- Miscellaneous

- January 16, 2025

Table of Contents

Ponzi and pyramid schemes are fraudulent financial activities with promises of high returns at little or no risk to the investor. These scams come camouflaged as genuine investment opportunities and lure new participants with the hope of earning profits. However, the returns for earlier investors are typically paid using funds from new participants, not from any legitimate business activity or investment growth.

The SEC estimates that, over the years, Ponzi Schemes have defrauded their investors of billions, with the most high-profile case being Bernie Madoff's scheme, which related to a total of about $65 billion.

Whereas the continuous recruitment of new investors keeps both schemes running, the moment this chain stops or slows down, the scheme collapses and many investors lose all their money.

The Federal Trade Commission (FTC) estimates that more than 99% of participants end up losing money in pyramid schemes, while only a small number of them obtain a substantial return.

Both scams sound similar in general, but they operate in different manners. Ponzi schemes attract investors and pay their returns with funds from those who joined the scheme earlier, whereas pyramid schemes involve a structure where participants earn primarily by bringing others into the scheme.

In this blog, we will explore methods to differentiate between these schemes and how they are similar, provide authentic instances, and also share insight into spotting them to keep yourself out of harm's way.

What is a Ponzi Scheme?

A Ponzi Scheme represents an investment fraud where new investors' funds are utilized to provide returns to earlier investors rather than from genuine investment profits. The scheme derives its name from Charles Ponzi, who gained notoriety for orchestrating a comparable scam in the early 20th century. These fraudulent schemes often pledge significant returns with minimal risk, a conspicuous warning sign. The perpetrators of such fraud heavily rely on a continuous influx of new investments to sustain the ability to compensate earlier investors.

Treating inflation as a business principle, a Ponzi scheme essentially feeds off recruitment. The scheme is based on the premise that most investors will not withdraw their investments at the same time. It collapses as soon as the inflow starts dwindling. It is alleged to have defrauded investors of an estimated $65 billion annualized $6 billion if you do not count it as accounting fraud. Get to know more about the Ponzi Scheme in detail in our latest guide.

What is a Pyramid Scheme?

Pyramid schemes are fraud investments designed to make money by always needing and recruiting new participants. Members, under such a scheme, make money much more through recruitment than from any plausible business activity or investment.

As new members join, they pay an entry fee, which is passed up to those who recruited them. These schemes are so named because of their structure: the base (new recruits) gets wider and wider and supports the higher levels (earlier participants).

With time, the contrivance of pyramids becomes impossible due to the requirement for continually refreshed perspectives in the base. When recruitment causes steadiness, the pyramid collapses.

Pyramid scams usually manifest themselves in the interfusion with MLM companies, in which products are passed on and sold, but they continue to keep the recruitment angle at the forefront of their activities. The FTC has cautioned that in many pyramid schemes, the majority of people actively lose money while only a small fraction have any chance of profiting at all. Pyramid scheme fraudsters often exploit these legitimate-looking marketing and business opportunities to trap victims into joining.

Ponzi Scheme vs Pyramid Scheme: Key Differences

While Ponzi and pyramid schemes may seem similar at first glance, there are significant differences:

|

Aspects |

Ponzi Scheme |

Pyramid Scheme |

|

Source of Funds |

Funds from new investors are used to pay returns to earlier investors. |

Money is generated by recruiting new participants who pay entry fees. |

|

Focus of the Scheme |

Focuses on attracting investors, with no emphasis on recruitment beyond the initial phase. |

Focuses heavily on recruiting new participants to generate profits. |

|

Sustainability |

Collapses when the flow of new investor money slows, as the operator cannot pay returns without new funds. |

Collapses when the pool of potential recruits is exhausted, as it requires an ever-expanding base. |

|

Investor Participation |

Investors believe their money is being invested in legitimate financial instruments. |

Participants are actively involved in recruiting others and are often promised profits for doing so. |

|

Scheme Collapse |

Dependent on constant new investments to pay returns to earlier investors. |

Dependent on continuous recruitment, it eventually becomes unsustainable. |

The difference between a Ponzi Scheme and a Pyramid Scheme lies in their operational structure and focus—while both are fraudulent, Ponzi Schemes are built on using new investor money to pay returns, and pyramid schemes revolve around recruitment as the primary source of profits. The Ponzi Scheme vs Pyramid Scheme distinction can help investors better identify these types of scams.

Similarities Between the Ponzi Scheme and Pyramid Scheme

Despite their differences, Ponzi schemes and pyramid schemes share several key similarities:

- Reliance on New Investors: Both schemes are very much relying on a constant stream of new entrants who would populate the systems. The scheme simply crashes businesses when the newcomers cannot bring in new money to the system.

- The promise of high returns: As for both types of 'businesses,’ they are based on the principle of extremely high, frequently unrealistic earnings with potentially little or no risk. They are aware that most people who are blinded by greed are easily trapped into joining the pyramid.

- Unsustainable Growth: Both are based on unsustainable strategies. Ponzi schemes keep returning money back to previous investors using money from new clients, while schemes depend on the constant addition of new members to enable them to pay commissions to other members.

- Fraudulent Nature: Ponzi fraudulent personnel and Pyramid fraudulent personnel also like to lie and persuade members of the public to invest in their schemes, masquerading them as usual business ventures.

- Inevitable Collapse: Since both schemes require constant recruitment to continue, they are bound to collapse once new investors stop joining. This leaves most participants with financial losses.

- Legal Consequences: Participants in both types of scams face severe legal and financial penalties. Authorities like the SEC and FTC regularly crack down on these types of frauds to protect investors and the public.

By understanding the common traits of these two types of schemes, individuals can better protect themselves from falling victim to pyramid scams and Ponzi schemes.

How to Spot Ponzi Scheme and Pyramid Scheme?

Recognizing a Ponzi or pyramid scheme early can help protect your finances. Here are some tips for spotting these types of fraud:

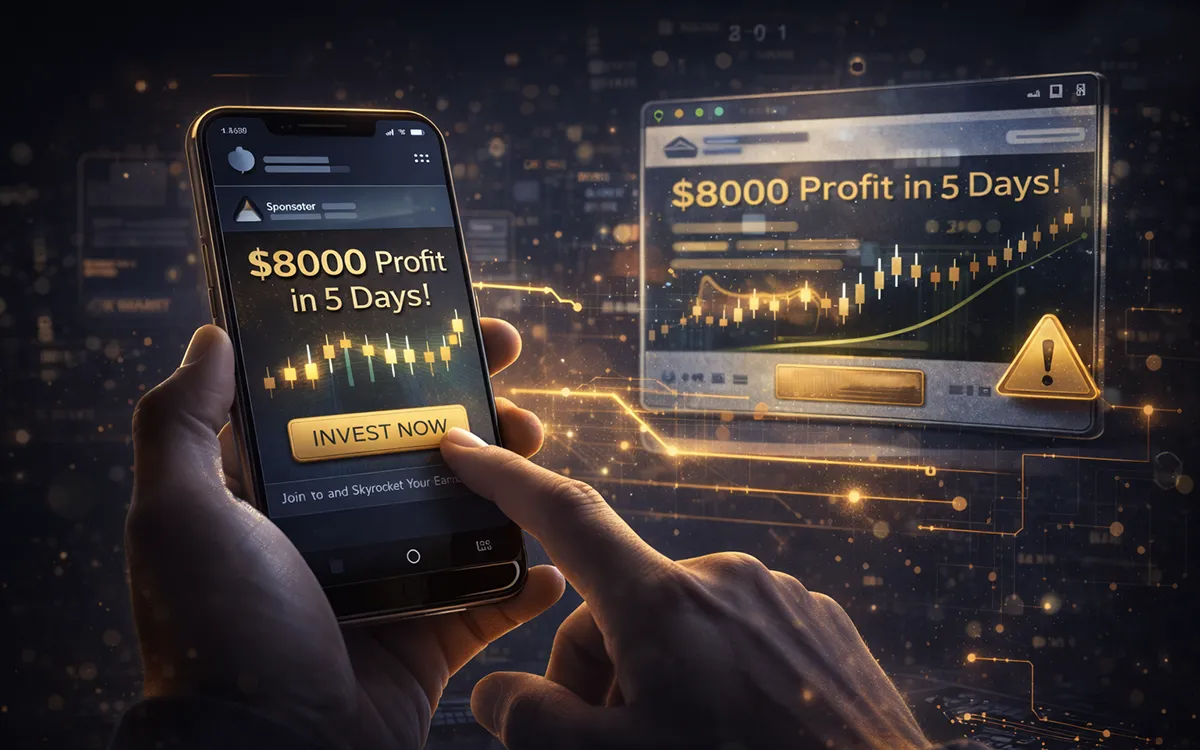

- Unusual and promising high yield with little risk: Promises of unusually high returns with a small or no risk should be treated with caution.

- Heavy emphasis on recruiting: If a scheme tries too hard to recruit others into the plan, it may be a pyramid scheme.

- There is no concrete information on the scheme. Generally, Ponzi or pyramid frauds will not be forthcoming about their business or investment plans.

- Don't sell products: Since in pyramid schemes many people have little other than recruits to show, they sometimes lack anything real, tangible, or solid by way of product sales. Ponzi schemes also often lack real investments or profits.

Warning Signs of Ponzi and Pyramid Schemes

It is therefore important to be in a position to tell whether one is dealing with a Ponzi scheme or a pyramid scheme. Here are some key warning signs to look out for:

- Unrealistic Promises of High Returns: Like the Ponzi scheme, pyramid schemes work under the policy of high-yield, low-to-zero-risk investment. When people hear that something is an investment opportunity, if the offer given is too good to be true, then it is. Be careful if someone tells you that you will earn money or promises certain returns that are much higher than common market interest rates.

- Lack of transparency: As in the case of investment, operators in both schemes do not usually elaborate on how it operates. If, for some reason, you cannot easily access straightforward and demonstrable facts about the investment or business model, then it is a no-go.

- Focus on Recruitment Over Product or Investment: In Ponzi fraud, emphasis is usually placed primarily on obtaining persons who will be investing in the fraudulent plan with little reference to the vehicle that will be invested in.The primary activity in the pyramid schemes is to attract as many participants as possible into the system, with minimal concentration being laid on the actual sales. A pyramid scheme scam is often when you are urged to bring other people into joining before they can get profits as you wish.

- Pressure to Invest Quickly: Scammers perpetually urge people to invest in some stock and make sales without affording the requisite time to investigate. As you have heard, if somebody is trying to force you to invest right now or force you to recruit other people right now, this is a sign of a great warning.

- Difficulty in Withdrawing Funds: The narratives collected depicted that once investors are many and little demand for new investments arises, the operators of the knowledge scheme may make it hard for investors to gain liquidity. Likewise in pyramids, one can experience various kinds of difficulties in the attempt to withdraw the invested money or earnings.

- Too Many Complaints or Legal Actions: In business, this means a company or investment opportunity requires some scrutiny if it has had legal problems if it has been fined for breaches, or if the business has a record of frequent customer complaints. Only a few important sources of information: Search for past legal problems such as lawsuits or regulatory investigations.

These are the warning signs to keep in mind so that you will not fall into the hands of fraudsters with their Ponzi Scheme or Pyramid Scheme. Knowing what a Ponzi scheme is and how a pyramid scam works will definitely help you make an informed decision and avoid financial losses.

Examples of Ponzi and Pyramid Schemes

Real-life examples of Ponzi Schemes and Pyramid Schemes help illustrate how these fraudulent operations work and the devastating impact they can have on investors. Here are some notable cases:

- Ponzi Schemes:

Bernie Madoff: Probably the most known Ponzi scheme in history, Madoff's scam did an estimated $65 billion worth of damages to investors. For years, through the umbrella of legend-building, it was said that he could deliver consistent and sustainable high returns on investments. Yet he was paying off clients with their money. It collapsed in 2008, leaving thousands of investors in financial distress.

Allen Stanford: Yet another large Ponzi scheme is that of Allen Stanford, who operated a fraud of $7 billion concealed behind a high-return certificate of deposit. The year 2012 would see Stanford convicted of many years of high-return fraud.

- Pyramid Schemes:

Herbalife: An example of possibly the most famous pyramid scheme that has an MLM face is Herbalife. The business has also gained a number of investigations from regulators and the FTC, who have frowned at the recruitment-based business model, arguing that most of the sales are fake. The fraud charges were made in 2016 and out of the penalty, the company agreed to pay $200 million towards the settlement.

The Zrii Scam: The little-known pyramid scheme was a health drink company called Zrii. Marcus encouraged selling a product while appointing recruitment bounties on those taking others into the program. Many in the recruitment-heavy scheme did not make ends meet; regulators later shut it down.

These examples indicate the far-reaching effects of such fraudulent schemes and highlight the need to exercise prudence in the assessment of investment opportunities. Recognizing Ponzi Schemes or Pyramid Scams will help save you from becoming a helpless victim.

Bottom Line

Both Ponzi schemes and pyramid schemes are fraudulent and illegitimate operations that can cause enormous financial loss. It's important to know their differences and similarities to spot the warning signs and safeguard oneself against such scams.

- Ponzi Schemes depend on an ongoing influx of new investments in order to pay returns to previously enrolled investors. These types of schemes are famous for promising great returns at minimal risk. However, they tend to go bust when new investor funds slow.

- The Pyramid Schemes are recruitment-oriented scams, wherein the member gets commissions for bringing in new members instead of selling an actual product or service. This makes pyramid schemes quickly become an unsustainable business.

Both promise high, immediate returns and have a reputation for making it hard for people to redeem their funds. Yet they are different in their structures and what they use as bait. Knowledge of the meaning of Ponzi schemes and of pyramid schemes helps to identify these cons early.

Knowledge is the best way to protect oneself from an act of fraud. If you suspect you were the victim of Ponzi or Pyramid Scams, Global Financial Recovery can help you recover lost assets.

FAQs (Frequently Asked Questions)

A Ponzi scheme consists of one operator who pays returns from other investors' money. In a pyramid scheme, profit is generated through the process of recruitment and membership fees.

Yes, Ponzi schemes are illegal in most countries. They violate the law on securities and entail harsh criminal penalties.

Yes, Pyramid Schemes are illegal in places like the United States and many other countries. The reason this would be classified as such is because pyramid schemes are fraudulent in making money off those joining without any real product or service.

Be cautious of investments that offer unusually high returns and lower risk. Do your research on such organizations. Don't be pressured to register any other members. Seek advice from a third party. Ensure that the offering does not have unrecognizable investment schemes or create hurdles for taking out the money.

They tend to break down whenever new money stops flowing into both systems. The operator can no longer pay out returns in Ponzi schemes to earlier investors. Pyramid schemes run out of their new recruits; hence they collapse.