- Miscellaneous

- December 23, 2025

Table of Contents

You’ve probably come across them while scrolling through the polished trading influencer with a luxury car, a beach-view laptop setup, and a promise that you can make money just like them. It feels convincing and real. And that’s how fake trading guru scams hook people.

The rise of social media made it unbelievably easy for anyone to act like an expert overnight. A few edited screenshots, a fake “student success” review, and a flashy lifestyle are all it takes to look like a marketing genius. Meanwhile, thousands of investors follow them into Telegram groups and crypto or forex schemes that have no real trading behind them.

What most people don’t realize is that these gurus are using psychology, not skill. They build what we call the Authority Illusion—the look, the confidence, and the story—all designed to make you trust them before you even question their results. And that’s why even smart, experienced people get caught in trading influencer scams every day.

In this blog, we’re going to break this entire system down: how these fake experts build their image, how they choose their victims, the signs most people ignore, and what you can do if you’ve already lost money to one of them.

What Are Fake Trading Guru Scams?

Fake trading guru scams are online fraud schemes run by individuals who pretend to be successful crypto, forex, or stock trading experts. These scammers use social media platforms like Instagram, TikTok, YouTube, Telegram, and even LinkedIn to gain visibility and trust. They market “exclusive/crypto trading signals,” high-return investment plans, and secret strategies that promise quick profits with no risk.

These scams rely heavily on fake success, staged lifestyles, rented cars, photoshopped profit charts, manipulated account dashboards, and paid testimonials. Their expertise isn’t real... but the financial loss to investors definitely is.

Who Are These Fake Trading Gurus?

They call themselves investment coaches, crypto mentors, or day-trading specialists. Though they call themselves experts, their credentials tell a very different story. But behind the scenes, they have:

- No verified trading license

- No regulatory oversight

- No track record on credible platforms like Bloomberg, CNBC, CoinMarketCap, TradingView, or Trustpilot

They profit not from trading but from membership fees, referral rewards, and stealing deposits.

Who Do Fake Trading Gurus Usually Target?

Fake trading gurus don’t cast a random net; they target people who are most vulnerable to their story and most eager for financial change. Their victims often share one thing: they want something to improve in life, and the guru promises a shortcut.

Here are the groups scammers focus on:

1. People Seeking Quick Financial Freedom

Anyone dreaming of replacing their income or escaping financial pressure becomes an easy target. Scammers know how tempting “quick results” sound when life feels stuck.

2. Beginners in Forex, Crypto, or Stocks

New traders don’t know how to verify real results, so they rely on the guru’s confidence. Scammers take advantage of that trust.

3. People Who Already Lost Money

This one is painful but true. If someone already had a trading loss, gurus promise “special strategies” that can help recover it, which makes people even more desperate to believe them.

4. Older Adults Who Trust Confident “Experts”

Scammers often target older investors who didn’t grow up with online trading tools and may not recognize digital manipulation or fake charts.

5. Anyone Active in Finance Pages or Groups

If you follow investment accounts or engage with trading posts, scammers assume you’re a potential believer, and they move quickly.

In short, fake trading gurus aim for people who feel overwhelmed, unsure, or hopeful about building wealth. They use confidence and lifestyle illusions to make their advice feel safe, even when nothing behind it is real.

How Fake Trading Gurus Scams Operate?

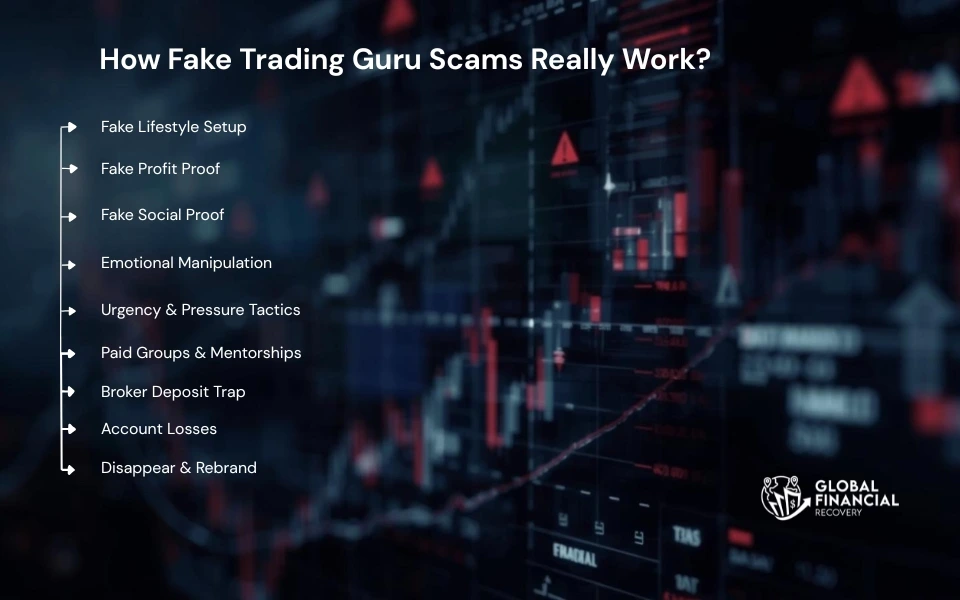

Here’s how the typical scam unfolds, from building a fake image to taking your money. Fake trading guru scams always start the same way: the 'guru' pretends to be a successful trader long before they actually try to sell anything. They begin by building an image of luxury cars, designer outfits, expensive vacations, and screenshots of huge profits. Most of these are rented, staged, or edited, but they’re meant to convince you that this person is living the dream life that trading can supposedly give you.

Once they look credible, they start posting “proof.” This is where the real manipulation begins. They share daily wins, show off charts with clean entries, and flood their stories with messages from “students” claiming massive results. But almost all of this is fake: profits come from demo accounts, testimonials are bought, and screenshots are easily edited with simple apps. The entire goal is to make you think, “If they can do it, maybe they really can teach me.”

After that, the illusion is strong, they use emotion to pull you in. They talk about financial freedom, escaping the 9–5 life, and how anyone can become a trader with the “right mentor.” They create urgency: “Only 5 spots left,” “Next signal dropping soon,” “Don’t miss this setup.” They want you excited, not thinking. They want you to trust their confidence without questioning their qualifications.

Then comes the money part. They introduce VIP groups, paid mentorships, “high-accuracy signal rooms,” or “secret strategies.” But inside these paid programs, there’s nothing special. It’s mostly basic knowledge, recycled content, and generic advice that doesn’t actually help anyone trade safely.

The final stage is where victims lose the most money: the guru convinces you to deposit into a specific broker or “copy trading account.” What they don’t tell you is that they earn a commission for every deposit you make. Some even have deals with offshore brokers that allow them to manipulate accounts. Once you put money in, the guru either burns your account with reckless trades or simply disappears.

That’s the cycle: create the illusion, build fake trust, sell the dream, take the money, then rebrand and repeat.

How Fake Trading Gurus Trick Investors?

Fake trading guru scams have a clear pattern. They may seem different online; some use flashy Instagram posts, others use Telegram groups, but the way they manipulate people is almost always the same. Understanding this process helps you spot the traps before it’s too late.

1. Telegram & WhatsApp Signal Groups (Trading Signal Scam)

Many fake trading gurus start by creating VIP signal groups. They promise “high-accuracy” trades every day. At first glance, it seems safe: winning trades appear in screenshots, and early followers may even see some small profits. But almost all of this is fake. Signals are copied from other sources, delayed, or randomly generated.

These groups are designed to get you hooked and pay subscription fees, often every month. Once enough people join, the guru may disappear or shut down the group, taking the money and leaving the victims confused.

2. Paid Mentorship Programs (Mentorship Trading Scam)

The next step is often a high-priced mentorship. They claim to teach you “secret trading strategies” or offer one-on-one coaching. In reality, most of these programs contain material you can easily find for free online. The guru uses their “success image,” luxury photos, fake testimonials, and staged charts to justify charging thousands of dollars. They may push you to open broker accounts while claiming it’s part of the course, setting you up for future commissions.

3. Account Management Scams (“I’ll Trade for You”)

Once they have your trust, some gurus offer to manage your account. They promise to trade for you while you learn. Victims deposit money into a broker they recommend. Here’s the trick: most trades are either reckless, pre-planned to fail, or completely fake. Gurus often use high leverage to burn your account quickly. When the account loses money, they blame the market or vanish entirely. This is one of the most common ways people lose large sums.

4. Unregulated Broker Partnerships (IB Commission Scam)

Many fake gurus have hidden partnerships with offshore brokers. They act as Introducing Brokers (IBs) or affiliates. Every deposit you make earns them a commission. This is the insider detail that competitors rarely mention: the guru is not trading for you; they profit simply from getting you to deposit and trade. The bigger your deposit, the more they earn. Often, these brokers are unregulated, meaning you have no legal recourse if funds are lost.

5. Ponzi-Style Payouts

Some gurus run Ponzi-style systems. They pay early followers with money collected from new victims to create the illusion of “consistent profits.” This builds trust and lures even more people into their programs. But once growth slows, payouts stop, and the scheme collapses. The guru then rebrands under a new name and repeats the scam cycle.

6. Fake Testimonials and Social Proof

To reinforce trust, they show fake testimonial videos, screenshots, or AI-generated faces claiming huge profits. They even use bots to post comments or fake messages in Signal groups and on social media. This psychological manipulation makes people feel they’re missing out if they don’t join, adding pressure to act quickly.

7. Lifestyle Illusion

Luxury is their strongest tool. Fake gurus rent cars, houses, watches, and clothing to create a rich “rich trader” image. The goal is to make you believe that trading is glamorous and lucrative and that they are the perfect mentor to get you there.

8. Pump & Dump and Market Manipulation

In crypto or low-liquidity markets, some gurus actively manipulate prices. They buy a coin, send “buy now” signals to followers, then sell at the peak, leaving investors with losses. This adds another layer of profit without the guru doing any real trading; it’s purely opportunistic.

9. Challenge Account Manipulation

Gurus often show “funded prop accounts,” or EA bots that supposedly generate profits. They sell access or claim they can help you pass challenges. The truth: most of these accounts are demo accounts edited to look real, and the challenges fail once you deposit real money.

10. Psychological Manipulation & FOMO Engineering

At every step, fake gurus exploit your emotions. They make it urgent: “Sign up now!” or “Next signal dropping soon!” They make you feel left behind if you hesitate. This constant pressure keeps victims acting without thinking and makes the scam much more effective.

Once you understand their tactics, spotting red flags becomes easier. Here’s what to watch for and why noticing each one can save your money.

How to Spot a Fake Trading Guru Scam?

Not every online trading guru is genuine. Before handing over your money, check for these common red flags and learn how they can help you avoid scams:

|

Red Flag |

What It Means / How It Works |

Why Knowing This Helps You |

|

Over-the-top lifestyle |

Shows luxury cars, designer clothes, and exotic trips to look successful like a fake millionaire. |

Realizes that lifestyle doesn’t equal trading skill. It stops you from trusting the image alone. |

|

Guaranteed profits / High accuracy signals |

Claims like “99% win rate” or “double your money in a week.” |

Understands that all markets are uncertain. Protects you from unrealistic promises. |

|

Pressure to join quickly (FOMO) |

“Only 10 VIP spots left,” “Next signal is closing soon.” |

Helps you pause and think before depositing money, avoiding impulsive decisions. |

|

Paid mentorships for basic info |

Charges high fees for content you can get online for free. |

Prevents you from wasting money on useless courses. |

|

Requests to deposit money with specific brokers |

Pushes unregulated or offshore brokers, often with IB commissions. |

Alerts you that they profit from your deposit, not trading skill, and avoid IB commission scams. |

|

Promises to trade for you / manage accounts |

“Give me access; I’ll trade for you while you learn.” |

Recognizes account management fraud and prevents loss of funds. |

|

Fake testimonials and social proof |

Uses bots, actors, or AI-generated reviews to create trust. |

Helps you verify legitimacy and avoid being fooled by fake success stories. |

|

Push into Telegram/WhatsApp signal groups |

Daily alerts, signals, or tips that seem professional. |

Makes you aware that signal scams are common and often useless. |

|

Ponzi-style payouts or early success stories |

Pays early participants with money from new victims to appear legitimate. |

Recognizes signs of unsustainable scams before joining. |

|

Over-reliance on hype and emotion |

Emphasizes lifestyle, urgency, and excitement over facts. |

Encourages critical thinking and emotional control, reducing the chances of being scammed. |

Fake trading gurus don’t just trick you out of your money; they trick you out of your confidence. When you know what warning signs look like, you stop second-guessing yourself and start questioning them. You become the one in control. Spotting red flags is just the first step. Next, let’s see how to protect yourself and what to do if a scam has already happened.

How to Protect Yourself from Fake Trading Gurus?

If someone claims they can help you “get rich by trading,” the safest move is to slow down and run a quick reality check. Legit traders don’t hide behind nicknames or pressure strangers into sending money. Real trading education is transparent, registered, and built on verified results, not screenshots.

Start by checking who they actually are. A genuine trading professional will have a real identity, not just a Telegram username. You should be able to search their legal name, see them registered with a reputable financial authority, and find proof of their trading history that’s independently verifiable, not cherry-picked or photoshopped.

Then look at their business model. If their main income comes from selling signals, paid mentorships, or promising to manage your account for huge returns, that’s not trading; that’s a marketing funnel. And if they push you toward an unregulated broker through a referral link, it’s almost guaranteed that they earn a commission every time you deposit money. That’s how many IB scams (Introducing Broker schemes) operate; your losses become their income.

Technology makes verification easier than ever. You can search reviews on trusted platforms, look up any blocked or warning-listed companies, and confirm whether the returns they promise are even realistic in trading markets. The moment their claims break the laws of finance (“100% guaranteed profit,” “zero risk trading”), you’ve spotted a major red flag. Already lost money? Don’t panic. Acting quickly increases your chances of getting some funds back.

Already Fell for a Trading Guru Scam? Here’s What to Do Next

If money is already gone, don’t panic. Many victims blame themselves and stay silent, which only helps the scammer. Instead:

- Document Everything: Chats, receipts, transaction IDs, withdrawal attempts

- Stop Further Payments: scammers often return later, pretending to “unlock funds.”

- Report and Dispute Quickly: Card chargebacks, exchange complaints, broker escalation

- Contact a professional scam recovery team: Trading Fraud Recovery specialists assist with case handling, blockchain tracing, and legal escalation.

Timing matters. The sooner you act, the better the chance of interrupting withdrawals or recovering funds.

Don’t Let False Experts Control Your Financial Future

The rise of fake trading gurus shows how easy it is to be fooled online. But you don’t have to be another statistic. Watch for red flags, verify credentials, and never rush into payments or signals. If you’ve been scammed, stop payments, document everything, and reach out to professionals experienced in account management fraud or trading signal scams.

With the right steps, it’s possible to recover both your money and peace of mind. Contact Globally Financial Recovery experts for investment or trading scam recovery from such fraudulent trading gurus.

FAQs (Frequently Asked Questions)

Look beyond luxury photos and social media followers. A legitimate trader will have verifiable trading history, regulated broker accounts, and transparent results. Check reviews on independent forums, and never trust claims of guaranteed profits. Remember: a flashy lifestyle doesn’t equal trading skill.

Many paid trading mentorships are overpriced and recycle content you can find for free online. Only consider mentorships with proven track records, verifiable results, and independent testimonials. Avoid programs that push you to deposit with specific brokers immediately.

Some gurus partner with unregulated brokers as Introducing Brokers (IBs). They earn commissions when you deposit or trade, not by trading successfully. Recognizing this helps you avoid scams disguised as “mentorship” or “managed account” offers.

Start with minimal funds to test any signals. Track your trades independently and compare results against real market data. Avoid depositing large sums or relying solely on “VIP signals.” If it feels like pressure or manipulation, exit the group immediately.

Yes, in many cases you can take action. Stop payments, document all communications, and report the scam to authorities or specialized recovery services like Global Financial Recovery. Acting quickly increases your chances of recovering funds from fake trading guru scams, account management fraud, or mentorship trading scams.