- Cryptocurrency

- January 23, 2026

Table of Contents

Most people don’t think their retirement savings could disappear overnight until someone convinces them to move their 401(k) or pension into crypto.

Crypto scammers often start with friendly conversations about financial security, retirement growth, and protecting savings from inflation. They position cryptocurrency as a “smart upgrade” and encourage victims to transfer retirement funds into what they claim is a secure, high-return crypto investment. For many, it feels like responsible planning, not a risk.

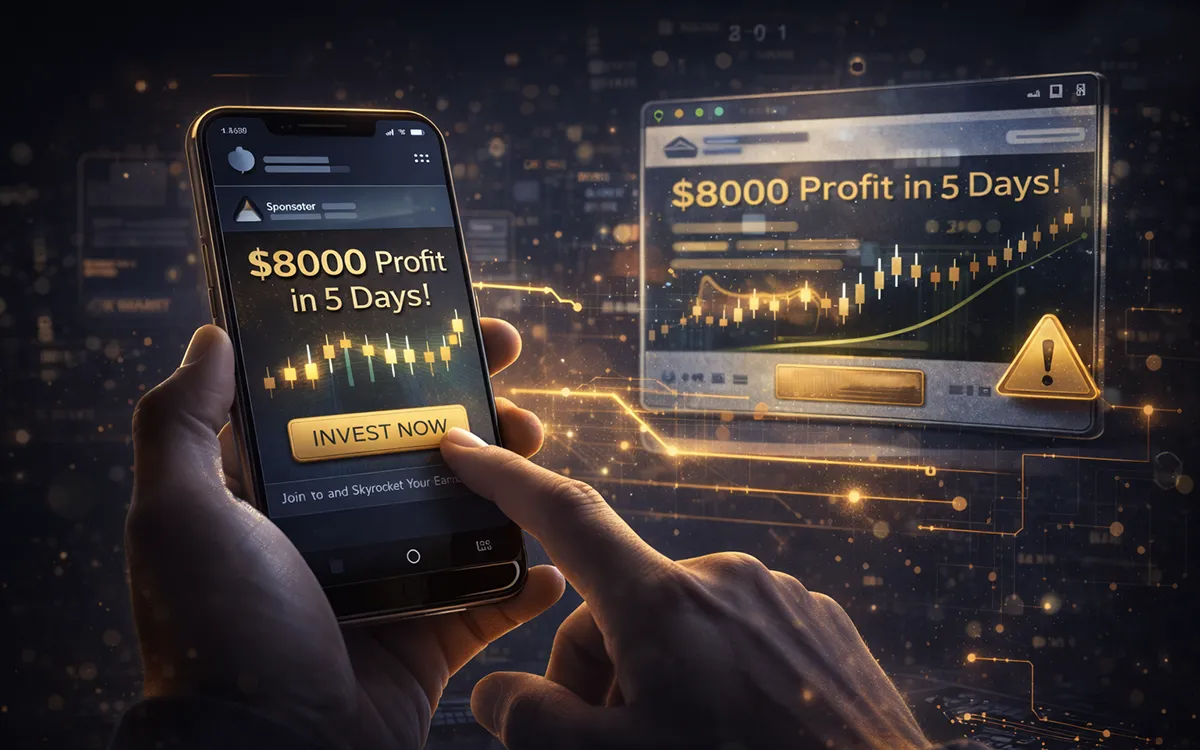

But these offers are frequently part of sophisticated retirement crypto scams. Fake trading dashboards, impersonated financial advisors, and pressure tactics are used to rush decisions and prevent second opinions. Once the money is sent, victims realize they’ve fallen into a carefully engineered scam targeting retirement accounts.

In this guide, we break down how scammers steal 401(k)s and pensions using crypto, the most common red flags, and how to avoid losing retirement savings to cryptocurrency fraud.

Why Retirement Accounts Are Attractive to Scammers?

Scammers aren’t randomly picking their victims; they target retirement accounts because of the money and the trust involved. 401(k)s, pensions, and other retirement savings typically represent tens or hundreds of thousands of dollars, making them highly attractive.

Fraudsters rely on psychological tactics, knowing that retirees or pre-retirees may be less familiar with digital currency and complex investment vehicles. By presenting themselves as financial experts or crypto advisors, scammers can make fraudulent investment opportunities appear credible, promising high returns, “exclusive” crypto deals, or safe diversification strategies.

Other reasons scammers focus on retirement funds:

- Significant, consolidated savings that are easier to exploit.

- Perceived security — people don’t expect threats to their retirement accounts, making scams more effective.

- Complexity of investment options — many retirees aren’t familiar with crypto, self-directed IRAs, or digital wallets.

Knowing about these weaknesses is key to protecting your retirement funds. When scammers realize someone has retirement savings, they use multiple tactics that appear legal and reliable to steal money.

Common Crypto Scams Targeting Retirement Accounts

Fraudsters put much consideration into developing their plans. Their stories are well designed, their websites are of a high quality, and they create a sense of urgency to act promptly, which makes them very persuasive.

These kinds of scams can be especially harmful when you are going to retire, since these new and safe opportunities appear interesting. The most common forms of cryptocurrency scams are listed below, and have plain language listed below so that you are aware of what to watch out for to help keep your savings safe.

|

Scam Type |

How It Works |

Why It’s Risky for Retirement Savings |

|

Fake Crypto Investment Platforms |

Victims are directed to realistic websites or apps that show fake profits. They’re encouraged to transfer money from a 401(k), pension, or IRA to invest in crypto. |

Once larger amounts are deposited, withdrawals are blocked, and the platform disappears. |

|

Self-Directed IRA Crypto Scams |

Scammers convince people to roll retirement funds into a self-directed IRA to invest in crypto or blockchain projects. |

These accounts offer fewer safeguards, making fraud harder to detect and recover from. |

|

Fake Financial or Crypto Advisors |

Scammers pose as experienced advisors offering “safe” crypto diversification for retirement plans. |

Victims trust the advice and unknowingly send funds to scam-controlled wallets. |

|

High-Pressure Retirement Rollover Scams |

Victims are rushed to act quickly and are often told rules are changing, or their pension is at risk. |

Pressure removes time to verify the investment, leading to impulsive transfers of large balances. |

|

Precious Metals + Crypto Combo Scams |

Crypto is bundled with gold or silver investments to appear conservative and secure. |

The mix lowers suspicion and convinces retirees that the investment is low-risk. |

|

Romance-Linked Retirement Scams |

A trusted online relationship slowly introduces crypto investing using retirement savings. |

Emotional trust replaces financial caution, often leading to devastating losses. |

What makes these scams especially dangerous is that they don’t feel risky at the start. In fact, many victims believe they’re making a responsible financial decision.

Scammers speak the language of retirement planning, long-term security, and diversification, exactly what people want to hear when protecting their future.

In many cases, victims don’t realize anything is wrong until they try to withdraw their money, and by then, the scammer is gone.

Now that you understand what types of crypto scams target retirement accounts, the next step is learning. To understand why so many intelligent people fall for these scams, it’s important to look at how scammers slowly guide victims toward moving their retirement funds.

How Crypto Scammers Slowly Convince Victims to Shift Retirement Funds

Crypto scammers rarely start by asking for money. Instead, they start by building comfort. Think of it like someone slowly moving your furniture toward the door; you don’t notice anything missing until it’s too late.

Scammers begin with conversations about financial security, retirement growth, or protecting savings from inflation. They present crypto as a modern upgrade to traditional retirement planning, often using familiar terms like “diversification” or “long-term strategy.” Once trust is established, they suggest moving funds from a 401(k), pension, or IRA into a crypto investment they control.

To speed things up, scammers create urgency. They may claim new regulations are coming, a limited opportunity is closing, or your retirement account could be at risk if you don’t act. The pressure is intentional; it stops people from verifying the advice or seeking a second opinion.

Understanding how scammers persuade victims is critical, but knowing the warning signs that appear during these conversations can stop a scam before any money is moved.

Red Flags of Crypto Scams Targeting Retirement Accounts

These warning signs show how crypto scams target retirement accounts. Learning them helps you stay alert and protect your hard-earned retirement savings.

- Unrealistic Returns

If someone promises guaranteed or very high crypto profits using your retirement money, it’s a big red flag. Real investments never guarantee returns.

- Pressure to Act Fast

Scammers often rush you by saying the offer will end soon or the rules are changing. Take your time; urgency is a common scam trick.

- Unsolicited Offers

Random calls, emails, or social media messages about crypto investments are warning signs. Legit companies don’t chase people this way.

- Self-Directed IRA Rollovers

Being told to move your 401(k) or pension into a self-directed IRA for crypto is often part of a scam. This can put your retirement savings at risk.

- Professional-Looking Platforms

Fake crypto websites and apps can look very real. A polished design does not mean the investment is safe.

- Isolation Tactics

If someone tells you not to talk to family, friends, or a financial advisor, that’s a serious red flag. Honest investments welcome second opinions.

- “Exclusive” or Limited-Time Offers

Claims like “only for you” or “ending today” are used to rush decisions. Slow down and verify first.

- Large Upfront Transfers

Requests for big transfers from your retirement account are risky. Scammers often disappear once the money is sent.

- Confusing Explanations

Overly technical crypto terms are used to confuse or scare people into trusting the scammer.

- Emotional Pressure

Fear, urgency, or “protect your retirement” messages are used to control decisions. Stay calm and think clearly.

Being aware of these crypto scam red flags helps protect your 401(k), IRA, pension, and retirement savings. Noticing something feels wrong can stop a scam before it causes damage.

What to Do If You Suspect a Crypto Scam Targeting Your Retirement Savings

When you have the suspicion that a crypto scam has contacted your 401(k), pension, IRA, or other retirement savings, pause and take a moment of thought before you act. Fraudsters like to give the impression that there is a rush to act, so take your time to research the financial advisor, cryptocurrency site, or investment.

Never put any retirement funds into a self-directed IRA or crypto investment without discussing it with someone very close or a licensed financial advisor and carefully reviewing all the paperwork before signing or transferring any of the money.

In case anything looks suspicious, report the activity, put on extra security measures by changing passwords and adding extra security, and check your retirement accounts against suspicious activity.

It is important to keep up to date on crypto-related scams of retirement accounts, investment fraud, and retirement fraud prevention in order to preserve your hard-earned money and make safe financial choices.

If you’re unsure whether an opportunity is legitimate, a quick checklist can help you pause and reassess before making a costly decision.

How to Avoid Crypto Scams Targeting Retirement Accounts

Before moving money from your 401(k), pension, or retirement savings, pause and check the following:

- No promises of guaranteed or low-risk crypto returns

- No pressure to act quickly or “limited-time” offers

- No unsolicited calls, emails, or social media messages

- The advisor and platform have verifiable credentials and registration

- No push toward a self-directed IRA for crypto without clear reasons

- Crypto platform can be independently verified online

- You are free to consult a family member or a trusted financial advisor

- No request for large upfront transfers from retirement accounts

If any part of an investment raises doubt, stop and verify before taking the next step. This checklist helps protect against crypto scams, retirement fraud, 401(k) scams, pension fraud, and risks associated with self-directed IRAs involving crypto.

When Retirement Funds Are at Risk, Acting Early Matters

Crypto scams targeting retirement accounts are becoming more sophisticated, but staying informed is your strongest defense. By identifying red flags, refusing to act under pressure, and confirming every investment opportunity, you can protect your long-term savings. If your 401(k), pension, or IRA may have been targeted, or funds have already been transferred, act immediately to limit further loss.

If you believe your retirement account has been targeted or you’ve already transferred funds, don’t wait. Contact Global Financial Recovery for professional guidance and support. Early action can make a real difference when dealing with retirement scam recovery, crypto fraud, and pension investment scams.

FAQs (Frequently Asked Questions)

Crypto scammers often focus on 401(k)s, pensions, and IRAs by offering fake “safe” or “high-return” crypto investments. They use urgency, professional-looking platforms, and confusing terms to gain trust and push quick decisions.

Not always. While self-directed IRAs are legal, scammers misuse them to move retirement funds into risky or fake crypto investments. Always verify the platform and advisor before transferring money.

Urgency stops people from checking facts. Scammers know that rushing decisions increases mistakes, especially when retirement savings are involved.

Immediately secure your accounts, change passwords, enable extra security, and inform your bank or retirement plan provider. Acting fast can reduce further loss.

Avoid unsolicited offers, verify every advisor, talk to trusted people, and never move retirement funds under pressure. Awareness is your strongest defense.