- Cryptocurrency

- January 23, 2026

Table of Contents

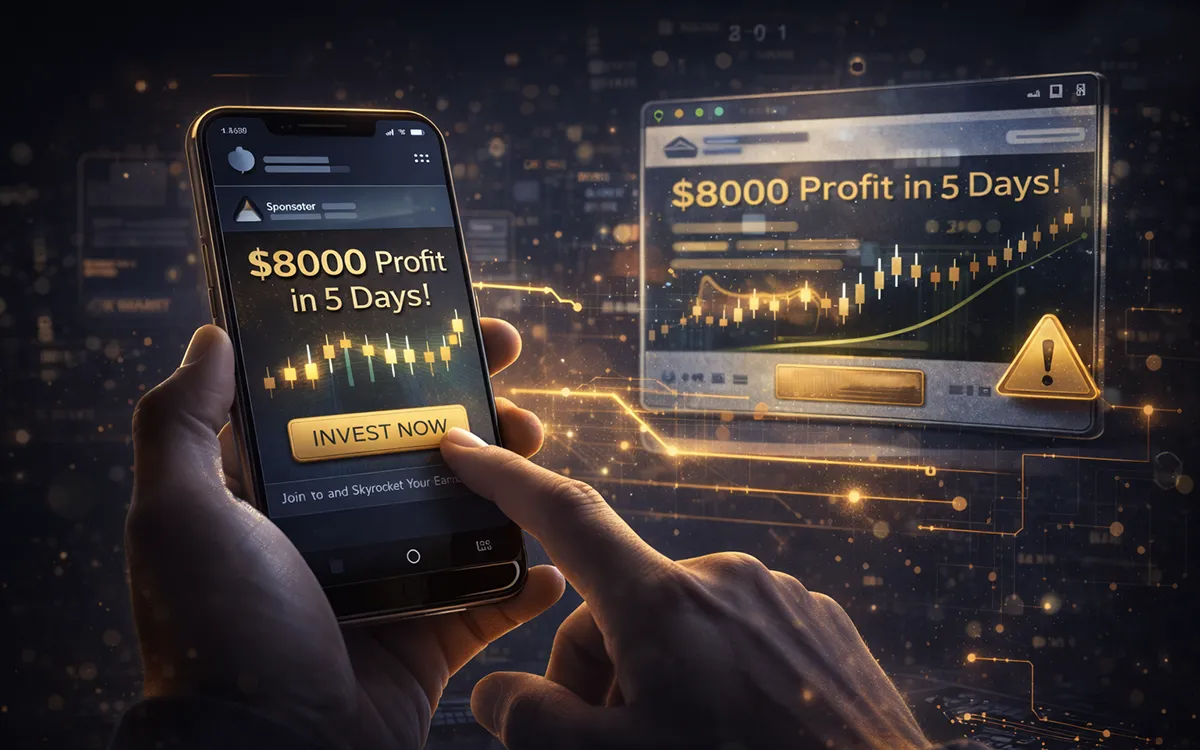

If you’ve ever hesitated before sending crypto, that pause matters. Many people who fall victim to crypto scams say the same thing afterward: everything looked fine, but something felt slightly off.

Crypto transfers are permanent. Once funds leave your wallet, there’s no “undo” button. Scammers exploit this by rushing people into sending funds to fake or unverified cryptocurrency wallets, often disguised as investment opportunities, support requests, or urgent account issues.

The impact is serious. According to law enforcement and industry reports, billions are lost to crypto scams each year, with over $3.4 billion in theft reported in 2025 alone. For many victims, the loss isn’t just financial; it affects trust, confidence, and future decisions around crypto.

This article explains how to verify a crypto wallet before sending money, what to check step by step, and how to spot common wallet verification scams. The goal isn’t to scare you, it’s to help you slow down, recognize warning signs early, and protect your crypto before a simple mistake becomes a permanent loss.

What “Verifying a Crypto Wallet” Actually Means

In crypto scams, verification is often misrepresented. Scammers talk about “verified wallets,” “approved addresses,” or “secure transfers,” but in reality, verifying a crypto wallet simply means doing your own checks before sending funds.

There are two parts to wallet verification. The first is technical, confirming the wallet address, network compatibility, and transaction details. The second is behavioral, watching for social engineering tactics like urgency, secrecy, or emotional pressure. Both matter equally.

Crypto wallets don’t reveal identity or ownership. That anonymity is built into how blockchain works, and scammers exploit it by creating confusion and pushing fast decisions. The goal of wallet verification isn’t perfection; it’s slowing down long enough to spot warning signs before money is sent.

Steps to Verify a Crypto Wallet Before Sending Funds

Step 1 – Identify the Type of Wallet You’re Sending To

Before sending crypto, take a moment to understand what kind of wallet you’re dealing with. This single step can prevent many common crypto scams.

Here are the main crypto wallet types to know:

- Exchange wallets

These belong to regulated crypto platforms. They are linked to user accounts, transaction histories, and compliance checks, which adds a layer of accountability. - Private wallets

These are controlled by individuals. They do not show who owns them, and once funds are sent, there is usually no way to reverse the transfer. - Wallets used by “investment platforms.”

Many scam platforms claim to manage investments but quietly route funds to privately controlled wallets with no oversight.

Scammers almost always ask for private wallet transfers because they are harder to trace and easier to misuse. Legitimate companies do not avoid regulated exchanges or insist that private wallets are the only option.

Step 2 – Carefully Double-Check the Wallet Address

Wallet addresses aren’t designed to be human-friendly. They’re long, complex, and easy to confuse, especially when you’re moving quickly. In crypto, even a single incorrect character means the funds are gone for good.

Some scams involve address-swapping malware, which works silently in the background. When you copy a wallet address, the malware replaces it with a scammer’s address before you paste it, making everything look normal unless you double-check.

Use these habits before sending crypto:

- Copy and paste the address instead of typing it

This reduces simple input errors. - Check the first and last four characters

This is the fastest way to spot a wallet address mismatch. - Avoid using screenshots as references

A wallet address should come directly from a trusted source, not an image.

These small steps greatly improve your crypto wallet address verification process.

Step 3 – Confirm the Correct Blockchain Network

A wallet address alone is not enough. The same address can exist on multiple blockchain networks, and sending crypto on the wrong network can result in permanent loss.

For example, USDT can be sent on different networks like ERC20 (Ethereum) or BEP20 (Binance Smart Chain). Even if the wallet address looks correct, choosing the wrong network means the funds may never arrive. In fact, sending USDT on the wrong network is one of the most common irreversible crypto mistakes.

Scammers often stay vague when talking about networks. They may say things like “just send it” or “any network works,” hoping you won’t double-check. Legitimate platforms clearly specify which blockchain network to use.

Step 4 – Send a Small Test Transaction First

Before sending a large amount of crypto, always send a small test transaction. This simple step alone prevents many irreversible losses.

A test transaction confirms three things at once:

- The wallet address is correct

- The blockchain network is right

- The recipient can actually receive funds

If the test amount arrives successfully, you can move forward with more confidence. If it doesn’t, you’ve avoided a much bigger mistake.

Watch how the recipient responds:

- Legitimate platforms are fine with test transfers

- Scammers often say test transactions are “not allowed.”

- Some claim there’s a “minimum deposit requirement.”

Those reactions are strong warning signs.

Step 5 – Watch for Wallet Scam Red Flags

Even if the wallet address and network look right, behavior still matters. Most crypto scams don’t fail because of technical mistakes; they fail because scammers pressure people into acting fast.

Here are the most common wallet-related red flags to watch for:

a) Urgency or Pressure

If you’re told you must send funds right now or risk losing access, profits, or an “opportunity,” pause. Real platforms do not force instant decisions.

Common phrases scammers use:

- “Your account will be frozen.”

- “This offer expires today.”

- “Send now to unlock withdrawals.”

b) Requests for Extra Fees

Be cautious if you’re asked to send crypto for:

- Wallet verification fees

- Liquidity or release fees

- Tax or compliance payments

Real crypto wallets do not require extra payments to receive funds.

c) Being Told Not to Double-Check

Scammers often discourage questions or outside advice. If someone tells you not to:

- Verify the wallet

- Send a test transaction

- Use a regulated exchange

That’s a strong warning sign.

d) Vague or Changing Instructions

Legitimate services give clear, consistent details. Scammers often:

- Avoid explaining networks

- Change wallet addresses

- Give unclear steps at the last minute

Confusion is not an accident; it’s a tactic.

d) Requests to Move Off Trusted Platforms

If you’re asked to avoid exchanges or move conversations to private messaging apps, be cautious. Real companies don’t hide their processes.

If something feels rushed, confusing, or secretive, don’t send funds. Taking a pause is not being slow; it’s being safe.

What to Do If You’ve Already Sent Funds to the Wrong Wallet

Sending crypto to the wrong wallet can be stressful, but how you respond next makes a difference.

Here’s what to do immediately:

- Stop all further payments

Do not send “unlock,” “verification,” or “recovery” fees. These are common follow-up scams. - Secure your records

Save the transaction hash, wallet addresses, timestamps, and all communication related to the transfer. - Check the type of mistake

If the issue is a wrong blockchain network, limited technical recovery may be possible. If the funds went to a scam-controlled wallet, recovery becomes much more difficult. - Be cautious of recovery promises

No one can guarantee crypto recovery. Claims of “100% success” are a major red flag. But reliable crypto recovery experts can help get your money as much as possible in the fastest way possible.

Acting calmly and avoiding further losses is the most important step after a wrong crypto transfer.

Slowing Down Always Protects Your Crypto

Verifying a crypto wallet isn’t about being perfect; it’s about being aware. Slowing down, checking details, and paying attention to pressure or vague instructions can prevent mistakes that can’t be undone.

If you believe you’ve sent funds to the wrong wallet or were misled during a crypto transfer, avoid sending more money and don’t rely on promises of guaranteed recovery. For guidance on what may still be possible, you can contact Global Financial Recovery to understand your options and recover your money.

FAQs (Frequently Asked Questions)

Yes. A crypto wallet can appear normal and still be unsafe. Wallet addresses don’t show ownership, licensing, or intent. That’s why crypto wallet legitimacy is judged by context who asked you to send funds, how they communicate, and whether they pressure you not by how the wallet looks alone.

Often, yes. Scammers frequently reuse wallet addresses across multiple victims or rotate addresses to avoid detection. This is why checking a wallet once doesn’t guarantee safety. Wallet verification should always be done at the moment you’re sending funds, not based on past transactions.

No legitimate crypto support team will ask you to send funds to “verify” a wallet. Requests like wallet activation fees, compliance payments, or liquidity charges are common crypto wallet scams, even when they come from people claiming to be support agents.

Not always, but often. A crypto network mismatch can sometimes be fixed if the receiving wallet supports that network and the owner cooperates. However, many cases are irreversible, which is why confirming ERC20 vs BEP20 before sending is so important.

Be cautious. There is no universal tool that can fully verify whether a wallet is safe. Tools can show transaction history, but they can’t confirm intentions. Anyone claiming guaranteed results or full wallet safety is overselling and should be treated carefully.