- Miscellaneous

- November 19, 2024

Table of Contents

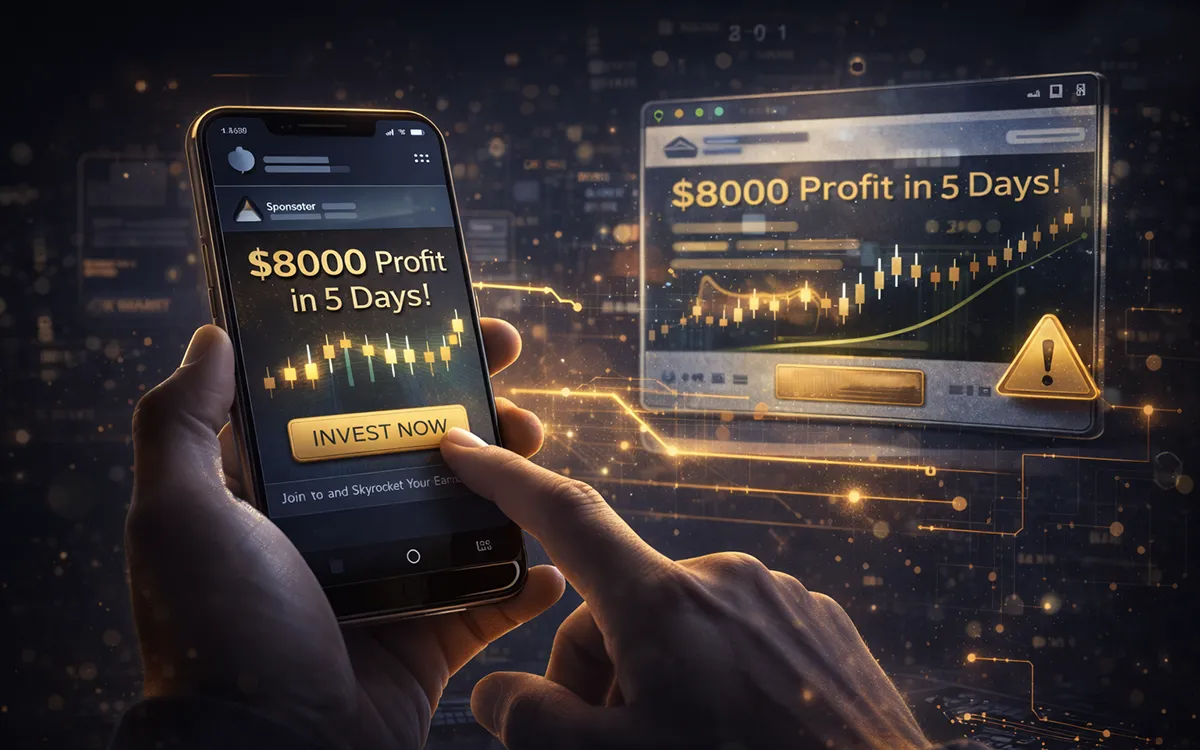

Wire fraud is a serious crime that affects both individuals and businesses, especially as financial transactions increasingly shift to digital platforms. With more people relying on electronic communication for payments and transfers, the risk of becoming a victim of wire fraud has significantly increased. Whether you’re wondering, "Can someone send you a fake wire transfer?" or concerned about the wire fraud minimum sentence, understanding how these scams work and how to protect yourself is vital.

In this guide, you will learn the wire fraud definition, its components, typical wire fraud scenarios, and actions you should take in case of an attempt. Being aware of the danger of wire fraud will help you avoid serious money damages and the problems related to your wire fraud sentencing, as well as penalties for other crimes, like mail fraud.

What is Wire Fraud?

Wire fraud means that a person defrauds others, and it is good to learn how it happens so that you do not become a victim.

Wire fraud denotes a situation in which a person makes use of e-mail or telephone to con another person or firm out of money or other property.

The key elements of wire fraud include:

- Using Electronic Communication: It could be anything from a phone call or through to an email.

- Intent to Deceive: Scammers are motivated to use the technology for their advantage with the intent to deceive or rip off their victim

- Execution of the Scam: It is a scam if victims are ripped off financially either without their knowledge or under the false pretext of financially enriching them

It is absolutely wrong to defraud people regardless of how the scam was carried out, and, thus, one has to be aware of how this is done so as not to be a victim.

Common Types of Wire Fraud

There are several common forms of wire fraud that individuals and businesses should be aware of:

- Wire Transfer Scams: Scammers trick the victim into wiring the money by impersonating someone familiar to the victim or a celebrity.

- Business Email Compromise (BEC): Mals lured employees into transferring company funds to other accounts by hacking a company’s email system.

- Real Estate Fraud: Other common ways of extortion include fake wire instructions where a con artist steals money from homebuyers by redirecting the payments for their properties to the con artist’s account instead of to the seller’s account.

Wire Fraud vs Mail Fraud

Many people wonder, "What is mail fraud and wire fraud?" Both may look similar as they involve schemes to defraud people out of money or property, but the difference lies in the method of communication used:

- Wire Fraud: Refers to the use of media tools through phone calls, electronic mail, or even the World Wide Web.

- Mail Fraud: It entails the utilization of post office services in executing criminal stalking.

Wire Fraud Examples

Understanding real-world examples can provide insight into how diverse wire fraud schemes can be:

- Sean Kingston Wire Fraud Case: The more interesting case is that of Sean Kingston, a singer who was charged with conspiracy to commit wire fraud in 2022. He was accused of sending false information to an investor who lost an amount of $250,000.

- Business Email Compromise (BEC): Another example can be considered the swindle when attackers pose as top managers of a particular company and then send emails to the workers stating them to perform the operations of transferring significant amounts of money via wiring.

- Romance Scams: Those targeted are taken advantage of as fake would-be sweethearts connive with them to send money to cater for any this or that emergency back home.

- Fake Rental Listings: At times, con artists post fake advertisements online for rental properties and time prospective occupants to send deposits before they view residences.

These examples prove why wire fraud is possible for any person at any level, regardless of their understanding of finance or not.

Wire Fraud Penalty

Wire fraud often carries heavy penalties, including wire fraud minimum sentences of several years in prison. If someone is caught committing wire fraud, the penalties can be severe:

- Fines: The fines that the criminals can be restricted from paying may go up to $1 million.

- Imprisonment: At worst, at the hands of offenders, one is confined with imprisonment for up to 20 years, depending upon the extent of the offense.

- Restitution: Usually, the courts would restrict offenders from returning their losses to their victims pertaining to fraudulent activities by paying them back.

Wire fraud is classified as a felony, much like mail fraud, which also carries serious penalties. Many wonder, “Is wire fraud a felony?” Yes, it is. Both wire and mail fraud have lasting impacts on a person’s life and reputation.

Wire Transfer Fraud Recovery

Recovering from wire transfer scams can be tough, but there are steps you can take:

- Payment Portal: Contact the relevant authority of the payment portal that was used for the wire transfer. Then tell them about the online fraud and request them to reverse the payment. Also, request them to suspend any further unauthorized payment and, if necessary, freeze the account.

- Talk to Your Bank: Your first step should always be to contact your bank and tell them that you have fallen victim to online fraud. They may have procedures and processes in place for recovering your lost funds.

- File a Claim: Some financial institutions provide insurance with respect to certain categories of fraudulent actions.

- Document Everything: Compile all the correspondence, like emails and messages, between the scammer and you. This can be used as evidence and can be helpful while bringing the scammer to the court of justice.

- Get Law Enforcement Involved: Make a detailed account of how you fell victim to the scam and provide all the screenshots and any other necessary correspondence shared by the scammer with you to the police as they can guide you in your recovery path.

- Consult Legal Experts: If you have lost a good amount of money, then it is probably best to seek consulting services, such as Global Financial Recovery, an online financial asset recovery firm that uses state-of-the-art software and hardware with their team of professionals to try and recover the financial asset that you have lost.

Conclusion

Wire fraud is a real and growing threat in the digital age. Understanding how these online scams are committed can help you prevent and save you from potential financial losses. Although you have the option of contacting the government official for the recovery of your lost financial assets, you can always contact us. Since the government resources are far stretched, it is next to impossible for them to track all the scammers and take legal action.

When you contact us for the recovery of your financial assets, you can be assured that we can regularly provide you with the latest update on the case as we can assign our dedicated team to solely concentrate on your case. Visit Global Financial Recovery for expert advice on securing your financial future and protecting yourself from fraud.

Being well-informed and vigilant can protect you from fraudulent wire transfers and keep your finances safe. Always verify any wire transfer requests and use secure methods when dealing with large transactions.

FAQs (Frequently Asked Questions)

Contact your bank immediately to attempt a reversal, report it to law enforcement, and gather any evidence, like emails or messages, for further investigation.

Yes, prevention involves verifying requests directly, using secure communication channels, and setting up two-step verification for transfers. Staying vigilant and confirming details can help reduce your risk.

Common signs of wire fraud include unexpected requests for payment, especially urgent or rushed requests. Fraudsters may use fake emails, urgent language, or high-pressure tactics to push you into completing a transfer. Be cautious of any unusual details, and verify before proceeding.

Some common wire fraud scams include business email compromise (BEC), where scammers impersonate executives to authorize fake payments, and real estate fraud, where scammers pose as agents or title companies. Always verify requests through direct communication and trusted contacts.

Most of the time, the money cannot be easily recovered after the successful completion of a wire transfer. However, acting immediately can get you started in reversing a scam by reaching out to your bank; it simply depends on how fast the scam is reported, so keep a close eye and act as soon as something goes wrong.