- Investments

- December 29, 2025

Table of Contents

Cloned broker scams are rising faster than most investors realize. Thousands of traders are being misled by cloned trading platforms that look identical to trusted brokers. These scammers steal a real broker’s identity, its name, license number, website layout, branding, and even customer support tone, making their platform look “professionally regulated” when it’s nothing more than a trap. Many of these clone sites are discovered on databases like Traders MBA or WikiFX, where scammers copy entire broker profiles to appear legitimate.

The problem is bigger than most people think. Surveys show that nearly 38% of traders who lost money in online investments were dealing with cloned brokers or fraudulent signal providers. The scam works because the platform looks real until the moment you try to withdraw. That is when the truth becomes clear: there was never any trading, never any profit, just a well-built illusion designed to drain your money.

This guide explains how cloned broker scams work, how they deceive even experienced traders, and the key red flags to watch for. It also shows how to verify a broker’s authenticity and what steps to take if you’ve already fallen victim to this type of trading fraud.

What is a Cloned Broker Scam?

A cloned broker scam happens when fraudsters impersonate a real, regulated broker by duplicating its entire identity. They copy the real broker’s website, logo, license number, terms and conditions, and even the customer support scripts. This is broker identity theft, crafted to make you believe you’re investing with a legitimate company when you’re actually dealing with a fraudulent one.

Clone-broker scams are far more dangerous than Ponzi schemes or signal scams because they look professionally regulated. Everything, from the login page to the trading dashboard, feels real. That’s why even experienced traders sometimes fall for them.

Crypto investors face similar risks. Clone brokers operate almost the same way as impersonation scams targeting new crypto investors, where scammers copy trusted crypto exchanges or wallet providers to gain credibility. Now, let’s break down how these scams work step by step.

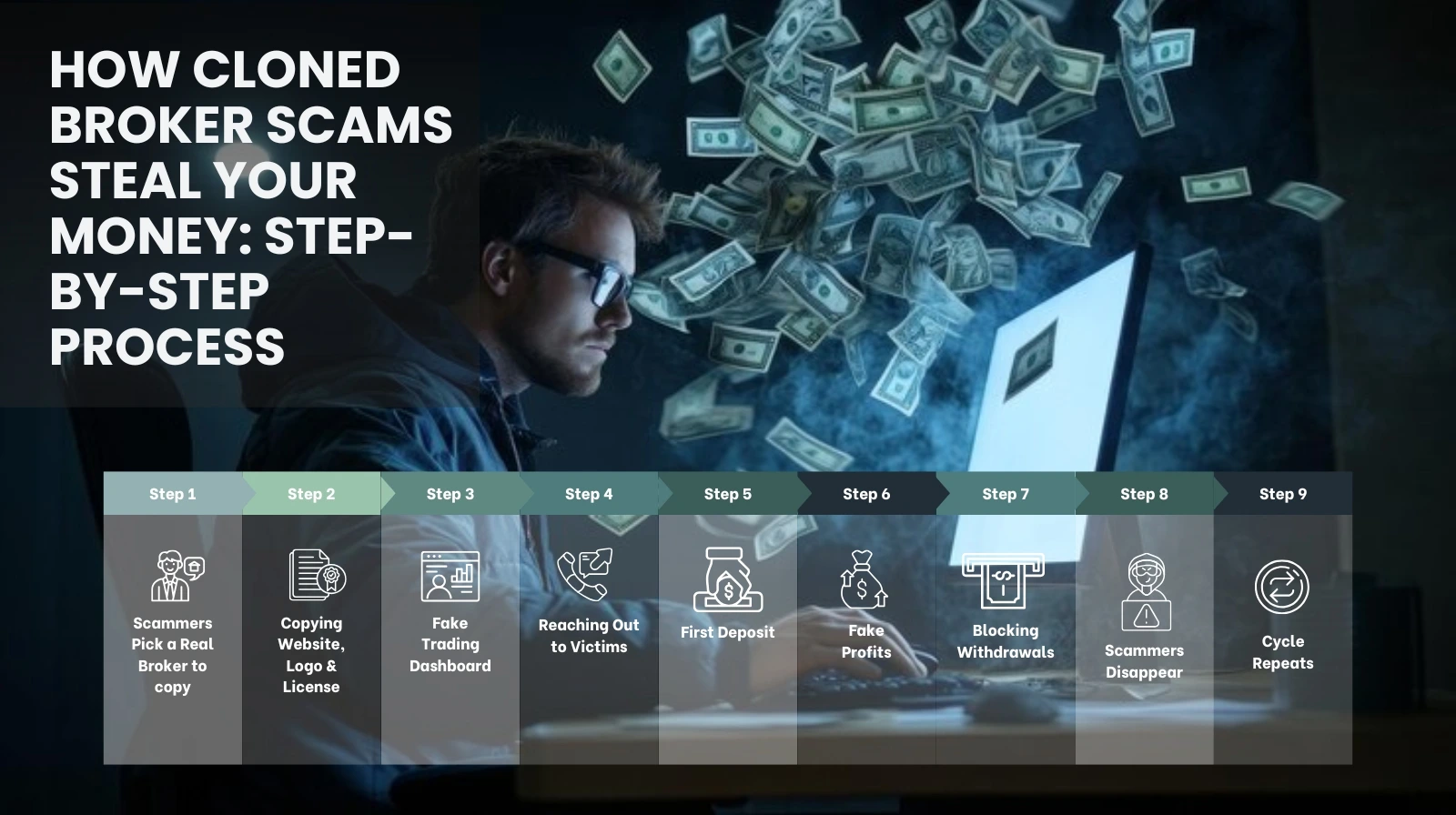

How Cloned Broker Scams Work: Step-by-Step Process

Cloned-broker scams aren’t random. Scammers follow a predictable system, a fraud lifecycle designed to make fake brokers look completely legitimate while quietly trapping investors. Once you understand the steps, you can stop the scam before your money disappears.

Step 1: Scammers Pick a Real Broker to Copy

The first step in a cloned broker scam is choosing a legitimate, regulated broker. By copying a broker that already has a reputation, scammers instantly gain credibility. Investors are more likely to trust a familiar name, which gives scammers a head start in building trust.

Step 2: Copying Everything - Website, Logo, and License

Next, scammers begin broker identity theft. They create a duplicate broker website, using:

- The broker’s official logo and branding

- Website layout and design

- License and registration numbers (often taken from public registries)

- Contact numbers and social media handles

Their goal is to make the fake broker look identical to the real one, leaving investors with little reason to suspect anything is wrong. Even experienced traders can be fooled at this stage.

Step 3: Creating a Fake Trading Dashboard

Once the website is ready, scammers set up a fake trading platform. This dashboard is carefully designed to trick users into thinking trading is happening:

- Live charts that look real but are manipulated

- Account balances and investment growth are shown in real time

- Fake profit notifications to encourage deposits

This makes investors believe their money is actually growing, which builds trust and reduces suspicion.

Step 4: Reaching Out to Victims

Now that the cloned broker looks authentic, scammers start actively contacting potential victims. They use multiple channels to reach investors:

- Cold calls pretending to be account managers

- WhatsApp, Telegram, and Instagram messages

- Email marketing campaigns

- Social media ads

The scammers present themselves as licensed representatives offering special trading opportunities, whose approaches appear professional and convincing.

Step 5: Getting the First Deposit

Investors are usually encouraged to start with a small deposit. This initial payment is critical because it establishes trust: the investor believes the broker is real.

After the first deposit, scammers often push for larger sums by using tactics like

- “Upgrade your account for higher profits.”

- “Add more funds to avoid margin liquidation.”

- “You’re close to reaching a big milestone deposit now.”

This gradual escalation keeps victims engaged and less likely to suspect fraud.

Step 6: Showing Fake Profits

To further convince investors, the fake platform displays impressive, unreal profits. The victim sees their balance increasing and believes their investment is successful. This sense of progress makes it emotionally difficult for investors to stop and question the broker’s legitimacy.

Step 7: Blocking Withdrawals

Eventually, the victim tries to withdraw their funds. This is the turning point. The cloned broker uses excuses to delay or block withdrawals, such as

- “You need to pay taxes before withdrawals.”

- “Verification fees are required.”

- “Anti-money laundering charges must be cleared.”

No matter how much the investor pays, the scammers prevent any real withdrawal.

Step 8: Scammers Disappear

Once they have extracted as much money as possible, scammers vanish. The fake website is taken offline, phone numbers are disconnected, and social media pages are deleted. Investors are left with no way to recover their funds, and the scammer moves on to a new cloned broker identity to repeat the cycle.

Step 9: The Cycle Repeats

These scammers don’t usually operate just once. They continuously clone new brokers, target new victims, and refine their methods. This makes cloned broker scams one of the most dangerous types of trading fraud today.

Understanding this scam lifecycle is one of the strongest protections investors have. These platforms mimic legitimate brokers so well that even professional traders sometimes fall for them, but once you know the pattern, you can spot the scam early and protect your investments. Next, we will look at how to post these cloned broker scams.

How to Spot a Cloned Broker and Protect Your Money?

Cloned broker warning signs aren’t always obvious. These scams are designed to look legitimate, but if you pay attention to the details, the truth shows up fast. Here’s a quick investor checklist to verify broker legitimacy:

|

Red Flag |

What It Looks Like |

Why It’s Dangerous |

|

Suspicious URL / Domain Changes |

Misspellings, extra characters, unusual extensions |

Indicates a fake copy of a real broker website |

|

Unsolicited Contact |

WhatsApp/Telegram messages, cold calls, pushy outreach |

Real brokers don’t chase investors with guaranteed-profit claims |

|

Fake or Unverified License Numbers |

Regulatory IDs that don’t match official databases (FCA, ASIC, CySEC, etc.) |

Clone brokers often steal license info, but can’t verify it |

|

Crypto-Only or Hidden Payment Methods |

Anonymous wallets, strange bank accounts, no chargeback options |

No way to trace or recover lost money |

|

Too-Perfect Reviews / No Track Record |

New domain, polished testimonials, but no real client proof |

Fabricated online identity built to win trust |

|

Pressure Tactics & Unrealistic Promises |

“Guaranteed returns”, “zero risk”, “limited-time offer” |

Designed to force emotional decisions |

If you spot even one of these signs, stop immediately and verify everything before depositing a single dollar. To learn how impersonators target crypto traders, read our guide on impersonation scams targeting new crypto investors.

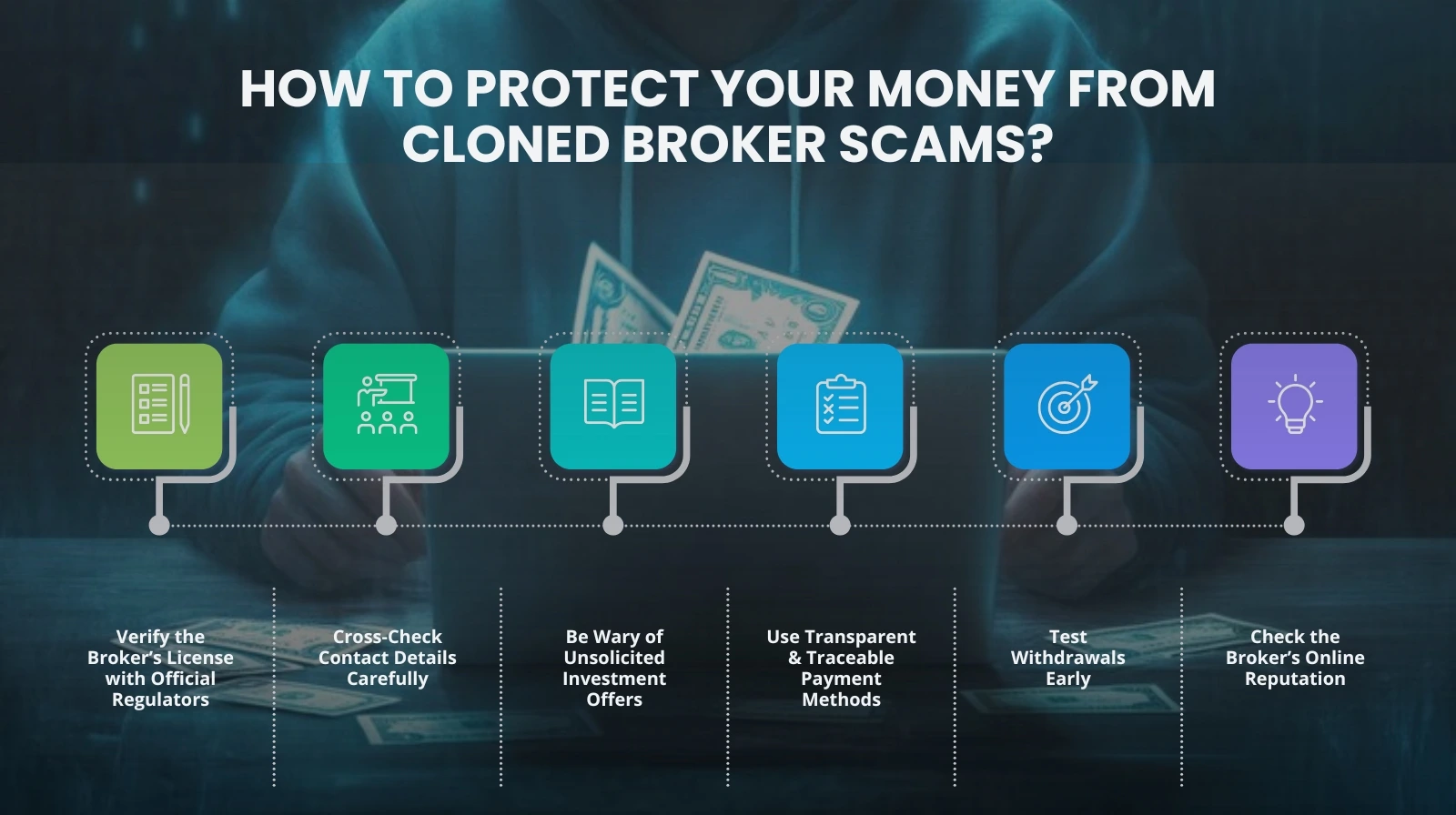

How to Protect Yourself from Cloned Broker Scams?

Protecting yourself from clone-broker scams starts with one simple rule: always verify before you invest. The first thing you should do is check whether the broker is genuinely registered with a real financial regulator, such as the FCA in the UK or ASIC in Australia. Regulators publish public databases.

If the license number doesn’t match or the contact details look different, treat it as a warning sign. And even if the website looks polished, never rely on the phone number or email they show you. Instead, go directly to the official regulator’s website, find the real broker’s contact information there, and confirm whether the company you’re talking to is legitimate or a clone.

If someone reaches out to you out of the blue on WhatsApp, Telegram, social media, or even through a cold call promising easy profits, high returns, or “guaranteed success,” that’s another major red flag. Real brokers don’t beg you to invest; scammers do. Also, pay close attention to how they want you to transfer funds. Requests for crypto-only deposits, strange third-party bank accounts, or urgent time-limited payments are all signs that the money will disappear the moment you send it.

Before you invest anything meaningful, start small. A trustworthy platform will allow you to test withdrawals without hassle. If you encounter delays, excuses, or constant pressure to deposit more before withdrawing, step away immediately; it usually means the scam is already in motion. Finally, do a quick background check online. A simple Google search with the broker’s name followed by words like “scam,” “fraud,” or “reviews” can reveal a lot, either a trail of victims or no history at all, which is just as suspicious.

By taking a few minutes to verify who you’re dealing with, you avoid wasting months trying to recover lost funds later. Caution upfront is always cheaper than regret after.

Stay Sharp, Stay Skeptical

Cloned broker scams are becoming harder to spot because scammers now copy real brokers down to every small detail. But once you understand how these scams operate, the red flags to look for, and the right verification steps, you’re far less likely to fall for a platform that only pretends to be regulated. Always verify, always cross-check, and never rush into an investment because someone claims it’s “risk-free.” Also, if you’ve already been targeted or lost money, help is available.

Need help recovering funds? Contact financial scam recovery experts today.

FAQs (Frequently Asked Questions)

Check the broker’s license on the regulator’s public register (FCA, ASIC, CySEC, etc.) and don’t trust the contact details on the suspect site; call the real broker using the regulator’s listing. If license numbers, contact info, or domain age don’t match, it’s almost certainly a clone. Recovery note: If you haven’t deposited, you’re safe; if you deposited, act fast. Quick bank or card reversal requests improve recovery chances.

Cloned brokers steal an actual broker’s branding, license numbers, and website structure, so they look professional and “regulated.” That realism delays detection. Recovery note: Because the scam mimics real trading activity, tracing funds can be complex but not impossible. Early reporting to your bank, the regulator, and law enforcement increases the likelihood of getting money back.

Not necessarily. Scam operators sometimes allow small withdrawals to build trust before blocking larger ones. Real verification is a successful, consistent withdrawal process using official payment rails. Recovery note: If you’ve withdrawn small sums but are now blocked, save all evidence and contact your bank and local regulator immediately. Partial recovery is sometimes achievable if funds haven’t been laundered.

Use regulated, traceable payment methods (bank transfer via the broker’s verified company account, credit card) and avoid crypto-only deposits, gift cards, or peer-to-peer wallets. Legitimate brokers will offer transparent banking and clear refund/chargeback options. Recovery note: Payments via credit card or bank transfer give you stronger recovery options (chargebacks, transaction disputes) than cryptocurrency, which is far harder to reverse.

Yes, sometimes. The best immediate steps are to stop further payments, document everything (screenshots, chat logs, receipts), contact your bank or card provider for a chargeback, and report to the regulator and local police. Reality check: Recovery odds are highest if you act within days while money is still traceable; once funds are converted, split, and laundered, recovery becomes much harder.