- Miscellaneous

- June 23, 2025

Table of Contents

In 2025, elderly scams are growing at a rapid rate. Every day, more senior citizens are being targeted by fraudsters using phone calls, emails, fake websites, and even social media. These scams are not just annoying; they can steal life savings, personal identity, and peace of mind.

The rise in senior citizen scams, especially those linked to fake tech support, phishing emails, and IRS impersonators, shows how urgent this issue is. Many scams are now designed specifically to confuse or frighten older adults into giving away money or information.

In 2023, Americans over 60 reported $3.4 billion in losses to scams, according to the FBI’s IC3, an 11% increase from the previous year.

This blog will guide you through the top scams targeting older adults, explain how these frauds work, and provide practical steps to help protect yourself or your loved ones. It’s time to build awareness and stand up to senior citizen fraud with compassion, clarity, and action.

Who Are the Main Targets?

Scams for the elderly are by no means random: they require careful planning.

A person who might be an elderly victim is often seen as trustworthy and may live alone. They are also typically unfamiliar with the ever-evolving tech universe. Therein lies the possibility of being victimized.

By the year 2025, the scams that target elderly persons will be far more sophisticated than they were some years ago. Fake emails, phone calls, texts, and even social media are all means by which criminals lure their victims.

They present themselves as relatives in distress, government officials, or even romantic partners. Such schemes have the most harmful effects when we talk about elder romance scams, where lonely seniors are scammed into sending money to individuals they think they've fallen in love with.

Why Are Seniors Often Targeted?

- Trusting nature: Many older adults grew up in a time when handshakes and honesty mattered. Scammers use that trust against them.

- Isolation: Seniors who live alone or don’t get regular social interaction may be more likely to engage with strangers.

- Declining memory or health issues: Conditions like dementia can make it harder to spot a scam.

- Access to retirement funds: Scammers know seniors may have savings, pensions, or Social Security benefits.

- Less tech awareness: Seniors may not always recognize phishing links, fake apps, or phone spoofing.

According to the AARP, more than $28 billion is lost to elder financial abuse each year.

In other words, older adults are seen as easy financial targets, and the emotional cost is often even greater than the money lost.

How Scammers Trick Seniors: Methods Used in 2025

Scammers don’t just rely on luck; they use proven strategies to deceive. In 2025, scam tactics targeting the elderly have become more manipulative and tech-savvy than ever. From urgent fake calls to phishing messages that look like real bank alerts, these tactics are designed to confuse and pressure older adults into acting quickly.

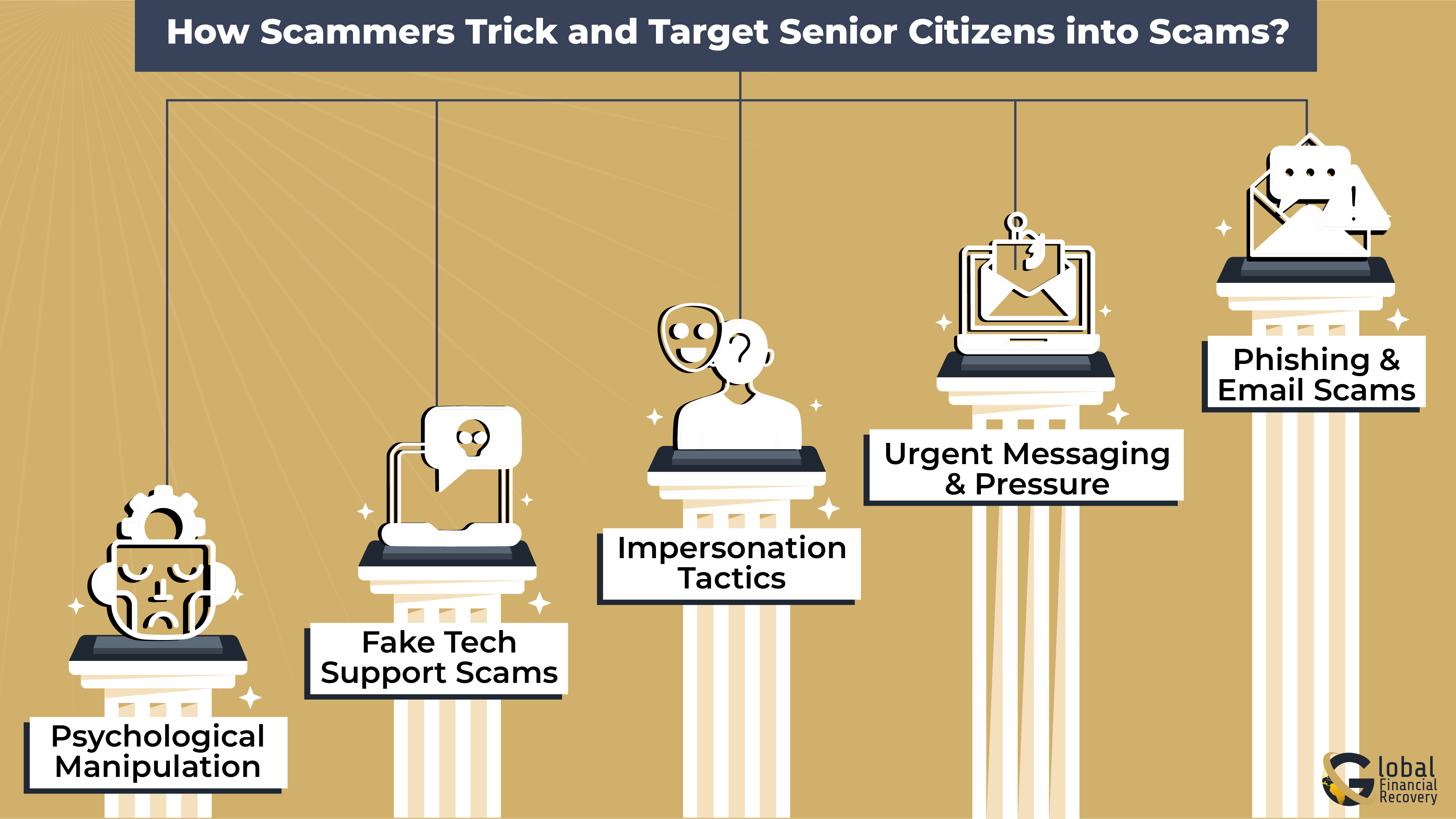

Top Methods Scammers Use To Scam Seniors:

- Psychological Manipulation

Scammers prey on fear, urgency, or even love. A common trick? Pretending a grandchild is in trouble and needs money immediately, this is known as the “grandparent scam.” Others may claim to be romantic interests, using trust-based deception to build emotional connections before asking for money. - Fake Tech Support Scams

Elderly people tend to receive calls or pop-up windows informing them that there is a virus on their machine. The offender claims to work for Microsoft or another computer-related firm, convincing the individual to provide remote access. Upon access, they may steal information or demand money. - Impersonation Tactics

They might impersonate the IRS, Social Security, Medicare, or even local police. They will typically use government-sounding language and caller ID spoofing to appear legitimate. Impersonation scams can frighten seniors into revealing personal information or paying fake fines. - Urgent Messaging and Pressure

Such messages as "Act immediately or lose your benefits" or "Click this link now to protect your account" are written to panic people. Scammers count on the elderly acting impulsively before they've had an opportunity to consider it or seek assistance. - Phishing and Email Scams

These usually appear like genuine messages from banks, authorities, or delivery companies. Clicking on the wrong link can lead to malware or identity theft.

Education and awareness are critical. Once you see the way scammers work, it is easy to put the lid on them before they do any damage.

How Scammers Reach Seniors: Phone, Email & Social Media Fraud?

In 2025, scammers are using phones, emails, texts, and social media to deceive seniors, where they feel most connected. Understanding how each channel is exploited is key to stopping a senior citizen scam before it starts.

|

Channel |

Scam Tactic |

How It Works |

Real Example / Red Flag |

How to Stay Safe |

|

Phone |

Robocalls, Fake IRS/Medicare Calls |

Scammers use automated or live calls pretending to be from government agencies (e.g. IRS, Medicare). They demand immediate payment or personal info. |

"You owe taxes. Pay now to avoid arrest." |

Hang up and call the agency directly using official numbers. Never provide banking info over the phone. |

|

|

Phishing Emails |

Emails appear from banks, retailers, or insurance providers. They ask seniors to click links or "verify" account details. |

Email from "Bank of America" asking to confirm account info |

Look for poor grammar, odd email addresses. Do not click links. Contact the institution directly. |

|

Text Message (SMS/Smishing) |

Fake Delivery Notices, Prize Claims |

Texts claim you’ve won money, or there's an issue with a package. Clicking links installs malware or steals info. |

"FedEx: Package delivery failed. Click to reschedule." |

Don’t click unknown links. Use official tracking tools. Report to your phone provider. |

|

Facebook & Social Media |

Romance Scams, Fake Investment Tips |

Scammers befriend or “flirt” with seniors online. They pretend to fall in love or offer investment deals, then ask for money. |

"I need help with a crypto investment. I trust you." |

Keep accounts private. Don’t share money with someone you haven’t met in person. |

|

WhatsApp & Messaging Apps |

Impersonation Scams |

Scammers pretend to be a family member who has a new number. They claim there’s an emergency and request money. |

"Hi Dad, my phone broke. Can you send $500 for my rent?" |

Call the real number to verify. Never transfer money without speaking to them. |

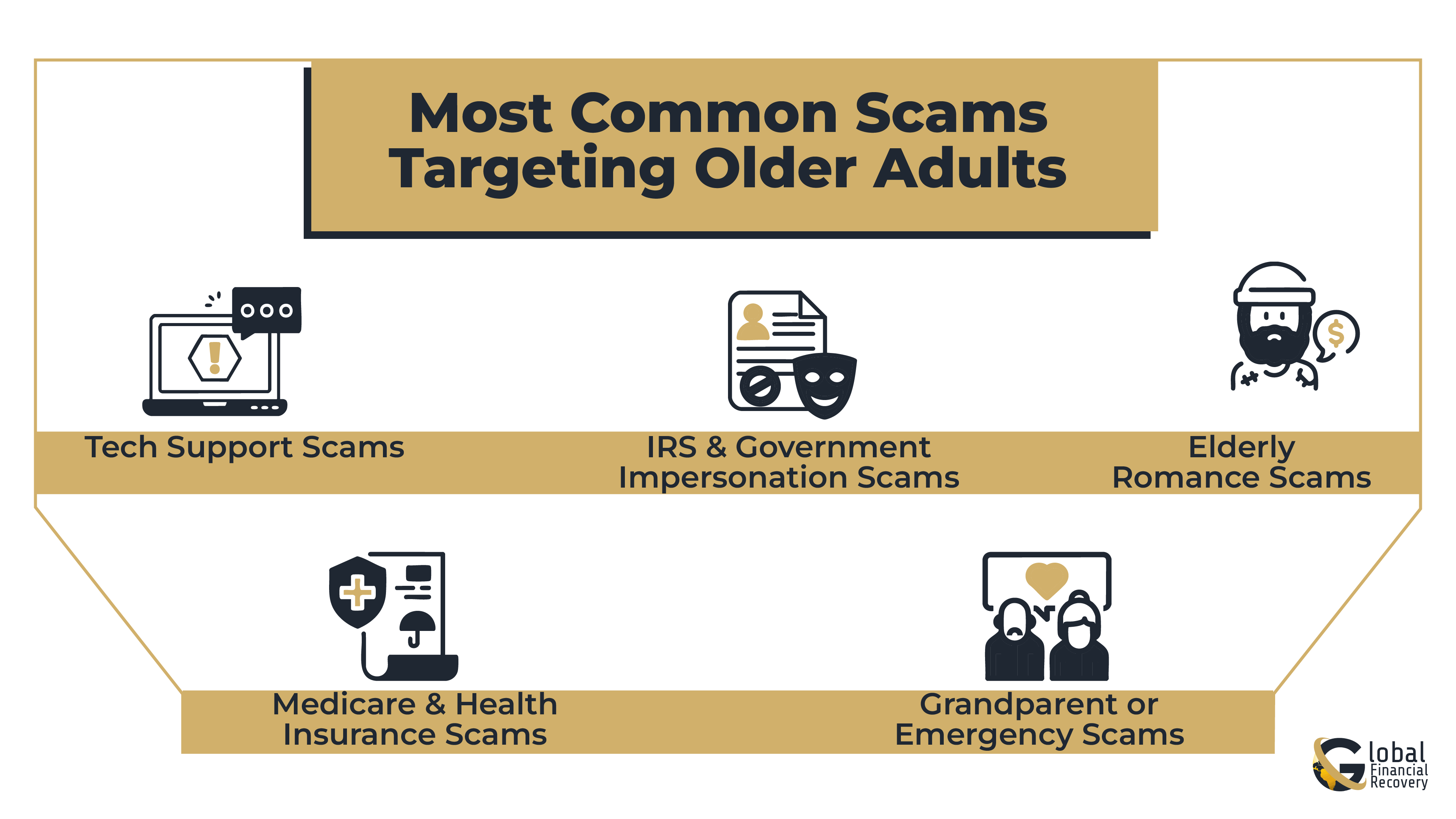

5 Most Common Elderly Scams in 2025

Scammers are constantly evolving, and in 2025, they’ve become even more sophisticated when it comes to targeting older adults. Many elderly people are retired, live alone, or may not be familiar with today’s rapidly evolving digital world, and that makes them vulnerable to online scammers.

Below are some of the most common senior citizen scams happening this year and how they work.

-

Tech Support Scams

This is one of the most common internet scams targeting seniors. It usually starts with a sudden pop-up on the computer or a phone call saying something like, “Your device has a virus!” The scammer pretends to be from Microsoft, Apple, or another trusted tech company. They ask the victim to give remote access to their device, and once they do, they either steal personal data or ask for payment to “fix” the issue.

What to do: Tell your elderly loved ones to never respond to tech support pop-ups or unsolicited calls. Real tech companies don’t operate that way.

-

IRS and Government Impersonation Scams

Many elderly scams involve someone pretending to be from the IRS or the Social Security Administration. They may call or email, saying the victim owes taxes or that their benefits will be suspended unless they act immediately. These scammers can sound very convincing, and they often use fear to pressure seniors into paying money or sharing private information.

Real talk: The IRS will never call and demand payment on the spot. Encourage older adults to hang up and verify through official government websites.

-

Elderly Romance Scams

Loneliness can be tough, and scammers take full advantage of it. With elderly romance scams, fraudsters create fake profiles on dating or social platforms. They build trust over time, pretending to fall in love. Then, they start asking for money, maybe for a medical emergency, travel expenses, or a visa issue.

How to protect your parent: If you suspect your elderly parent is being scammed, talk to them gently. Ask questions and offer to help check the person’s identity. Most romance scammers avoid video calls or in-person meetings.

-

Medicare and Health Insurance Scams

In these financial scams against seniors, scammers pose as Medicare representatives offering free equipment or services. They ask for Medicare numbers or personal details and use them to bill for services that never happened. Sometimes, they even send cheap or useless equipment, then charge Medicare for expensive gear.

Tip: Remind seniors that they should never share personal or insurance information unless they’re 100% sure who they’re talking to.

-

Grandparent or Emergency Scams

This scam tugs at the heartstrings. The scammer pretends to be a grandchild (or someone claiming to be with the grandchild), saying they’ve been arrested, are in an accident, or need help. They ask for money fast and often beg the victim not to tell anyone.

Protective advice: Always double-check. Call your grandchild or a trusted family member. Most of the time, the emergency is fake.

These scams targeting the elderly are dangerous, not just financially but emotionally too. They can leave seniors feeling embarrassed, confused, and afraid to trust others. That’s why senior scam awareness and open conversations with family are so important. If you’re ever unsure about something, it’s okay to ask for help because staying safe starts with staying informed.

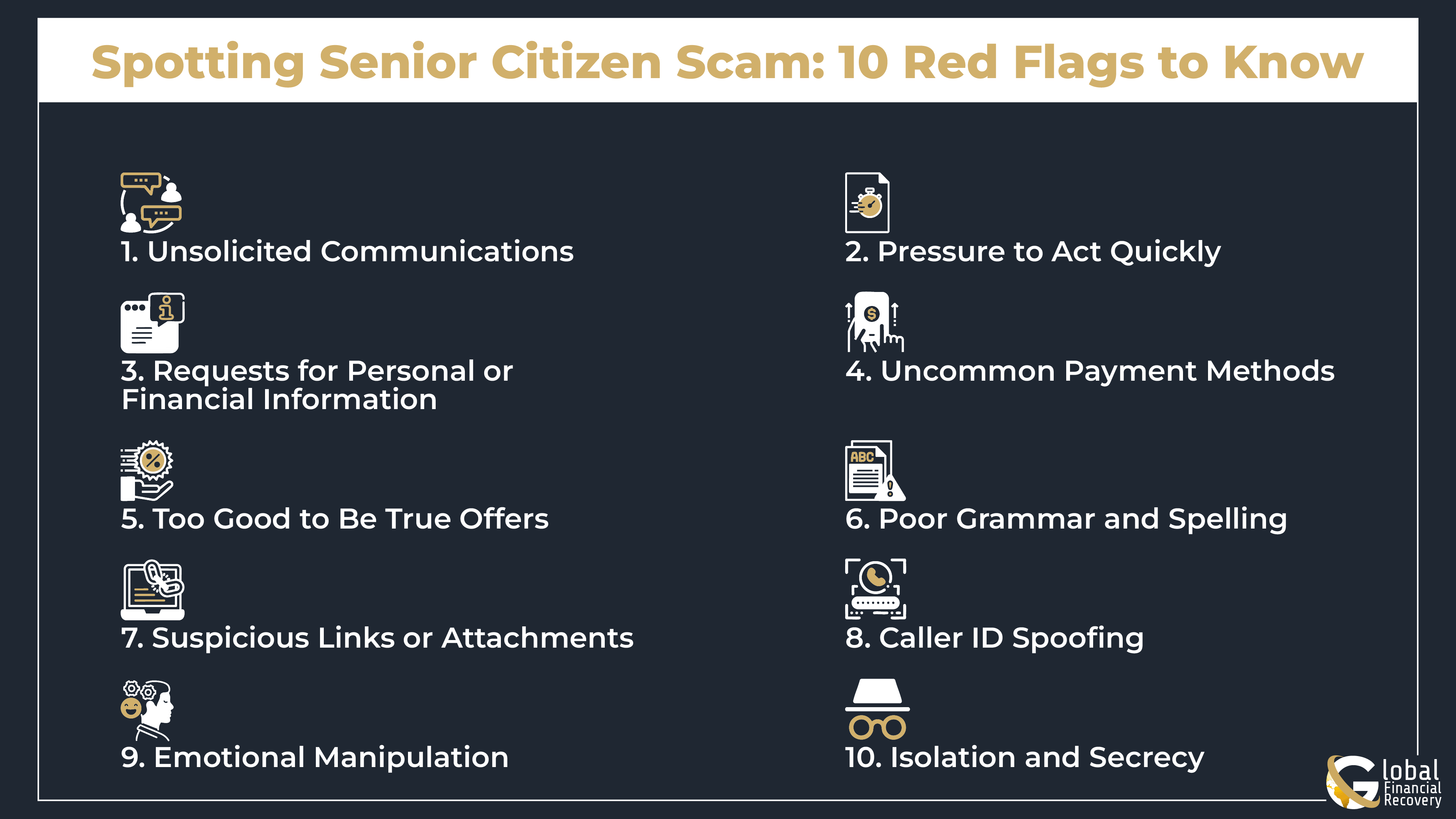

How to Spot a Senior Scam: 10 Red Flags to Know

In 2025, scams targeting seniors have become increasingly sophisticated, often exploiting trust, technology unfamiliarity, and social isolation. Recognizing the warning signs is crucial for fraud protection for seniors and enhancing senior scam awareness.

1. Unsolicited Communications

Scammers call, email, or message people, usually impersonating legitimate individuals from the bank, agencies, or some kind of technology firm. They go on to say that an urgent problem must be dealt with immediately.

Red Flag: Unexpected contacts asking for personal information or for you to take immediate action.

2. Pressure to Act Quickly

Besides urgency and threats, there are some with other potential consequences. For instance, one might threaten legal actions; however, account suspension might follow. A scare of opportunity loss also works.

Red Flag: Demands to act immediately or to make payment to avert some kind of bad consequence.

3. Requests for Personal or Financial Information

Genuine organizations will never solicit private data through unsecured methods. Do not partake in giving your Social Security number, bank account details, or password.

Red Flag: Requests for personal info over the phone, via email, or through text messages.

4. Uncommon Payment Methods

The scammer mostly wants you to pay by gift cards, wire transfers, or cryptocurrencies, given that the methods are difficult to track.

Red Flag: Requests for payments through unusual methods, especially when coupled with demands for urgency.

5. Too Good to Be True Offers

Steer clear of promises of large sums of money or prizes. Be suspicious of investment opportunities that ask you to cut a check or give out personal information up front.

Red Flag: Offers that seem overly generous or require payment to claim rewards.

6. Poor Grammar and Spelling

Grammatically incorrect or poorly written scam messages likely come from irresponsible sources.

Red Flag: Alarming spelling mistakes or strange syntax in messages.

7. Suspicious Links or Attachments

Phishing emails to elders usually have suspicious links or attachments that, once clicked, lead to malware downloading or fake web pages.

Red Flag: Unexpected emails with attachments or links from expected senders.

8. Caller ID Spoofing

Spammers can spoof caller ID to show real numbers, and calls seem to be from trusted institutions.

Red Flag: Calls from known numbers that still ask for sensitive information or money.

9. Emotional Manipulation

Elderly scams frequently appeal to emotions like fear, love, or sympathy to get responses. For instance, elderly romance scams establish trust first before asking for money.

Red Flag: Emotional appeals that lead to requests for money or personal information.

10. Isolation and Secrecy

Scammers may instruct victims to keep the interaction a secret, preventing them from seeking advice or assistance.

Red Flag: Being told not to discuss the situation with family or friends.

How to Avoid Senior Citizen Scams in 2025: Prevention Tips That Work

Pay attention to desperate calls, texts, or emails that are requesting your money or your personal information. Senior scams are quite frequent, and many times they claim to be from the IRS, Medicare, or even a grandchild who is in trouble. Even if it does not feel right or not right, just hang up and check with a trusted contact.

Seniors are usually victims of romance scams through social media. Scammers make fictitious relationships and ask for money. Do not connect with strangers, and do not post personal details on social media networks.

To support efforts to prevent online scams targeting seniors, begin by creating strong passwords. Further, employ a password manager and enable two-factor authentication. Also, do not give your Social Security number, banking information, or passwords over telephone calls or emails that were not made by you.

Keep yourself informed from well-researched sources such as the FTC and the National Council on Aging. Wisdom is power that will help you recognize new tricks at short notice.

In addition, check your accounts regularly and set up an alert for fraud. In the event that you find some suspicious and/or unfamiliar charges, report them as soon as you can.

Also, pay attention in order to be mindful of what you are posting online. Using your social media postings, scammers can craft a convincing lie that distracts you in online scams targeted at seniors.

And most importantly, do not be scared to ask for help. If in doubt about whether to do something or not, do not hesitate to call a family member or a caregiver. Seniors’ scam-free living begins with being skeptical, aware, and connected.

How to Report a Senior Scam and Take Legal Action?

If you or an elderly loved one has been scammed, it’s important to act fast. Here's how to report senior scams and get help:

- Call the National Elder Fraud Hotline at 833-372-8311 for guidance.

- Report scams to the FTC at reportfraud.ftc.gov.

- Contact your local police to file a report; this is key if money was stolen.

- Contact Global Financial Recovery for support and scam recovery tips.

- If the scam was online, file a report at the FBI’s Internet Crime Center via ic3.gov.

Save all messages, emails, and receipts. These help in tracking the senior citizen scam and may support legal action.

Staying aware of elderly scams, knowing how to report them, and recognizing the signs of financial abuse in elderly people can protect others from falling victim too.

Conclusion: Staying Ahead of Scammers in a Digital World

As we have seen, the scams aimed at the senior citizens in 2025 are improved, individual and relentless. From tech support scams and government impersonators to romance and emergency scams, threats are diverse, but the prize is always the same: to take advantage of vulnerability. Yet, there seems to be a pattern to take advantage of vulnerability.

The positive side to it is that knowledge is power. By keeping a lookout, keeping abreast, and maintaining transparency of communications with those we love, we may minimize these risks to a great extent and thus protect those whom we love most of all.

If you or someone you care about has been the victim of a scam, do not hesitate to do something about it.

Talk to a professional recovery expert now by visiting the site Global Financial Recovery. We are the experts in assisting victims of online fraud in recovering their money.

FAQs (Frequently Asked Questions)

Elder Financial Exploitation (EFE) refers to the unauthorized or improper use of an older adult’s funds or assets, often by someone they know, like a caregiver or family member. Unlike anonymous online scams, EFE typically involves trusted individuals misusing their access or power. It’s legally distinct and often harder to detect.

Consent fatigue happens when a person, especially a senior, is overwhelmed by constant pop-ups, permissions, and requests for action online. Scammers exploit this by bombarding users until they unknowingly grant access, download malware, or click on malicious links out of habit.

RAT scams have scammers using them to deceive seniors into installing software such as TeamViewer or AnyDesk with promises of tech support. After installation, scammers have full control of the victim’s computer, access bank accounts, or plant spyware. This is an emerging trend of fake refunds or tech support scams.

Vishing is the abbreviation for “voice phishing,” a process in which scammers pretend that they are banks, Medicare agents, or even police when calling people up. Older people who tend to believe voice communication is in favor of text or email more often are at greater risk of these social engineering schemes.

Yes. The scammers now use AI-generated voices to pretend to be grandchildren, doctors, or police officers. The deepfake audio calls are usually included in "emergency scams", where a fake emergency situation is created to quickly get money out of you.