lost funds."

They do not wait for you to find them; they come and find you. They will call, email, text, contact you through social media, or send you a letter, all claiming they are going to help you get back your lost funds.

-

Building Trust and Credibility

Once they have your attention, fake recovery companies work hard to seem legitimate. They may call themselves attorneys, government investigators, or professional recovery specialists. They may present a credible company name and even a professional-looking website they created.

They will use legitimate laws, credible government agencies, and real recovery strategies to sound smart. Some will even represent that they work directly with the U.S. government, regulating agencies, law firms, or consumer advocacy groups.

The scammers will often provide details about your original scam, which also adds credibility. This information usually comes from the same criminal networks that scammed you the first time.

-

Creating Urgency and Hope

Recovery scam operations are experts at psychological manipulation. They create a sense of urgency by claiming you need to act quickly or lose your chance forever. They might say the window for recovery is closing or that they've already recovered some of your money but need fees to release it.

At the same time, they feed your hope. They promise things like guaranteed recovery, special connections, or exclusive access to recovery funds. They tell you exactly what you want to hear, that you can get all your money back.

-

The Fee Demand

Here's where the recovery scam business model becomes clear. After building trust and creating urgency, they ask for money upfront. This is the core of how recovery firm scams work: they charge fees before providing any service.

Don't pay for services you haven't yet received, ever. This is a fundamental rule that legitimate companies follow, but recovery scammers ignore.

Common fee requests include:

-

- "Processing fees" to start your case

- "Legal fees" for court filings

- "Insurance" to protect your recovery

- "Taxes" that need to be paid before funds are released

-

The Delay Tactics

Once you pay the initial fee, the scam recovery process enters a new phase. They string you along with updates, progress reports, and excuses. They might say your case is moving through the system or that they need just a little more time.

This phase can last weeks or months. The scammers know that the longer they keep you engaged, the more likely you are to pay additional fees when they ask for them.

-

Additional Fee Requests

As the fake recovery process continues, they'll ask for more money. Each request comes with a plausible explanation, unexpected court costs, additional legal fees, or special charges that weren't anticipated.

The fees often increase over time. What started as a few hundred dollars might grow into thousands as they continue to exploit your hope and desperation.

-

The Final Disappearance

Eventually, the recovery scam operators either disappear entirely or make it clear that they can't help you. At this point, you lost even more money on top of the scam losses you initially incurred. At times, they blamed external things, such as the courts, government agencies, or even you for not providing the right information, but they have never admitted that there was no legitimacy to begin with.

Red Flags to Identify a Scam Recovery Firm

Falling for a recovery scam can feel like being robbed twice, first by the original scammer, then by someone pretending to help. Below is a quick comparison table to help you spot warning signs before it’s too late:

|

Red Flag |

What It Means |

Why It’s Suspicious |

|

Unsolicited Contact |

You’re contacted randomly via email, call, or message |

Legit firms don’t chase victims unless you reach out first |

|

Upfront Payment Demands |

They ask for money before any work begins (e.g., for “case opening” or “tax clearance”) |

Classic advance fee fraud tactic; real firms are transparent about payment structures |

|

Guaranteed Recovery Promises |

Claims like “100% money-back guarantee” or “full recovery within 5 days” |

No one can guarantee recovery, especially if crypto or international accounts are involved |

|

Vague Company Details |

No physical office, generic email, missing or fake social media presence |

Fake recovery firms often hide behind unclear branding and disposable contacts |

|

Pressure to Act Fast |

They say things like “act now or the money will be lost forever.” |

Scammers push urgency so you don’t verify their claims or credentials |

|

No Real Credentials |

They lack legal certifications, verifiable license numbers, or proven case studies |

Authentic firms will show who they are, what they’ve done, and how they operate |

|

Too Good to Be True Claims |

“We work with the FBI” or “We’ve recovered millions” with no proof |

Fraudsters use name-dropping to build fake authority |

|

Refusal to Answer Questions |

They dodge details or change the subject when you ask for proof |

Real firms explain their process clearly and don’t deflect tough questions |

|

Fake Reviews or Testimonials |

Only 5-star ratings with no details, or duplicate names and stories |

Scam recovery firms buy or fake reviews to seem trustworthy |

|

Unprofessional Communication |

Poor grammar, inconsistent info, or aggressive follow-ups |

Scammers often use templates or outsourced agents to communicate |

Quick Tip:

Before trusting any firm, Google their name + “scam” and check review platforms like Trustpilot or BBB.

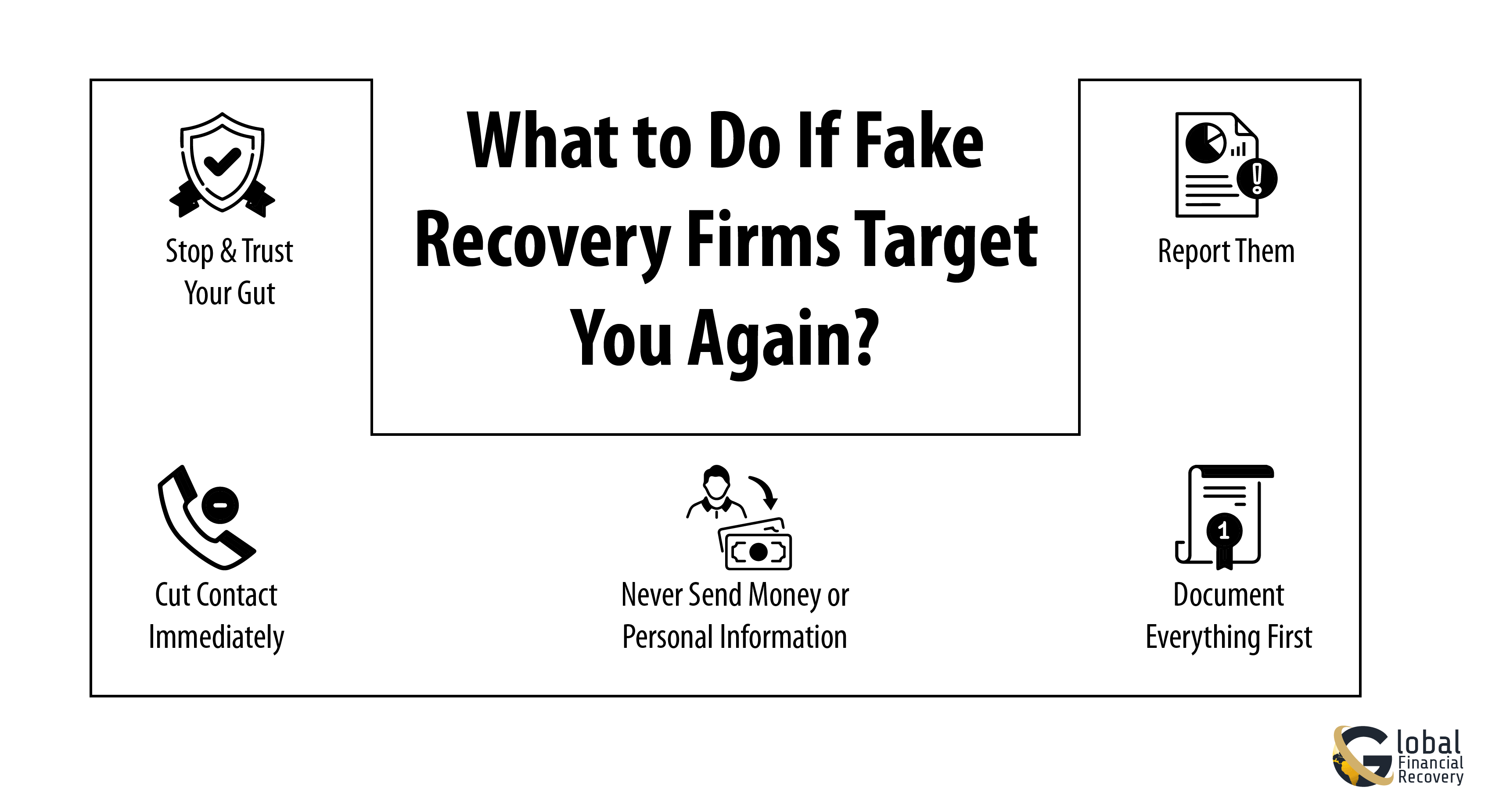

What to Do If You've Been Targeted Again?

Been scammed once, and now someone's calling with promises to get your money back? You're not paranoid for feeling suspicious—you're being smart.

Recovery scammers specifically target people who've already lost money because they know you're desperate for a solution. If someone contacts you claiming they can recover your funds, here's what to do:

-

Stop and Trust Your Gut

That uncomfortable feeling you have? Listen to it. If something feels off about their offer, it probably is. You've been through this before; trust the wisdom that experience gave you. Don't keep talking to them just because they sound professional or claim to have good news. The more you engage, the better they get at finding ways to manipulate you.

-

Cut Contact Immediately

Block their number. Delete their emails. Don't respond to their messages. You don't owe them explanations or politeness. Real recovery services don't cold-call victims or create urgency with phrases like "limited time offer" or "act now before it's too late."

-

Never Send Money or Personal Information

Whatever they may sound like, never send money, cryptocurrency, or gift cards. Never share passwords or bank details or any information about yourself. Real companies for the recovery do not ask for advance payments or require your financial details from you before demonstrating any real results.

-

Document Everything First

Before blocking them, save screenshots of messages, emails, and any payment requests they've made. These records matter if you decide to report the scam later.

-

Report Them

By reporting these scammers, you're protecting the next person from going through what you're experiencing. File reports with

-

You're Stronger Now

Being targeted again feels awful, but remember you recognized the warning signs this time. That's not luck; that's growth. You survived one scam and learned from it. Every person who spots these recovery scams and walks away makes it harder for these criminals to hurt others. You're not just protecting yourself; you're part of the solution.

How to Safely Research a Legitimate Recovery Company?

If you have already been scammed one time, it is completely understandable to want your money back, but that is when many people fall into their second trap. Fake recovery firms are trying to take advantage of people who have already been victimized by fraud, preying on your emotions by promising to get fast results or guaranteeing a refund if you just send them more money.

That’s why it is so important to learn how a trusted recovery firm can work for you. Taking just a bit of time to verify a company could save you from more emotional and financial pain.

Start by checking their online presence. A real business will have a professional website, a valid business address, and a verifiable email (not just Gmail or ProtonMail). Look for a Google Business listing, and if possible, check their team on LinkedIn. Be cautious if they only message you on Telegram or WhatsApp without offering any traceable contact info; fake recovery firms often hide behind encrypted platforms.

Next, search for honest reviews and complaints. Type the company’s name into Google with phrases like “scam,” “complaints,” or “real or fake.” For example, try searching “BrightFunds Recovery reviews” or “BrightFunds Recovery scam.” If all you see are overly perfect testimonials on their own site or no presence outside of it, that’s a red flag.

A legit fund recovery help provider will always offer a free consultation first. This gives you a chance to ask clear, direct questions like:

- What is your recovery process?

- Are there any upfront fees?

- Have you handled similar cases before?

- Do you work with banks or legal authorities?

If they dodge your questions, rush you to pay, or give vague answers, don’t go further. A trusted recovery firm will be transparent and take time to explain.

Also, confirm that the company is officially registered. Ask for their business license or registration code and check on your country's online registry. They should also offer you a well-written agreement that details your rights, how much they'll charge you, and what is included as part of their service.

Another great sign? Education, not a sales pitch. Reputable companies typically will include valuable content like posts, tips on how to prevent scams, and breakdowns of fraud cases to help promote awareness instead of just trying to sell you services.

If a company only talks about prices, urgency, or success stories without offering guidance, be cautious. The real ones support victims with useful knowledge, not empty promises.

Don’t Let Scammers Win Twice

If you’ve made it this far, you’ve already taken an important step toward protecting yourself from recovery firm scams. Many scam victims, especially those recovering from crypto, forex, or romance fraud, are unaware that they could be targeted again, this time by fake recovery firms offering false promises and demanding more money.

By reading this guide, you now understand how to spot recovery scams and protect yourself from falling into another trap. Whether recognizing advance fee fraud, looking for suspicious signs, or deciding on a trusted recovery firm, this knowledge is your best guard.

If a suspicious company has contacted you, think twice before making a reply. Have this guide handy while choosing safer. From reporting recovery fraud to seeking recovery scam victim help, you’re not alone, and support is available.

And if you’re actively searching for legit fund recovery help, use what you’ve learned here. Ask the right questions, verify credentials, and trust your gut instinct. The goal is not just to recover whatever was lost but to prevent being victimized further.

Need Real Help Recovering Your Funds?

You don’t have to face this alone. At Global Financial Recovery, we offer honest, professional support for victims of online scams with no false promises.

FAQs (Frequently Asked Questions)

The idea is a very legitimate one, and this is precisely why recovery firm scams are so harmful. The most advisable thing to do is to avoid any company that requires advance money or offers a complete payup. Honest recovery companies describe their procedure, provide evidence of labor, and give you an opportunity to raise inquiries before any cash is exchanged.

No, this is a classic advance fee fraud tactic. Scammers often pretend your money is “ready” but locked due to taxes or transfer delays. If they won’t release even partial proof of recovery without payment, it’s most likely a scam.

Most fake recovery companies purchase your contact details either from the original scammers or from data leaks. They are aware you have fallen prey to a scam before and use that to win your trust. Be very wary of unsolicited inputs that look like good advice.

First, stop all contact and do not send more money. Save all emails, receipts, and messages as evidence. Then, report the scam to agencies like the FTC, IC3, or your local consumer protection group. You can also speak to a real recovery expert to learn what options might still be available.

No. This is normal of recovery firm fraud. Actual businesses are transparent in regard to their service and charges and do not request any payment prior to watching actual output. Scammers phrase things like one-time fee to make them seem little and immediate