- Investments

- September 17, 2025

Table of Contents

Fake investment dashboards are one of the fastest-growing online scams. At first glance, these platforms look just like real trading accounts, complete with charts, account balances, and even “advisors” offering guidance. Victims believe their money is growing, but in reality, everything on-screen is carefully fabricated.

These scam platforms prey on trust, showing fake profits and blocking withdrawals until victims lose their savings. According to recent news reports, more than 17,000 fake news sites are actively promoting scams, including fraudulent dashboards that mislead victims into believing they are earning profits.

This guide explains how fake trading dashboards work, the red flags to watch for, and how you can protect yourself in 2025 before it’s too late.

What is a Fake Investment Dashboard?

A fake investment dashboard is a website or app that looks like a real trading or investment platform but is completely fake.

It’s designed to trick you into thinking your money is growing, showing you impressive charts, rising account balances, and fake profits. Everything you see, your “earnings,” your trades, even withdrawal confirmations, is carefully faked by scammers.

On these dashboards, you might notice:

- Balances that always seem to go up

- Charts are moving like real markets

- Fake transaction histories

- Messages urging you to invest more

- Buttons for withdrawing money that never really work

The purpose is simple: make you trust the platform enough to keep depositing money. But there’s no real trading happening behind the scenes; it’s all just a digital illusion built to steal your funds.

How Fake Investment Dashboards Actually Work?

Fake investment sites might look real; that’s how they trick people. They’re sophisticated digital traps, built to look and feel like genuine trading platforms. Every color, chart, and line of code is designed to make you believe you’re investing wisely, while behind the scenes, it’s all a carefully choreographed illusion.

Here’s how fake trading platforms work from start to finish and how so many people get caught in the scam.

Step 1: How They Hook You

It always begins with the hook. Scammers know exactly where to find you on Instagram, Facebook, TikTok, Telegram, or even your email inbox.

You might see an ad boasting how someone flipped $500 into $10,000 overnight using a “new AI trading system.” Or you’ll stumble upon a fake news story claiming a famous celebrity or business leader has discovered a secret investing method. Sometimes, the bait is as simple as a fake testimonial from someone who looks like an ordinary investor sharing their “success story.”

These messages are crafted to tap into your emotions of greed, hope, and curiosity. And once you click the link, you’ve stepped right into the scammers’ playground.

Step 2: They Make It Look Real

The layout looks clean and professional, just like real platforms such as Binance, MetaTrader, or eToro. Price charts move to appear live, and the dashboard shows login areas and fake company logos, and they even add fake badges to make it look like they're officially approved.

You’re asked to fill out KYC forms, upload documents, or talk to “customer support.” The scammers want you to believe you’re engaging with a regulated financial service. They even add legal-sounding terms in their privacy policy and terms of service, but it’s all just for show. Underneath, the scam dashboard backend is nothing but scripted code with no real connections to financial markets or trading infrastructure.

Step 3: They Show You the Dream

Once you’ve signed up and deposited your first bit of money, sometimes as little as $100 or $250, that’s when the fake investment platform goes to work.

Suddenly, your dashboard shows your balance increasing. Maybe it’s climbing by 1-2% every day. The charts blink and update to trick you into thinking they’re active, supposedly reacting to global market changes. You’ll see fake trading histories filled with winning trades and positive returns. All of this is an illusion. Behind the scenes, scam dashboard backend systems generate these numbers and animations purely to convince you that your investment is growing. There’s no real trading, no genuine profits, only a carefully crafted performance designed to keep you excited and investing more.

Step 4: Then Comes the Personal Touch

Not long after, you get a phone call, an email, or a chat message from someone claiming to be your personal “account manager” or “investment advisor.” They sound professional and friendly. They congratulate you on your “amazing profits” and talk about your financial goals. They offer insider tips or urge you to upgrade your account for even bigger returns.

But underneath the charm is a calculated strategy. They’re following a script designed to manipulate your emotions:

- They flatter you, calling you smart and savvy.

- They create urgency, warning you about a closing window of opportunity.

- They drop exclusive deals that “only high-tier clients” can access.

Their mission is simple: extract more money from you, layer by layer, while keeping you convinced that you’re on the path to wealth.

Step 5: They Start Making It Hard to Withdraw

Inevitably, the day comes when you try to cash out your profits. And that’s when everything changes.

You’ll run into one obstacle after another. Suddenly, you’re told you must pay unexpected fees, maybe a “withdrawal fee,” “tax clearance,” or an “account unlock charge.” Support becomes slow. The friendly account manager who used to call you daily now stops picking up the phone. Sometimes, your account gets flagged for suspicious activity, or the withdrawal status stays stuck at “pending.”

No matter what excuse they give, the truth is simple: these fake trading platforms were never built for withdrawals, only deposits. Your money was gone the moment you sent it.

Step 6: They Vanish or Double Down

Eventually, one of two things happens.

In many cases, the platform vanishes or shuts down overnight. The website disappears, phone numbers go dead, and your login no longer works. This is known as an exit scam: scammers shutting everything down once they’ve drained enough money from victims.

But sometimes, they don’t disappear at all. Instead, they keep you trapped in an endless loop. They promise to help you recover your “stuck funds,” but only if you pay another fee. Or they trick you into yet another fake investment opportunity, claiming it’s the only way to get your money back. This is how victims can get pulled deeper and deeper into the scam, sometimes losing not just thousands but their entire life savings. Meanwhile, the scammers quietly move on to new victims, using the same playbook.

Scam dashboard backend systems and fake investment software use clean design and fake data to make everything look real. They’re made to make you believe you’re building wealth until you discover it was all a lie.

Types of Fake Investment Dashboards You Should Know

Fake investment dashboards vary in style, but all use tricks to attract and fool investors. Here’s how different types of scam dashboards and fake trading platforms operate and what scammers usually say or promise:

|

Type |

How It Works |

Common Scammer Phrases |

|

Ponzi-Style Dashboards |

Show steady daily returns (e.g. 2% daily), typical in crypto High-Yield Investment Programs (HYIPs). Profits shown are actually new victims’ deposits. |

“Earn guaranteed daily returns!” “Your investment grows 2% every day!” “Withdraw anytime, no risk!” |

|

Forex/Binary Options Scam Dashboards |

Mimic legit platforms like MetaTrader 4 or 5. Allow fake “trading” with no real market connection. Early trades look profitable, then turn into losses to force more deposits. |

“We’re experts in forex trading.” “Your trade just won $500. Invest more to keep winning!” “Market volatility caused losses in deposits to recover.” |

|

Crypto Investment Scam Portals |

Display fake token balances, staking profits, or NFT values. Claim wallets are “locked” or require gas fees for withdrawals. Use real crypto logos and terms. |

“Your funds are locked for security.” “Pay gas fees to release your crypto.” “Stake more tokens for higher rewards.” |

|

Celebrity-Endorsed Platforms |

Advertise using fake news articles and social media posts claiming celebrities endorse the platform. Dashboards show “auto-trading” or “AI investing” tied to famous names. |

“Elon Musk uses this to double his money!” “Exclusive AI software makes you rich!” “Featured on major news channels!” |

|

Copycat Broker Clones |

Clone real brokers like eToro or Binance. Use identical dashboards but hosted on different, suspicious domains. Victims often arrive via phishing links. |

“Log in here to access your secure account.” “We’re the official support for [real broker name].” “Update your KYC to avoid account suspension.” |

Bottom line: Every type of fake investment platform’s dashboard uses psychological tricks and convincing language to look real. Knowing how fake trading platforms work helps you spot these scams before you lose your money.

Why These Dashboards Look So Real (But Aren’t)?

Fake investment dashboards are convincing for a reason: they’re built to copy everything you expect from a real trading or crypto platform. That’s why many people don’t spot the scam until it’s too late.

Here’s why they work so well:

- Design mimicry:

Scammers copy the full layout of real brokers, including logos, charts, menus, and colors, so the dashboard feels familiar and professional. - Fake live data:

Charts move. Prices change. It all looks dynamic, but it’s often just pre-coded or copied from a real exchange with no real-time connection at all. - Trusted badges and licenses:

Many sites display fake “FCA-regulated” or “CySEC-licensed” badges. These images look official, but don’t link to any real authority. - Interactive pop-ups and alerts:

Dashboards may show fake trade activity, profit alerts, or withdrawal updates to make the platform seem busy and trusted. - Live chat

Some platforms include chat windows or “advisors” who offer guidance, but they’re actually scammers trained to keep you engaged and investing. - KYC processes and verification steps:

Fake platforms often ask for ID uploads or verification steps to appear legitimate. These are just stalling tactics or, worse, used for identity theft.

Together, these elements give victims a strong sense of trust and urgency, even though nothing underneath is real.

Key Warning Signs to Spot a Fake Investment Dashboard

Spotting a fake investment dashboard isn’t always easy, especially when scammers make them look so professional. Yet, if you know what to watch for, the signs of a scam dashboard start to become clear.

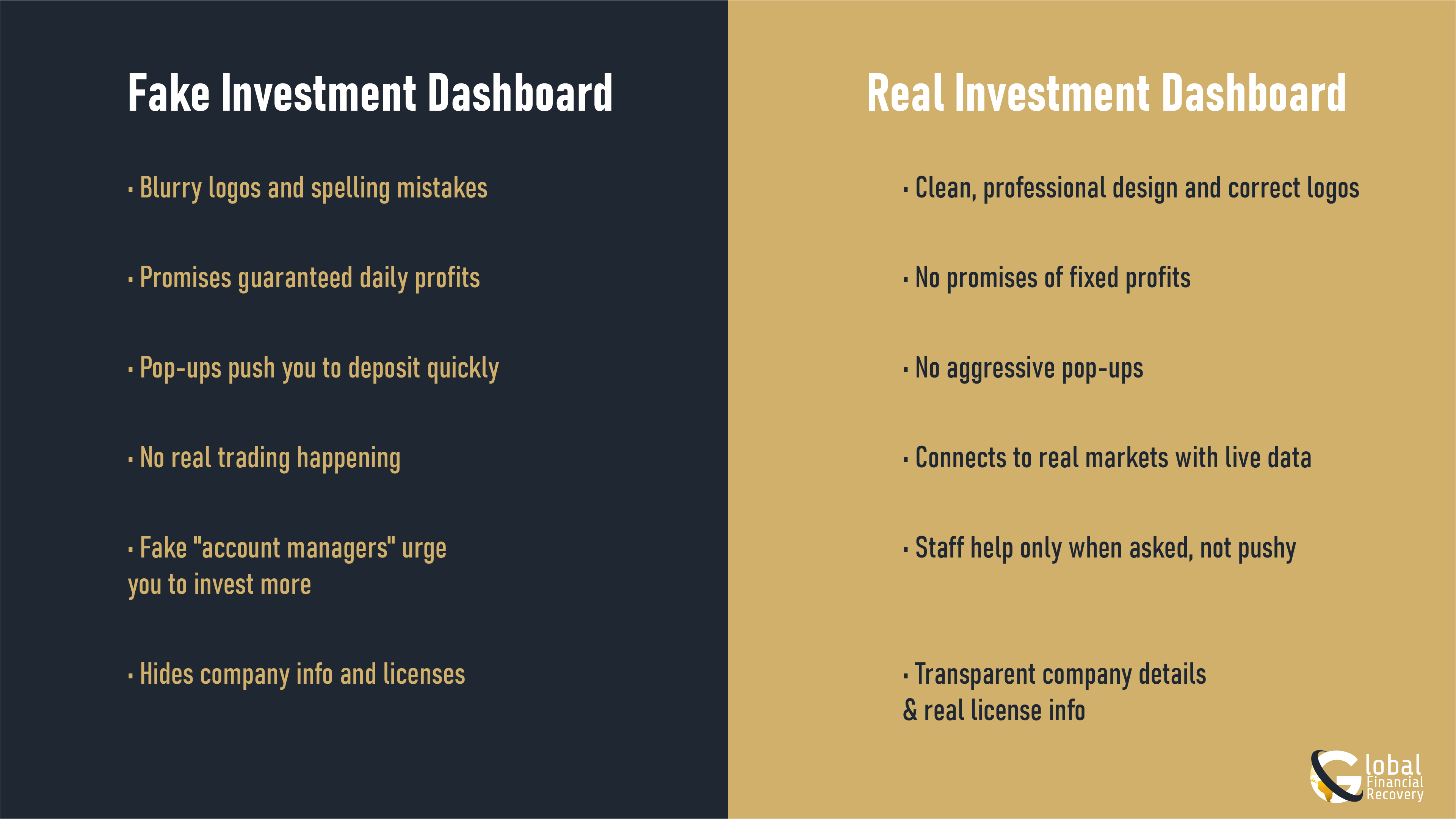

One of the biggest red flags is unrealistic returns or guaranteed profits. Scammers love to show you balances growing steadily, often promising daily returns like 2% or 3%, regardless of market conditions. Real investments can’t promise such fixed, high gains without risk. If a platform is boasting guaranteed profits and flashing big numbers, it’s a strong clue you’re dealing with fake trading screenshots rather than real performance.

Another warning sign is locked funds and withdrawal barriers. Victims often find they can deposit money easily, but when they try to withdraw, the platform invents excuses like “verification fees,” “taxes,” or “gas fees.” Even after paying these so-called fees, funds remain inaccessible, trapping victims deeper into the scam.

Scammers also use fake account balances and transaction histories to build trust. Your dashboard may show impressive profits and “successful trades,” but these figures are entirely fabricated. Every dollar you think you’ve earned might exist only on-screen, carefully crafted by scammers to keep you investing more.

Some scam sites look fancy at first, but small clues can expose them. Watch for blurry logos, bad grammar, or broken links. Real investment platforms don’t have these sloppy mistakes.

Scammers also use pressure and fear. Fake “account managers” might rush you to deposit more money or warn you about fake emergencies. Real companies don’t pressure you like that.

Always check who’s behind a platform. Legitimate sites clearly list their company details and licenses. If you can’t verify this info, it’s a big red flag.

Finally, beware of fake testimonials and celebrity endorsements. Scam dashboards often claim that big names like Elon Musk or Shark Tank investors use their platform. They may even show fake news headlines to build credibility. But these claims are usually completely fabricated and are a classic hallmark of investment fraud.

If a platform shows you unrealistic profits, blocks your withdrawals, or starts pressuring you to invest all of a sudden, you're likely looking at an investment dashboard. And noticing those signs could be a lifesaver for you, able to save any remaining dollars you have worked for thoroughly.

How Scammers Manipulate Victims Using Fake Investment Dashboards?

Fake trading dashboards are a common tool used in investment scams. These dashboards are designed to look like genuine trading platforms, giving victims a false sense of trust. Scammers use them to display fake profits, manipulate emotions, and convince people to invest more money, only to steal it in the end. Here's how these dashboards trick people.

1. Fake Profit Dashboards

Scam websites show users a dashboard with fake earnings. It looks like the user is making profits daily, even when no real trading or investment is happening. It makes people believe their money is growing, so they feel comfortable and are more likely to deposit additional funds without asking questions.

2. Assigned “Account Managers” or Advisors

After registration, someone reaches out claiming to be your personal account manager. They offer help, give advice, and encourage more deposits. These people sound professional and friendly, which builds trust. Victims believe they are receiving expert help, not realizing the person’s goal is to convince them to invest more money.

3. Urgent Alerts and Pressure Messages

Pop-up messages appear on the platform with warnings like “Deposit now to avoid account suspension” or “Market opportunity closing soon.” These messages create pressure to act quickly. Victims often deposit more money without thinking it through, trying to avoid problems or missing out on a supposed opportunity.

4. Fake User Chats and Comments

Some platforms show live chat boxes or comment feeds where other “users” appear to be making big profits or thanking the company for payouts. These are not real people.It makes the website seem active and trustworthy. Victims think other users are having success, so they assume the platform is working and decide to invest more.

5. Fake Celebrity Endorsements and Company Logos

The website might display pictures of celebrities or well-known businesspeople, claiming they support or use the platform. It may also include logos of banks or news sites. Familiar faces and brands make the platform look trustworthy. Victims assume the company must be legitimate if it's linked to well-known names, even though the images are used without permission.

6. Extra Fees When Withdrawing

When a user tries to withdraw money, the platform suddenly demands payment for “taxes,” “verification,” or “release fees.” These fees were not mentioned before.Victims think they need to pay these fees to get their money back. Even after paying, the platform usually delays or blocks the withdrawal again, asking for more money.

7. Small Early Payouts

Sometimes, the scam platform allows a small withdrawal early on such as $50 or $100. This makes it seem like the system works.After receiving a small payout, victims feel more confident and invest larger amounts. But after that, the platform blocks further withdrawals and asks for more deposits instead.

8. Website Design That Looks Like Real Companies

Scam websites often copy the look of real trading platforms—similar layout, colors, charts, and buttons—to appear professional. A familiar design makes people feel the platform is legitimate. Most victims don’t check if the company is licensed or registered because the site looks like other sites they trust.

How to Avoid Fake Investment Dashboards and What to Do If You’ve Been Scammed?

Fake investment dashboards can look very real, with nice designs and charts that seem trustworthy, but often, no real trading is happening. To stay safe, always check if the platform is officially licensed by a financial regulator by looking it up on government websites yourself, not just trusting what the site claims. Also, read honest reviews from other users and be careful of web addresses that look similar to well-known brokers but aren’t quite right.

Legitimate investment sites clearly state the company details and will not pressure you with constant pop-ups asking for more money or putting urgency on how to fund your account. Scammers will show you a profit that is staged or have someone playing your account manager so that they can try to manipulate you into sending them more money.

If you think you’ve been scammed, stop talking to them and don’t send any more money. Save everything—emails, screenshots, and payment info, and report the scam to the right authorities. There are experts who can help you try to recover your lost money.

Don’t Let a Fake Dashboard Be Your Last Investment

If you’ve made it this far, give yourself credit; you’re already protecting yourself more than many people ever do. Learning how fake investment dashboards work and how scammers play on your emotions can help you keep your money. Signs, like odd website names, mismatched company details, and pressure to send more, can help you see through the act.

If you’ve been caught up in one of these scams, remember this: it’s not your fault. This is a message to you in case you have been a victim of one of such scams: it is not your fault. These are the criminals who are experts in deceit. You are worth investing in peace and confidence. Maybe you are attempting to prevent a rip-off, or perhaps you lost money and are trying to get it recovered; either way, just know that you are not alone; you have options.

Think you’ve been scammed? Don’t wait. Start your recovery journey today with Global Financial Recovery.

FAQs (Frequently Asked Questions)

No, and that's actually one of the biggest red flags. If your balance suddenly grows fast or you’re told you “earned $500 overnight,” chances are it’s just a number they made up to lure you in deeper.

These scams promise you passive income by “staking” crypto. The dashboard shows fake token growth, but your crypto is either never really staked or has already been stolen.

Yes, and they do. Scammers often use a backend admin panel to edit your balance, fake trade history, and even simulate “live support.” What looks like your account is growing is often just smoke and mirrors.

It’s part of the manipulation. These fake advisors praise your decisions, offer help, and build trust, all while convincing you to invest more. It’s social engineering wrapped in a friendly tone.

Yes, some scammers create fake trading mobile apps that look just like real ones. They may even be available on third-party app stores or sometimes briefly sneak onto Google Play. Always check the app developer and read real user reviews.