- Investments

- February 2, 2026

Table of Contents

Every major social network, Facebook, Instagram, TikTok, and X, has become a hotspot for investment scam ads. Scammers are using paid promotions to push people toward clone broker websites that copy the look and feel of trusted platforms. With realistic branding and bold claims about “high return investments,” these ads reach the exact people most likely to click them.

The problem is simple: these websites aren’t real. They’re designed to take your money and disappear. More victims are reporting losses after clicking fake crypto trading platform ads than ever before.

This article explains how these social media ads work, the red flags to look out for, and what you can do to stay safe.

Why Clone Investment Websites Look Legit but Aren’t

Clone investment websites are fraudulent platforms engineered to imitate genuine financial institutions with near-perfect accuracy. Cybercriminals reproduce licensed companies’ names, regulatory numbers, contact details, and visual branding to create spoofed trading environments that appear fully legitimate. Many even display fabricated performance charts, “live trades,” or customer account balances to enhance credibility.

Victims fall for these sites because they exploit two psychological triggers:

- Authority bias - the website looks official, so the company must be real.

- Familiarity - people trust what looks known or reputable.

Scammers amplify this trust by using targeted social media ads, which provide a smooth transition from a credible-looking ad into a professional-looking site, eliminating suspicion. This combination is extremely effective, which is why clone platforms have become one of the fastest-growing investment scam methods worldwide.

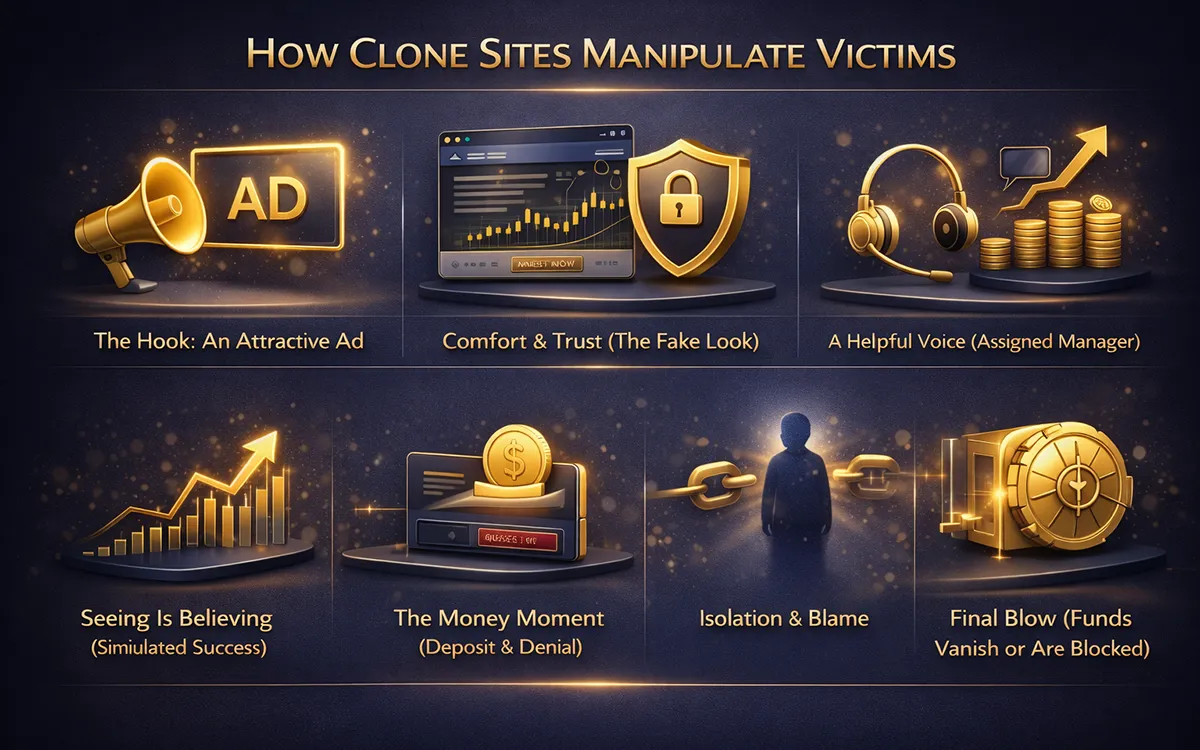

Step-by-Step Tactics Used by Clone Investment Scams

Clone investment scams are designed to feel safe at first. Through small, seemingly harmless steps, they slowly build trust, causing even cautious individuals to recognize the fraud only after funds are involved.

-

The Hook: An Attractive Ad

It usually starts with an ad that speaks directly to a hope or need: quick returns, retirement gains, or a “secret” trading robot. That hook is intentionally aligned with what the person wants.

-

Comfort & Trust (The Fake Look)

When the user lands on the site, everything feels familiar and safe: professional photos, copied logos, and friendly copy. That comfort lowers suspicion immediately.

-

A Helpful Voice (Assigned Manager)

A person or live chat reaches out quickly. They sound helpful and knowledgeable, answer questions, and build a relationship; they become a trusted point of contact.

-

Seeing Is Believing (Simulated Success)

The victim is shown rising balances and test trades. Seeing a growing number on the screen feels like proof, and that emotional lift often leads to a real deposit.

-

The Money Moment (Deposit & Denial)

After the deposit, things change: withdrawals are delayed, additional “verification” is requested, and small technical excuses appear. Victims often blame themselves or assume delays are normal.

-

Isolation & Blame

Scammers pressure victims not to tell anyone, claiming confidentiality or exclusive terms. This isolation increases shame and reduces the likelihood of immediate help.

-

Final Blow (Funds Vanish or Are Blocked)

When victims insist on withdrawal, the support fades, the account is frozen, or the site goes offline. Many people only realize they’ve been scammed when they can’t contact anyone and the money is irretrievable.

-

Aftermath & Confusion

Victims are left confused and ashamed; they don’t know who to call or how to prove the fraud. That’s when recovery specialists and law enforcement must step in.

If any of these steps sound familiar, don’t blame yourself its the process that is designed to exploit normal human behavior. The next section explains the most common scam ad types and how to spot them before money is lost.

Common Types of Scam Ads Used on Social Media Platforms

The world of social media is full of advertisements that seem authentic but are in reality used to take part of your money. Fraudsters continue to evolve their tactics, so you must be aware of the most popular forms of deceptive advertisements you are likely to encounter.

The scammers use the same advertisement format on different platforms, only altering the name and images while retaining the identical tricks.

|

Type of Scam Ad |

Description & How It Works |

Example |

|

Celebrity-Endorsed Investment Ads |

Deepfake images or stolen photos of celebrities/influencers claiming they invested in “secret” trading platforms. Creates false authority and trust. |

An ad showing Elon Musk promoting a “crypto trading robot” that doesn’t exist. |

|

Guaranteed Return or “Risk-Free” Investment Ads |

Promises extraordinary profits with no risk. Uses phrases like “Double your money in 24 hours” or “No risk crypto bot” to lure victims. |

A Facebook ad claiming you can earn 10% daily with zero risk by joining a “secret trading platform.” |

|

AI Trading Bots & Automated Investment Schemes |

Promotes AI-powered trading bots, forex bots, or crypto algorithms with fake performance charts or “live” dashboards to simulate credibility. |

An Instagram ad showing a bot dashboard with fake “live” crypto trades and inflated profits. |

|

Redirects users to private messaging apps where scammers use personalized persuasion, fake testimonials, and urgency tactics to extract money. |

Clicking an ad that sends you to a Telegram group promising exclusive early crypto investments. |

|

|

Pump-and-Dump or Fake Token Promotions |

Promotes new cryptocurrencies, NFTs, or tokens with promises of early access or insider tips. Exploits FOMO and often disappears after collecting investments. |

A TikTok video promoting a new NFT drop with “guaranteed profits,” which disappears after users send funds. |

Signs That a Social Media Investment Ad or Website Is a Scam

Social media investment scams follow patterns. Once you know what to look for, many clone websites and fake ads become easier to spot before any money is lost. Even professional-looking ads and websites often reveal themselves through consistent warning signs.

-

Guaranteed or “Low-Risk” High Returns

Any ad promising consistent profits, “risk-free trading,” or fixed daily returns is a major warning sign. Legitimate investments never guarantee outcomes, especially in volatile markets like crypto or forex.

-

Celebrity Endorsements Without Verifiable Proof

The scam advertisements usually include well-known businessmen, TV stars, or crypto influencers who say they use the service. These pictures and videos are often stolen or produced by artificial intelligence. Unless the endorsement is shared on the personal site or the authentic social media accounts of the individual, it is most probably a fake one.

-

Pressure to Act Quickly

Phrases like “limited spots,” “last chance today,” or “exclusive invitation” are designed to override rational thinking. Scammers rely on urgency to prevent victims from researching the platform or seeking advice.

-

Being Redirected to WhatsApp or Telegram Immediately

Legitimate financial firms do not move serious investment conversations to private messaging apps after a single click. This tactic allows scammers to avoid oversight and isolate victims from outside opinions.

-

A Professional Website With No Verifiable Registration

Clone websites often look polished but fail basic checks:

- No valid regulatory license

- Fake or copied company addresses

- Registration numbers that don’t match official databases

- No independent reviews outside of the site itself

If the company cannot be verified through trusted regulators, it should not be trusted with your money.

-

Simulated Profits Shown Immediately After Signup

Many fake platforms display instant gains to build confidence. These dashboards are controlled by scammers and do not reflect real market activity. Seeing quick profits is often the hook that leads to larger deposits.

-

Withdrawal Problems Followed by New Fees

A common pattern is being asked to pay taxes, unlocking fees, verification charges, or liquidity fees before withdrawing. Legitimate platforms deduct fees automatically; they don’t ask for extra payments to “release” your money.

-

Discouragement From Talking to Others

Scammers often say things like “keep this confidential,” or “others won’t understand this opportunity.” Isolation is intentional. The moment someone advises you not to seek outside input, the risk increases significantly.

-

Ads That Appear Repeatedly Even After Being Reported

Seeing the same investment ad resurface after being flagged doesn’t make it legitimate. Scam campaigns often rotate domains and accounts faster than platforms can remove them.

If even one or two of these red flags appear together, pause immediately. Most victims only realize something is wrong after multiple warning signs have already been present.

In the next section, we’ll explain exactly what to do if you’ve already clicked a scam ad or deposited money and how to limit further damage.

How to Protect Yourself from Social Media Investment Scams

The safest way to avoid social media investment scams is to slow down and verify everything before you act.

Watch out for any advertisement that claims guaranteed returns or abnormally high returns, particularly when it urges you to act early or transfer the discussion to WhatsApp or Telegram. Always do your own investigation of the investment company by searching its official site, databases of regulators, and actual user warnings, but not testimonials posted on the site itself.

Account balances or profit dashboards should not be relied upon since they can be easily spoofed on clone sites. Do not follow investment links that the social media advertisements display, and do not put money into the platform before you have verified that it is a legitimate one through several reliable sources.

When something seems to be in a hurry, hiding something, or even seems to be overdone, the indecision is usually your most reliable indicator.

If you have been scammed by such a scam, contact investment recovery experts to get back your money.

The Real Risk Behind Social Media Investment Ads

Social media ads can make investment scams look convincing, especially when they use familiar branding or promise fast profits. But many of these ads lead to fake websites designed to steal money.

Scammers constantly adapt, which means even careful people can be caught off guard. If you or someone you know has lost money to a social media investment scam, don’t delay. Contact Global Financial Recovery to report the fraud, explore recovery options, and protect yourself from further scams.

FAQs (Frequently Asked Questions)

Yes. In many cases, clone websites are visually cleaner and more polished than the legitimate companies they copy. Scammers focus heavily on design, user dashboards, and smooth navigation because appearance builds trust. A professional-looking website does not mean the platform is regulated, licensed, or safe.

Scammers rarely run just one ad or account. They use rotating ad profiles, cloned business pages, and short-lived campaigns that disappear before moderation catches them. Once an ad is removed, a nearly identical version often reappears under a different name, making enforcement difficult and inconsistent.

Yes, and it’s a deliberate tactic. Allowing a small withdrawal early on helps convince victims that the platform is legitimate. This “proof” lowers defenses and encourages larger deposits later. Once more money is invested, withdrawals are delayed, blocked, or tied to fake fees.

In some cases, yes. If a victim shares identification documents, wallet access, or installs remote software, scammers may attempt further fraud, identity misuse, or additional wallet draining. That’s why stopping communication and securing accounts quickly is critical after suspecting a scam.

Be extremely cautious. Many victims are contacted by “recovery agents” shortly after being scammed, often by the same criminal networks. Legitimate recovery services do not guarantee results, demand upfront pressure payments, or contact victims out of the blue.