- Investments

- October 9, 2024

Table of Contents

The metaverse—an expansive virtual world where people interact, socialize, and conduct business—has gained massive popularity. However, as its popularity grows, so does the risk of financial fraud in the metaverse. With digital assets becoming increasingly valuable, the threat of financial scams in the metaverse has never been more real.

This blog will explore the different types of financial fraud in the metaverse and provide practical tips on how to protect your money in the virtual world.

Understanding Financial Fraud in the Metaverse

- Financial fraud in the metaverse involves schemes designed to mislead individuals and steal their virtual wealth or funds.

- One of the most circulating is the investment scam in the metaverse, promising to get returns due to virtual investments, after which scammers disappear with the given payment.

- The other form of digital fraud in the metaverse is phishing, where the fraudsters trick the user into providing information that, in the end, makes the user's virtual properties disappear.

Types of Financial Fraud in Metaverse

-

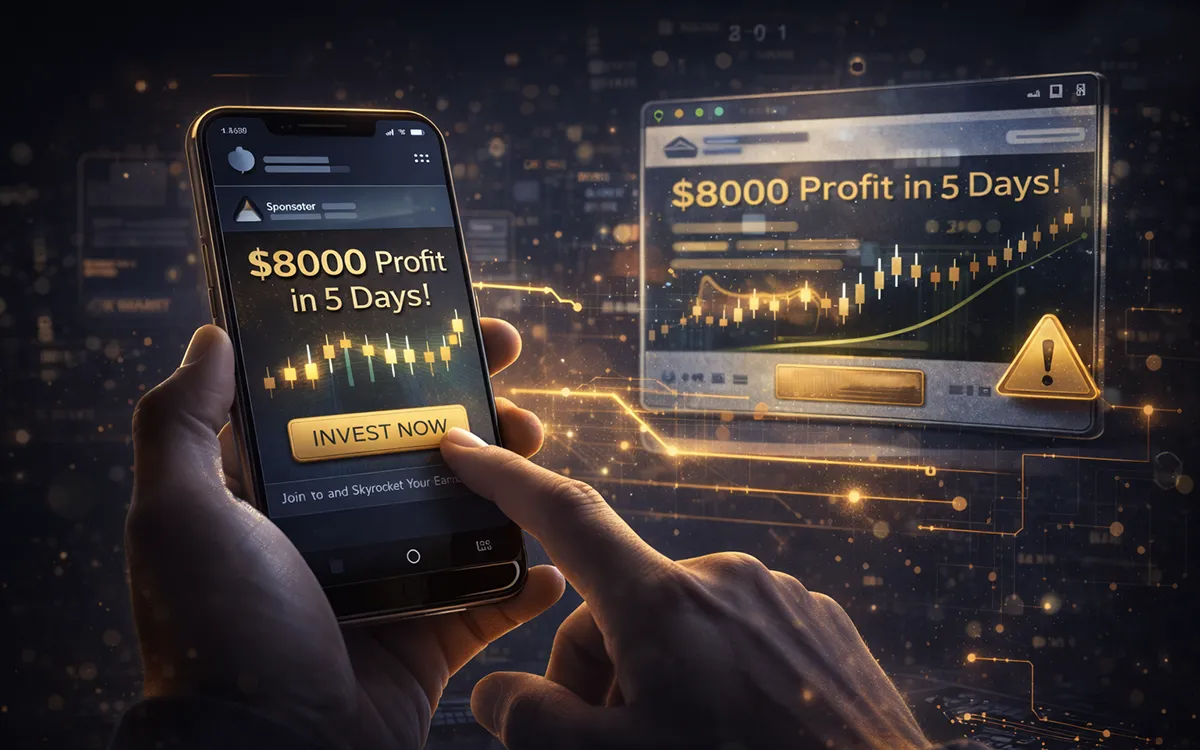

Investment Scam in Metaverse

- Scammers are out to have in their pools of victims through promising returns for investment in virtual reality, encrypted monetary tokens, or NFTs.

- They always run very professional websites, and endorsements from nowhere, and also do operate for a very short time to gather enough before disappearing.

-

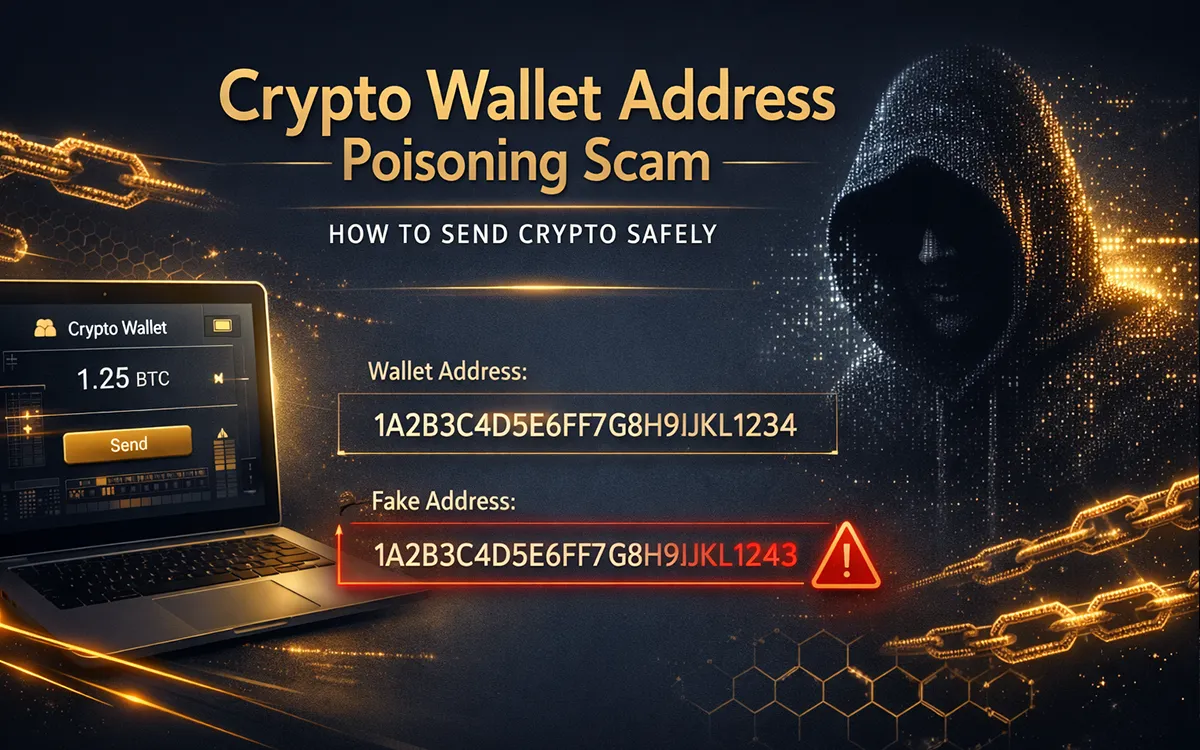

Phishing Scams

- Scammers impersonating real platforms or sending fake email copies with the aim of stealing users' login credentials are what these usually refer to.

- Such credentials are then used to siphon off digital assets from the users' accounts, which is a very common type of digital fraud in the metaverse.

-

Ponzi Schemes

- These rely on the entry of more new investors to pay earlier investor's returns up to the point that the scheme collapses when new investments slow down, leaving most participants at a loss.

-

Fake Virtual Goods and Services

- For example, cybercriminals sell online fake clothes, weapons, or even pets that do not exist at all, meaning that the money of one naive user goes directly into the villain's pocket without getting the product.

Signs and Red Flags of Metaverse Scams

- Unrealistic Returns: If the investment opportunity in the metaverse promises unrealistically high returns with little or no risk, it is more than likely a financial scam in the metaverse.

- Pressure to Act Quickly: Very often, online scammers make people act urgently—to invest quickly before they "miss out" on some lucrative opportunity.

- Lack of Transparency: Legitimate projects are usually transparent about their operations. Be wary of platforms that remain vague about their team location or business model.

- No Verifiable Endorsements: Scamming methods are always accompanied by fake endorsement claims. So, from celebrities to social media influencers, look out for such claims and verify them before you invest.

- Bad Quality Website Design and Grammar: This may not be true in all cases; however, the vast majority of fraud sites do have bad designs and depict apparently known misspellings and grammatical errors.

Real-Life Example of Metaverse Fraud

Consider the case of a user who invested in what seemed to be a legitimate virtual real estate project in the metaverse. The project promised high returns, boasting an impressive website and endorsements from fake social media influencers.

After the initial investment, the user was unable to access their virtual property or withdraw funds. The website and the so-called developers vanished overnight, leaving many investors without their money or assets. This is a classic example of an investment scam in the metaverse.

How to Protect Your Money in the Virtual World?

- Stay informed: Regularly update yourself on emerging scams in the metaverse.

- Use Reputable Sites: Only trade or invest in known and trusted platforms to avoid metaverse scams.

- Check Before You Invest: Never invest in any opportunity without checking it thoroughly.

- Enable two-factor authentication: 2FA saves your accounts from undesirable access and digital fraud in the metaverse.

- Report Suspicious Activity:Any suspicious activity should be immediately brought to the notice of the authorities on the platform and help sought.

Conclusion

The metaverse is awash with opportunity but opens the doors to such dangers as financial fraud. Be vigilant and aware of the ways of securing your virtual assets against investment scams and other financial crimes in the metaverse.

If scammed, find your way to immediately contact financial fraud recovery professionals and seek the help of their expert guidance in recovering your assets.

Key Takeaways:

- Stay Vigilant: Protect yourself from financial fraud in the metaverse.

- Recognize Red Flags: Identify investment scams early.

- Act Quickly: Respond immediately to suspected scams.

- Stay Informed: Keep up with emerging scams.

- Seek Help: Contact the professional fund recovery firms if you've been scammed.

FAQs (Frequently Asked Questions)

The financial fraud in metaverse involves the scams committed to taking virtual assets or money.

Use reputable platforms, activate two-factor authentication, and confirm all investment opportunities before you send your money in.

Common scams include investment scams, phishing, Ponzi schemes, and the sale of fake virtual goods.

Some of the red flags include unrealistic return on investment, pressure to act quickly, no transparency, fake endorsements, and major warning bells for poorly designed websites.

Recover lost assets with a call to the fund recovery experts.