My name is Daniel. I’m 49 and live in Arizona. I’m not a trader or a crypto expert. I invested in crypto years ago, held onto it, and sold part of it when prices went up. Like anyone else, I just wanted to make sure I paid my taxes properly and didn’t get into trouble.

That’s how I ended up falling for a crypto tax scam disguised as a legitimate tax service.

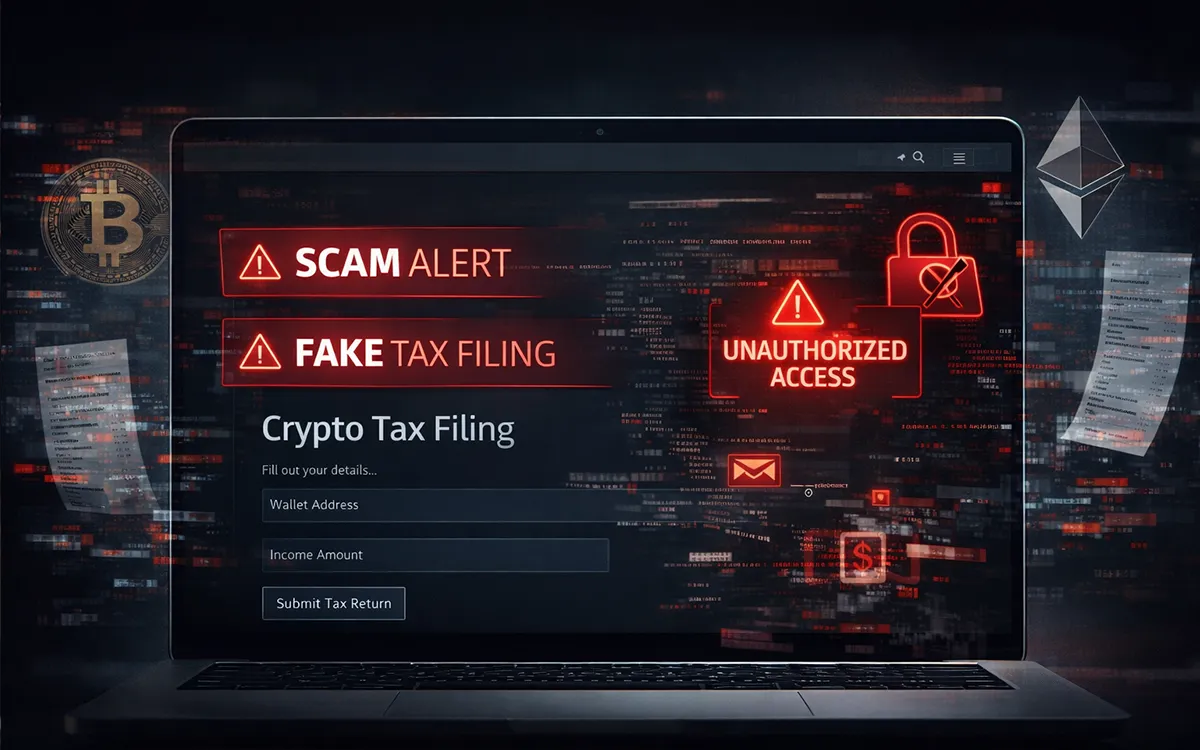

After selling some crypto, I started searching online for help with crypto taxes. I found a website that claimed to specialize in crypto tax filing and IRS compliance. It looked professional. There were tax forms, legal language, and even a phone number.

I reached out. The person I spoke with sounded knowledgeable and calm. He told me I owed back taxes related to crypto gains and warned that penalties could grow quickly if I didn’t act. He said they could “handle everything” if I paid the amount upfront.

I was nervous, but I wanted to do the right thing. Over the next two weeks, I sent three payments totaling about $92,000. Some were labeled as tax payments. Others were described as “processing” and “compliance” fees. Each time, I was told it was the final amount.

Then came another request. That’s when something felt off.

I asked for official IRS documentation. The responses became vague. Calls stopped getting answered. Emails slowed down, then stopped completely. The website I had been using suddenly went offline.

That’s when I realized I had been caught in a crypto IRS tax scam.

The stress was overwhelming. I wasn’t trying to avoid taxes. I was trying to follow the rules. I kept asking myself, can money lost in a crypto tax scam be recovered? Or is it just gone?

I contacted authorities and filed reports. I was told these scams are becoming more common and that recovery depends on tracing where the money went. There were no guarantees.

That’s when I reached out to Global Financial Recovery. From the beginning, they didn’t talk down to me. They explained how fake crypto tax services work, how scammers impersonate tax professionals, and how fear of the IRS is often used to rush victims into paying.

I provided bank records, transaction confirmations, emails, and payment details. They were clear about timelines and realistic outcomes. After about four months, I received an update I didn’t expect.

They were able to successfully recover approximately $57,000 of the money I had lost by tracing accounts and working through recovery channels.

Not everything came back. I knew that was possible. But getting back more than half lifted a huge weight off my shoulders.

What hurt the most wasn’t just the money; it was the feeling of being tricked while trying to do the right thing. Getting some of it back helped restore my confidence.

If you’ve lost money to a crypto tax scam, I can’t promise results. But I can say this: these scams are real, they’re increasing, and you’re not alone. Asking for help is better than staying silent.