- Miscellaneous

- January 8, 2025

Table of Contents

A Ponzi scheme is an investment scam that works on a pyramid system; the cash of the latest entrants is utilized to pay the preexisting investors. Ponzi frauds are named after Charles Ponzi, thus illustrating such frauds after the man who pioneered them at the beginning of the twentieth century. Ponzi frauds depend on using the new money to pay the earlier investors.

In a Ponzi scheme, the operator or Ponzi fraudster conceals your money and tells you that you stand to make giant profits while incurring negligible risk. When new and fresh investors are brought in, the fraudster uses their money to pay the earlier investors more profits, which gives the impression of a profitable business scheme.

However, because there is no product that is being produced and sold to realize actual profits, the course of the pyramid approaches its doom the moment it becomes hard to find new members to join the pyramid or the operator can no longer invest the requisite capital to award the expected profits as was agreed upon.

Understanding Ponzi fraud is essential for protecting yourself from falling victim to these types of scams. Let’s dive deeper into the history and mechanics of this fraudulent scheme.

Ponzi Scheme History: Who was Charles Ponzi?

The Ponzi scheme is named in relation to Charles Ponzi, an Italian-born conman who pioneered one of the earliest and most famous pyramid schemes. In 1919, Ponzi moved to America and felt that the international postal reply coupon business that involved exchanging coupons for postage in different countries was the perfect business for him.

Ponzi sold postal coupons, saying that he needed people’s money to purchase these coupons in foreign nations with low exchange rates only to sell them in nations with high rates. A lot of investors were attracted to him due to the promises of getting rich quickly and really big money. Nevertheless, instead of investing the money in purchasing coupons, Ponzi just paid other investors out of the money of others.

With time, more and more individuals channeled their money to the scheme, and the mastermind at the center of the pyramid confidence fraud continued paying earlier investors. However, the scheme was bound to burst for one cannot continue paying previous investors while searching for other investors to invest in the fraudulent plan; this Ponzi could not until he found himself in trouble.

Ponzi was arrested in 1920, and this informed the start of this form of fraud commonly referred to as the Ponzi scheme, a fraudulent investment scheme whereby investors are paid returns out of the investments of new investors, not nouveau riches or other earnings generated by the supposed business behind the scheme.

How Does a Ponzi Scheme Work?

Ponzi schemes operate on a simple but deceptive principle: using money from new investors to pay returns to earlier ones. Here’s a step-by-step breakdown of how it works:

- Step 1: Promising High Returns

- The operator, usually a Ponzi scam, introduces an investment plan with unusually high, steady rates of return.

- Such returns are usually accompanied by bold statements such as 'risk-free’ or ‘guaranteed,’ which should be alarming.

- Step 2: Attracting Investors

- The first movers are attracted to the venture with the aim of achieving first-dollar returns.

- Another technique that the fraudster could use is to incorporate some happy investors into the program, convincing potential victims that it is real.

- Step 3: Payments by way of New Investments

- It is not from any activity in a legitimate business that the operator can assemble the funds to pay the promised returns to earlier investors as well as make returns to new investors.

- In doing so, the appearance of a successful and profitable business organization is given.

- Step 4: Expanding the Scheme

- The scheme uses successive enrollments that allow it to generate funds for the reward payments.

- This means that as the number of individuals seeking to invest for the first time increases, then the pressure to continue to operate increases.

- Step 5: Collapsing Under Pressure

- This is a fatal flaw of the scheme, as it breaks down where it is hard to get new investors in or where a high proportion wants their money back.

- By this point, most participants lose their investments, while only the early investors and the fraudster may benefit.

Understanding how a Ponzi scheme works is crucial in identifying and avoiding these scams. Modern variations, like the cryptocurrency Ponzi scheme, use digital assets to disguise their fraudulent activities, making vigilance even more important.

Red Flags of Ponzi Schemes

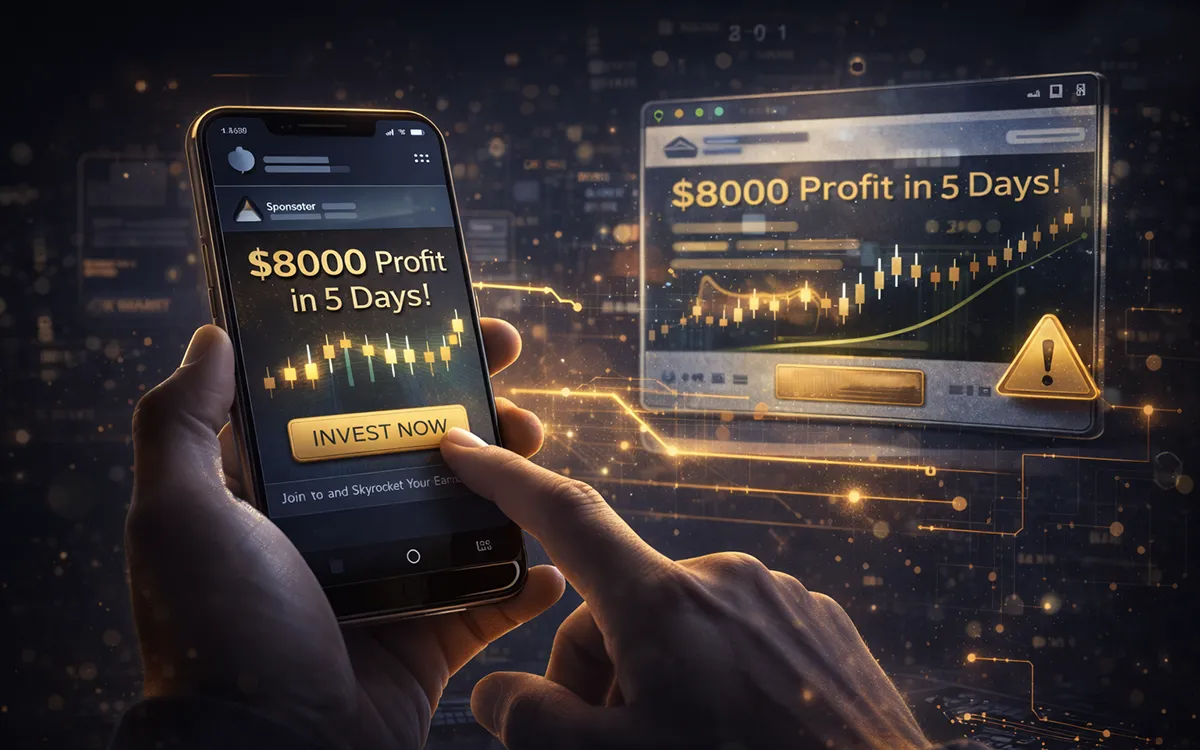

Ponzi schemes can be tricky, but knowing the signs can help you avoid falling victim to such cryptocurrency scams. Here are some key red flags:

- Unrealistic Returns

Ponzi fraudsters often promise high, consistent returns with little or no risk. If it sounds too good to be true, it probably is—just like the Bernie Madoff Ponzi scheme, where returns were promised but never existed.

- Lack of Transparency

Be wary of investments that are vague about how profits are made or avoid detailed questions. Ponzi scams typically lack legitimate operations. In the Madoff investment scandal, this was a key warning sign.

- No Market Fluctuations

If an investment is paying returns consistently, independent of the market, it might be a Ponzi scheme. This is how the long-lasting Ponzi schemes like Madoff's lasted so long.

- Pressure to Invest Fast

Fraudsters create urgency, a need for you to make quick decisions. That might be common in Ponzi scams, especially ones like cryptocurrency Ponzi schemes, which require a large number of new investors to keep it running.

- Difficulty With Withdrawals

If you’re having trouble getting your money out, it’s a major red flag. In the largest Ponzi schemes, including Madoff’s, this became a serious issue.

- Lack of Proper Documentation

Legitimate investments come with clear documents. If a scheme refuses to provide these, it’s likely a Ponzi fraud.

Stay alert to these signs and avoid falling victim to a Ponzi fraud. Always verify investments before committing, especially with cryptocurrency Ponzi schemes, which have become increasingly popular.

How to Protect Yourself from Ponzi Schemes?

Protecting yourself from Ponzi schemes requires vigilance, research, and a healthy dose of skepticism. Here are some tips to help you avoid becoming a victim:

- Do Your Research

Always verify the investment opportunity. Check if it’s registered with regulatory bodies like the Securities and Exchange Commission (SEC). Ponzi fraudsters often operate outside of the law.

- Question High Returns

Be wary of promises of high, consistent returns with little risk. In legitimate investments, returns fluctuate. Ponzi scams often promise returns that are too good to be true.

- Watch for Pressure Tactics

If an investment opportunity gets you to follow the next course of action and its immediate basis is referred to as the ‘act now, ’ then it could be a scam. This is when the fraudulent promoters of the Ponzi schemes will work under high pressure, constantly seeking to make you act fast.

- Know How the Investment Works

If you don’t fully understand how the investment generates profits, don’t invest. Ponzi schemes tend to be vague about their operations, as was the case in the Madoff investment scandal.

- Look for Independent Opinions

Consult with a financial advisor or look for reviews from trusted sources before investing. Independent opinions can help identify whether the opportunity is a Ponzi fraud.

- Be Skeptical of Too Much Secrecy

Transparency is key in legitimate investments. If the operator is unwilling to provide clear details or financial records, it’s a red flag. Ponzi fraudsters often avoid scrutiny to hide their fraudulent activities.

- Check for Licensing and Regulation

Ensure the investment is licensed and regulated by relevant authorities. Ponzi schemes often operate in unregulated environments to avoid detection.

Bernie Madoff's Ponzi Scheme: Biggest Ponzi Scheme Ever

Certainly, one of the oldest and most famous Ponzi schemes was launched by Bernie Madoff, who scammed his clients out of billions of dollars. Here’s how the Madoff investment scandal unfolded:

- Madoff's Massive Scheme

Bernie Madoff was involved in the world’s biggest pyramid scandal, termed a Ponzi fraud; Madoff sold his fraud as a splitting strike trading technique with assured high returns in the shortest time possible. As a matter of fact, there was no sound investment plan that could be associated with the Wall Street icon—Madoff was merely providing returns to victims of his plunder through the funds contributed by fresh victims.

- The Scale of the Fraud

Madoff’s investment scam has been christened the largest Ponzi fraud in the history of the world, with losses estimated at about $65 billion. It was long-lived and reached out to the famous clientele, charities, and common folks, who practically believed in the credibility of Madoff.

- The Collapse

The fraud was exposed in 2008 when the outbreak of the financial crisis meant that Madoff could no longer cultivate clients to invest in the fake scheme. When the withdrawal requests increased, the entire system crumbled, and the real scam was unveiled.

All these fraudsters have faced the law, but none more severely than Pell, who was sentenced to 150 years behind bars, or Madoff for the same number of years.

- Lessons from the Madoff Scheme

Real estate investments and pyramids, which Charles Ponzi began at the beginning of the twentieth century, were the initial versions of such a fraud, but the Madoff case revealed that large and reputable organizations engaging in similar schemes are also possible.

Ponzi schemes are also against the law; anyone can be charged with running one like Madoff was prosecuted.

What has happened in this particular case is a good lesson that individuals should learn when dealing with ‘get rich quick’ schemes, which actually is an ideal example of how a typical Ponzi fraudster operates by exploiting the people's trust and greed.

Famous Ponzi Scheme Examples and What to Learn From Them

In recent years, some high-profile pyramid scams have occurred, each giving the public important lessons about the risk of investing in a business without proper regulation. Here are a few infamous examples:

- Bernie Madoff Ponzi Scheme

As discussed earlier, the Madoff investment scandal was the largest Ponzi fraud in history, with an estimated $65 billion in fake profits promised to investors.

Key Lesson: Never get comfortable with investment opportunities irrespective of the recommendation given by close friends or investment firms.

- Charles Ponzi's Original Scheme

In the early 1900s, Charles Ponzi became the namesake for all similar schemes. He promised high returns on international postal reply coupons, paying early investors money from newer ones.

Key Lesson: Understand the origin of Ponzi schemes to recognize the basic elements of fraud.

- Tom Petters Ponzi Scheme

Tom Petters was convicted of fraud with 20 counts of fraud and money laundering with 50 years of imprisonment, and he defrauded investors of about $3.65 billion. He forged documents to pretend to make purchases in consumer electronics with which he would create perceived sales revenue, but which essentially were embezzlement.

Key Lesson: What should be noted is that some of the companies either avoid clear profiles or provide fake certificates.

- Allen Stanford Ponzi Scheme

Allen Stanford was convicted for running the biggest $7 billion offshore certificates of deposit (CDs) investment scam that used the guise of a formal Ponzi scheme.

Key Lesson: Avoid investing in any opportunity that looks hard to invest in or any field of lower understanding. The authors of Ponzi schemes like to overlay the plan with all sorts of details in an effort to lend an aura of legitimacy to the operation.

- Cryptocurrency Ponzi Scheme

The introduction of cryptocurrencies has led to the emergence of the cryptocurrency Ponzi schemes as a new form of Ponzi fraud. These frauds tend to give people high-profit yields through investing in fake or non-existent virtual currencies or disguising criminal activities concerning the mining of cryptocurrencies.

Key Lesson: It goes further and advises on the potential dangers of patronizing cryptocurrency. The escrow service tells you only to invest your money after confirming the authenticity of the platform.

- The Largest Ponzi Scheme in History

Other notable Ponzi schemes include the largest Ponzi schemes run by figures like Richard W. Baker and R. Allen Stanford, which collectively bilked investors of billions of dollars. These cases highlight the scale of damage that Ponzi scams can cause to both individuals and institutions.

The Bottom Line

Ponzi schemes are fraudulent investments that are risky and unlawful and which can lead to extreme losses. From the Madoff investment fraud, or the more contemporary bitcoin scams, fraud is the unlawful act of making use of some people’s confidence in order to get funds that will be used to pay what is, in reality, a fantasy.

To avoid falling victim, always be cautious of investments that sound too good to be true. Do thorough research, question high returns, and be wary of pressure tactics. Stay informed about the origin of Ponzi schemes and the signs of a Ponzi scam so you can protect yourself.

If you believe you've been involved in a Ponzi fraud, seeking professional advice and support is crucial. Visit Global Financial Recovery for expert assistance in recovering funds lost to fraudsters and ensuring your financial security.

FAQs (Frequently Asked Questions)

The best-known type of Ponzi scheme was perpetrated by Bernie Madoff, who had been running a pyramidal scheme for years. He embezzled about $65 billion from investors; this scandal is now famously referred to as the Madoff investment scandal. His scheme is the largest Ponzi scheme in history, and from the case, the world can learn about the effects of blindly trusting promised high returns on investment.

Some people have described the U.S. Social Security system as being similar to a pyramid-selling scheme in that it receives cash from some current workers, whereby it pays benefits to retirees, and it is assumed that future generations will continue to contribute. However, Social Security is affiliated with the government and has support from taxes.

Yes, Ponzi schemes are illegal in virtually every country. They are considered fraud because they involve misrepresentation and the use of new investors’ money to pay returns to earlier investors. Those caught running Ponzi scams can face severe penalties, including imprisonment and financial restitution to victims.

Some of the largest Ponzi schemes include:

- Bernie Madoff's scheme ($65 billion in losses)

- Allen Stanford’s scheme ($7 billion)

- Tom Petters’ scheme ($3.65 billion)

These cases show the immense scale of financial damage caused by Ponzi fraud.

Yes, cryptocurrency Ponzi schemes have become more prevalent in recent years. These scams promise high returns through investments in digital currencies or mining operations but rely on funds from new investors to pay older ones. Like traditional Ponzi schemes, cryptocurrency scams collapse when the flow of new investors slows down.