- Investments

- January 28, 2026

Table of Contents

Ramp and dump scams are designed to appear legitimate. Using professional websites, controlled price movements, and long-term growth narratives, these schemes often avoid immediate suspicion and make manipulation harder to detect.

Unlike traditional pump and dump schemes driven by sudden hype, ramp and dump scams rely on slow trust-building and consistent messaging. Many of these operations are coordinated through private groups and social media scams, where reassurance and repeated signals influence investor decisions.

In this blog, we explain how ramp and dump scams work, how they differ from classic pump and dump schemes, the warning signs investors often miss, and what to do if you suspect market manipulation.

What Is a Ramp and Dump Scam?

A ramp and dump scam is designed to feel calm and believable. Instead of pushing prices up quickly, scammers raise the value of a crypto asset little by little. This slow increase creates confidence and makes investors feel they are watching natural growth rather than manipulation. That is what separates ramp and dump scams from classic pump and dump schemes.

Behind the scenes, the price movement is controlled. Communities are managed, questions are moderated, and positive sentiment is encouraged. As more people invest, liquidity builds. Once the scammers believe enough money is locked in, they sell their tokens and exit. The price drops fast, and investors are left with assets that quickly lose value. This type of crypto price manipulation works because it feels logical, professional, and low-pressure.

How Ramp and Dump Crypto Scams Work Step by Step

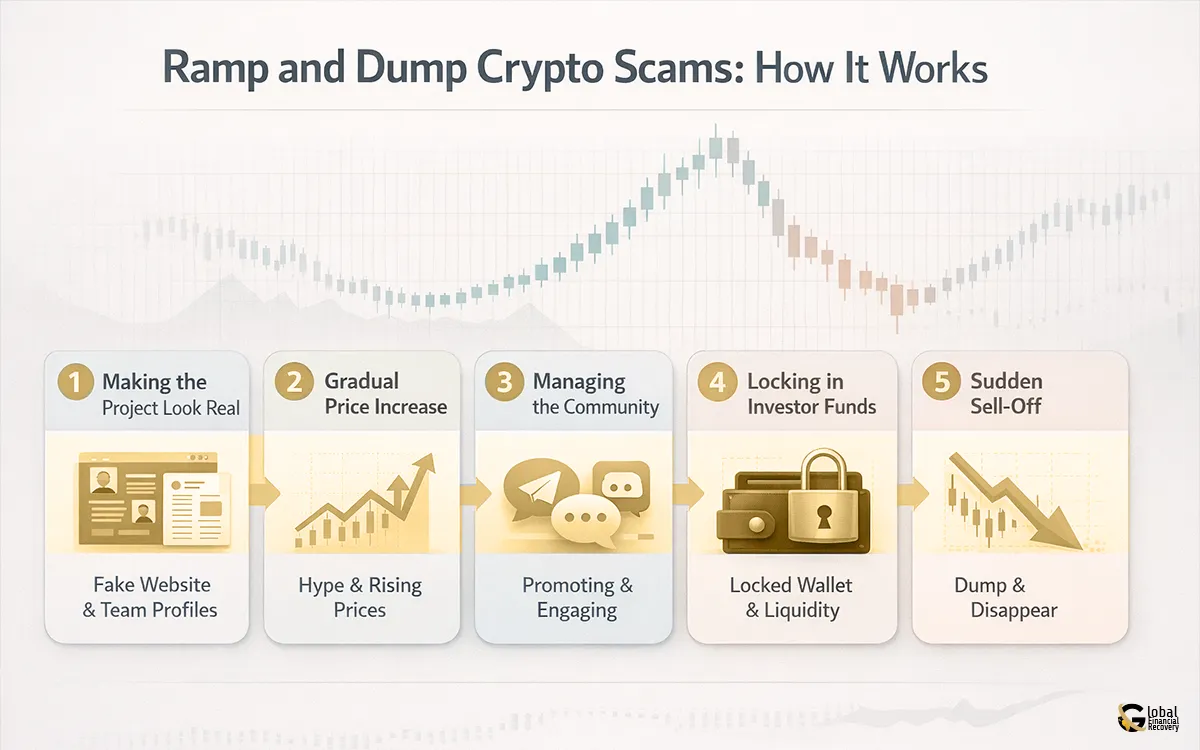

Understanding ramp and dump scams requires looking at each stage carefully. Unlike sudden, obvious scams, these schemes unfold slowly, making them harder to detect. Here’s a step-by-step breakdown of how these scams operate and why they trick even experienced investors.

Step 1: Making the Project Look Real

Ramp and dump scams start with appearance. The project looks professional and well planned. The focus is on long-term potential, not fast returns. This helps investors lower their guard.

Step 2: Gradual Price Increase

The price rises slowly. There is no hype. This steady movement creates trust and makes investors feel safe. Many investors mistake this for genuine growth.

Step 3: Managing the Community

Online groups are closely controlled. Positive stories are highlighted. Doubts are quietly removed. This creates the impression that everyone believes in the project.

Step 4: Locking in Investor Funds

As confidence grows, more money flows in. Technical terms are used to explain why selling is limited. This stage builds liquidity while discouraging early exits.

Step 5: Sudden Sell-Off

When the time is right, the scammers sell their tokens and disappear. The price drops fast. Investors are left with losses and little explanation. This is how many ramp and dump crypto scams end.

Warning Signs of Ramp and Dump Crypto Scams

Ramp and dump scams are effective because they don’t look like scams at first. Many of the warning signs appear reasonable, professional, and even reassuring. The table below breaks down the most commonly overlooked red flags, why they seem harmless, and what they actually signal beneath the surface.

|

Red Flag |

How It Is Presented to Investors |

Why It Feels Legitimate |

What It Often Signals |

|

Gradual, consistent price increases |

Marketed as healthy, organic growth |

Slow movement feels safer than sudden spikes |

Price is being artificially supported to build confidence |

|

Strong emphasis on long-term vision |

Focus on future roadmaps and milestones |

Suggests planning and seriousness |

Delays scrutiny and discourages early exit |

|

Professional website and branding |

High-quality design, whitepapers, and visuals |

Creates authority and trust |

Visual polish used to mask weak fundamentals |

|

Locked liquidity or restricted selling |

Explained as protection against volatility |

Sounds like investor safety |

Limits exist while liquidity accumulates |

|

Highly moderated Telegram or Discord groups |

Keeps discussions “positive and focused” |

Reduces noise and confusion |

Critical questions are removed to control sentiment |

|

Frequent reassurance from admins |

Claims that dips are normal or planned |

Maintains calm and confidence |

Prevents investors from reacting early |

|

Influencer mentions or partnerships |

Shared as validation or proof of legitimacy |

Leverages authority bias |

Often paid, exaggerated, or misleading endorsements |

|

Technical explanations without transparency |

Complex language around tokens and mechanics |

Sounds advanced and professional |

Used to confuse and avoid direct answers |

|

Discouragement of outside research |

Framed as avoiding misinformation |

Builds group loyalty |

Isolates investors from independent verification |

|

Promises of stability over returns |

Focus on “safe growth” rather than profit |

Appeals to cautious investors |

Stability is artificially engineered, not real |

Understanding these subtle warning signs helps investors avoid confusing controlled manipulation with genuine market growth. The earlier these patterns are recognized, the lower the risk of financial loss.

While red flags explain what to watch for on the surface, the real power of pump and dump scams lies in how they influence investor behavior. The next section explores the psychology behind why these scams feel so convincing.

Why Ramp and Dump Scams Feel Legitimate

Ramp and dump scams succeed because they don’t trigger fear. They trigger comfort. Instead of pushing urgency, they create a sense of stability and control, which lowers an investor’s natural defenses.

One key factor is trust built over time. Gradual price growth makes the project feel predictable. Investors begin to associate slow movement with safety, even when that movement is artificially controlled.

Another reason is social reassurance. Active communities, supportive comments, and constant updates create the feeling that others have done the research. When doubts appear, they are often softened or removed, reinforcing group confidence.

These scams also rely on authority bias. Professional branding, technical language, and occasional expert or influencer mentions make the project appear credible. Investors assume that a well-presented project has been vetted, even when it hasn’t.

Finally, ramp and dump scams exploit emotional alignment, not greed. The messaging focuses on patience, long-term thinking, and responsible investing. This makes cautious investors feel validated rather than pressured.

Because the manipulation feels logical and calm, many people don’t recognize it as a scam until the price collapses. Understanding this psychological design helps investors separate genuine growth from controlled market manipulation.

Now that the psychological tactics are clear, the next step is understanding how these scams appear in real situations. The following section looks at common ramp and dump patterns investors encounter across different crypto markets.

How to Protect Yourself From Ramp and Dump Scams

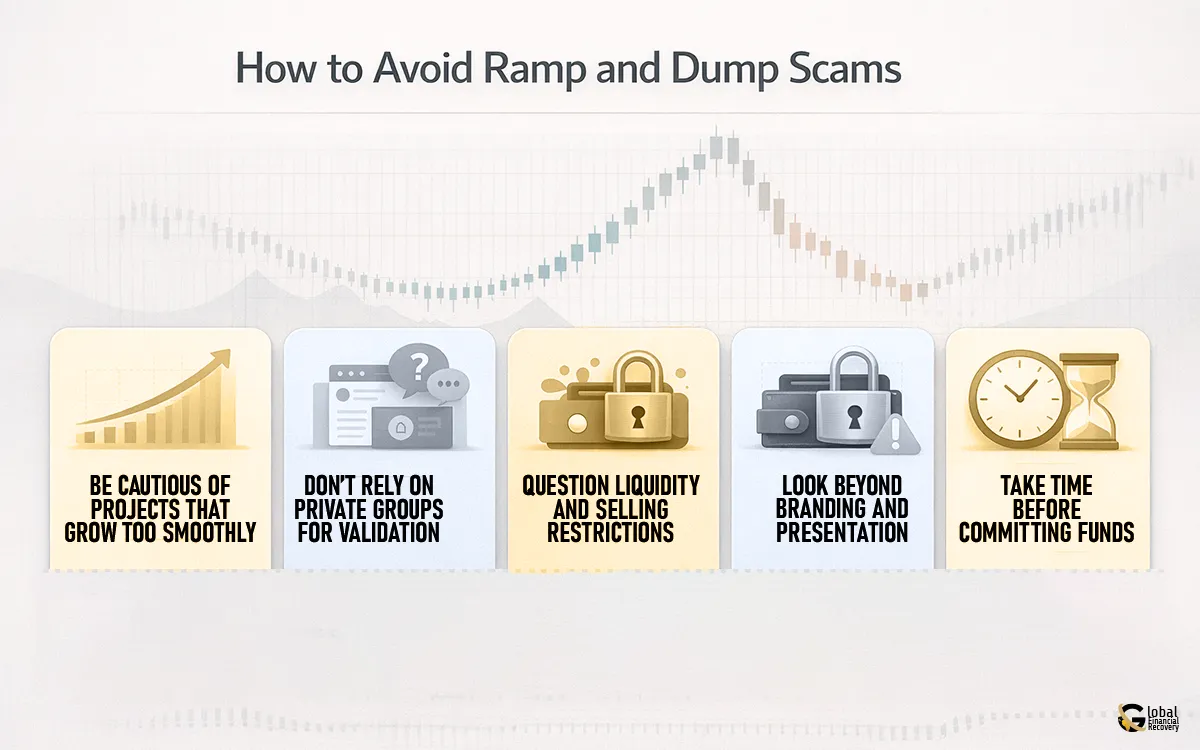

Avoiding ramp and dump scams doesn’t require advanced trading knowledge. It requires slowing down, questioning patterns, and refusing to rely on group confidence alone.

-

Be cautious of projects that grow too smoothly

Consistent, low-volatility price increases may feel safe, but genuine markets usually move unevenly. A price that only goes up deserves closer scrutiny.

-

Don’t rely on private groups for validation

Telegram and Discord communities are easy to control. Positive sentiment does not equal real demand. Always verify information outside the group.

-

Question liquidity and selling restrictions

If selling is limited or delayed, understand exactly why. Vague explanations using technical language are often meant to prevent early exits.

-

Look beyond branding and presentation

Professional websites and roadmaps are easy to create. Focus on transparency, not appearance. Ask whether the project’s growth is driven by real use or controlled activity.

-

Avoid decisions based on comfort or reassurance

Ramp and dump scams succeed by making investors feel calm and patient. If confidence comes from repeated reassurance rather than clear facts, step back.

-

Take time before committing funds

Legitimate opportunities do not disappear overnight. Pressure to “stay in” is often a warning sign, not a reason to invest.

The most effective protection against ramp and dump scams is awareness. When investors understand how manipulation is disguised as stability, they are far less likely to confuse control with genuine growth.

Recognizing these patterns early can make the difference between avoiding a scam and learning about it the hard way. It also helps in crypto fraud recovery. The final section brings together the key takeaways every investor should remember.

Awareness Is the First Step to Avoiding Market Manipulation

Ramp and dump fraud works because it does not raise a red flag immediately. They reduce suspicion with time, consistency, and trust rather than pressure or hype. When investors know how these schemes operate and why they think they are legitimate, it is much easier to notice manipulation before losses are made.

Cryptocurrency scam frauds are becoming more nuanced as the crypto market expands. Listening to price patterns that seem overcontrolled, doubting information exchanged within closed groups, and never making a decision based on reassurance alone can all help a great deal in cutting down the risk. Being aware does not eliminate all the losses, but it will assist the investors in avoiding errors due to false confidence.

Should you feel that you have fallen victim to a ramp and dump scheme or feel that the market has been manipulated, it is important to seek clarification at an early stage. Contact Global Financial Recovery for recovery and to regain your peace of mind.

FAQs (Frequently Asked Questions)

Yes. Ramp and dump schemes fall under market manipulation, which is illegal in regulated markets. While crypto enforcement can be complex, the activity itself is deceptive and fraudulent.

Because they avoid hype and urgency. Slow price growth, professional presentation, and controlled communities make these scams appear legitimate.

Yes. These scams are often designed for cautious and informed investors, making them harder to recognize.

New tokens, low-liquidity assets, and projects promoted in private groups are more easily manipulated.

Stop investing more funds, document all details, and seek clarity before making further decisions.