- Romance

- May 15, 2025

Table of Contents

Online love can feel magical - until it turns into a scam. In 2023 alone, romance scammers stole $1.14 billion from Americans, with median losses hitting $2,000 per victim, according to the Federal Trade Commission. The worst part? Many didn’t lose money to strangers - they lost it to someone they thought they were in love with.

Welcome to the world of crypto romance scams, where digital charmers use dating apps, love bombing, and emotional manipulation to gain trust fast. Once the bond feels real, they strike. The setup? A fake cryptocurrency investment.

The catch? A fake tax return or crypto tax fee you must pay to "unlock" your profits.

This isn’t just digital romance fraud - it’s financial abuse dressed as affection. Victims are tricked into paying fake crypto tax invoices, often through shady platforms that vanish once the money is gone.

These dating and romance scams are evolving fast, and no one is safe. The goal of this guide is simple: to show you how these scams work, the red flags to spot, and how to protect both your heart and your crypto wallet.

Understanding Crypto Romance Scams

A crypto romance scam is when someone pretends to be romantically interested in you, usually online, eventually, with one goal: to steal your money using fake cryptocurrency investments. These scams are rising fast, especially across dating apps and social media.

The playbook is simple but dangerous. It starts with a fake online relationship, filled with affection and consistency. The scammer appears emotionally invested. They might even video chat (with deepfakes or stand-ins), send gifts, or talk about a future together. This builds trust, and that trust becomes the weapon.

Once you’re emotionally hooked, the scammer introduces a “golden opportunity,” usually a crypto investment. It could be Bitcoin, altcoins, or a new trading app they “use themselves.” It looks legit. It works at first. You might even see fake profits in your account. But when do you try to withdraw the money? That’s when it turns dark.

Suddenly, you're told there's a “tax,” “clearance fee,” or “regulatory hold” on the funds. They might say it’s a blockchain compliance step, a pre-withdrawal crypto tax, or even a government rule. It sounds official, but it’s all fake. You’re not investing. You’re being drained.

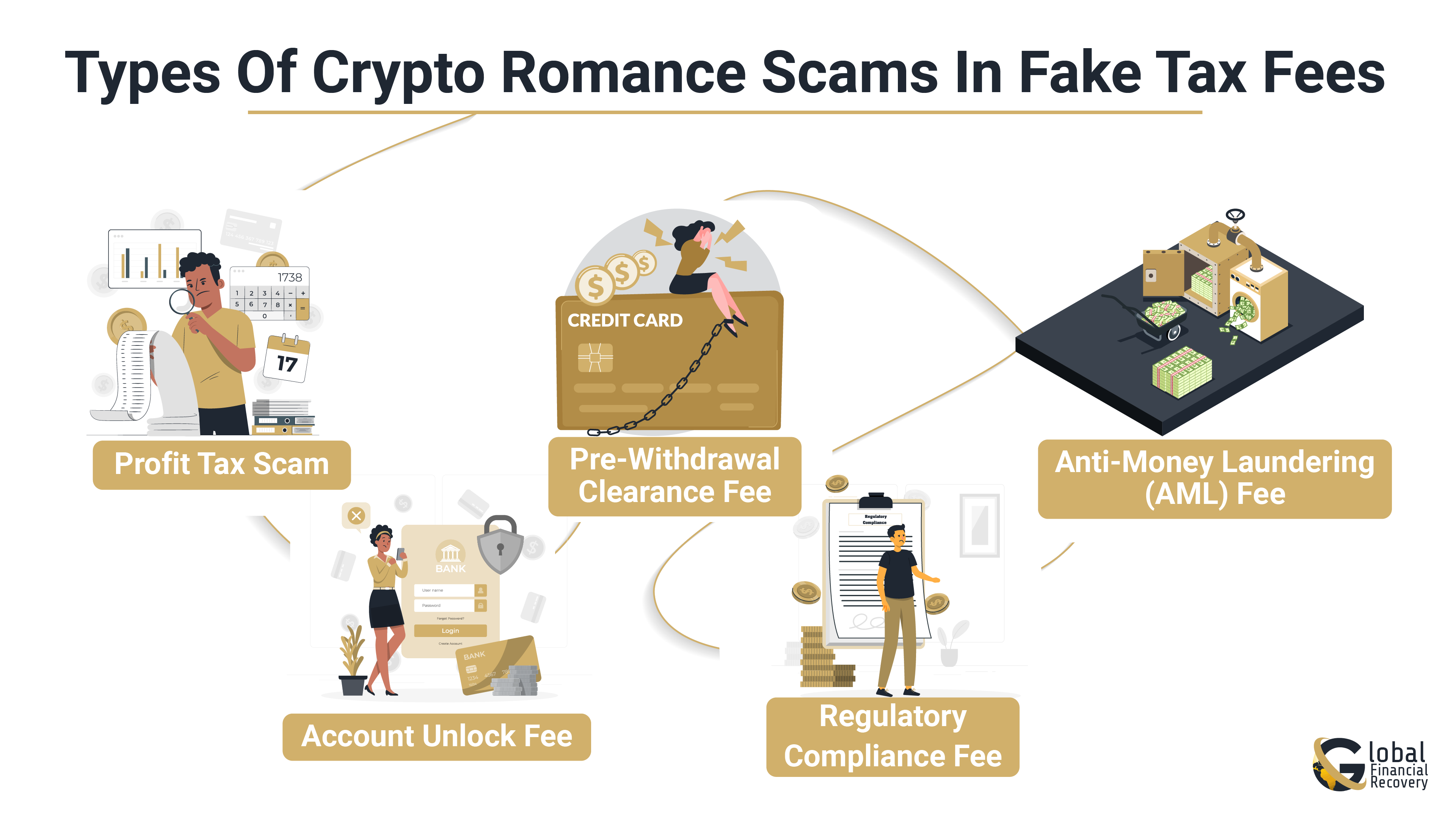

Types of Crypto Romance Scams in Fake Tax Fees

Crypto romance scams have evolved, with fraudsters employing various deceptive tactics to exploit victims emotionally and financially. A prevalent method involves the use of fake tax fees to illicitly obtain funds. Below are common types of these scams:

1) Profit Tax Scam

In this scheme, after convincing the victim to invest in a fraudulent cryptocurrency platform, the scammer creates substantial profits. When the victim attempts to withdraw these non-existent gains, they are informed of a mandatory "profit tax" that must be paid upfront. This tax is entirely fake, and any payments made go directly to the scammer.

2) Account Unlock Fee

Here, the scammer claims that the victim's account has been "locked" due to security protocols or regulatory issues. To regain access, the victim is instructed to pay an "unlock fee." This fee is baseless, serving only as a means for the scammer to extract additional funds.

3) Pre-Withdrawal Clearance Fee

In this variation, victims are told that a "clearance fee" is required before any withdrawals can be processed. The scammer asserts that this fee is a standard procedure to comply with financial regulations, but in reality, it's another way to get money.

4) Regulatory Compliance Fee

Scammers may claim that new government regulations necessitate a compliance fee to continue trading or withdrawing funds. This tactic exploits the victim's lack of familiarity with financial regulations, convincing them to pay to avoid legal complications.

5) Anti-Money Laundering (AML) Fee

In this scenario, the scammer insists that an AML fee is required to verify the legitimacy of the funds before processing any withdrawals. This pretense leverages the victim's awareness of financial crime prevention measures to justify the fraudulent fee.

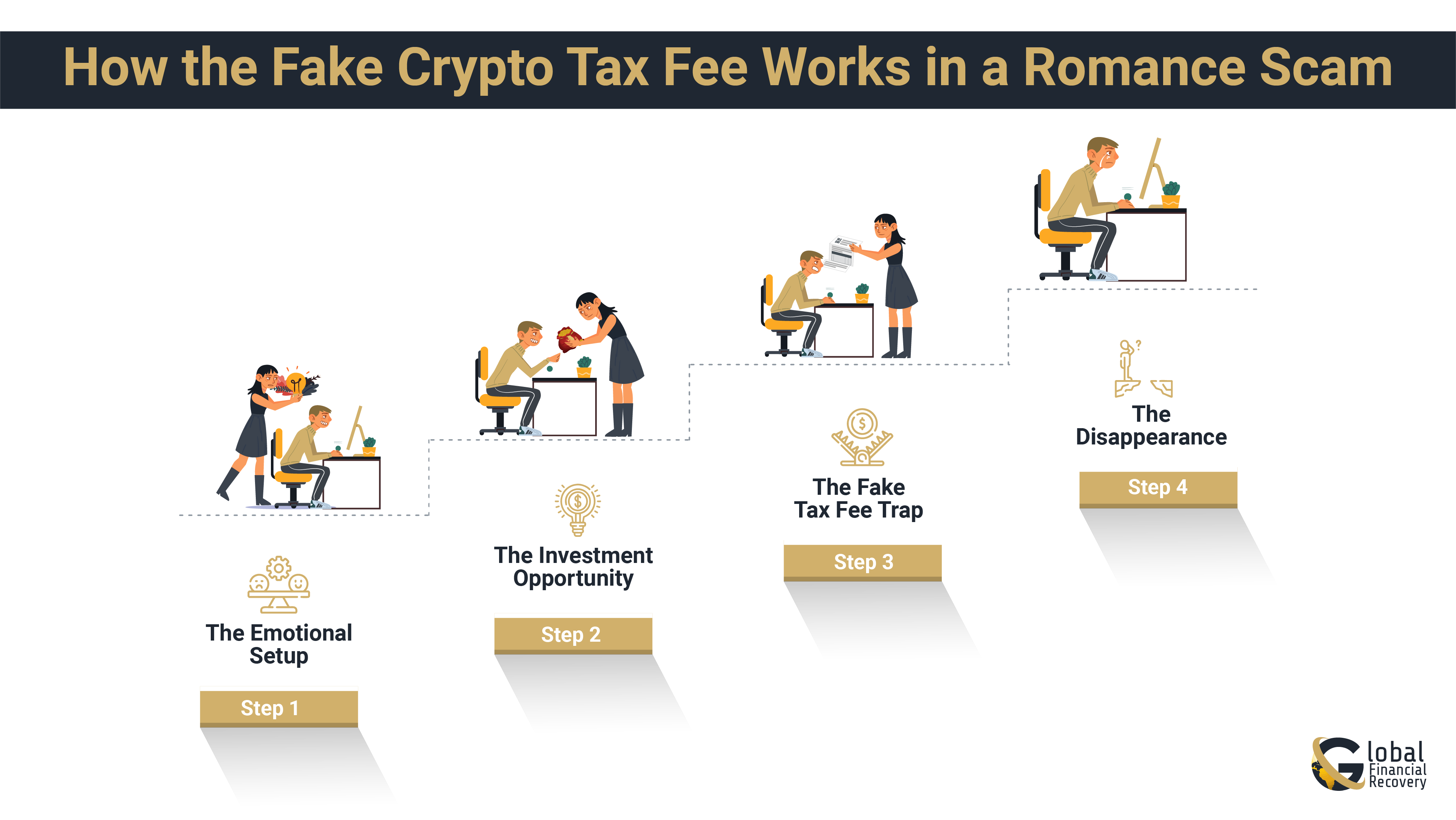

How the Fake Crypto Tax Fee Works in a Romance Scam?

Cryptocurrency romance scams have grown, and one of the most damaging tactics used today is the “fake crypto tax fee” scam. At its core, this method involves emotionally manipulating victims into believing they owe a tax or other regulatory fee before they can withdraw their funds. Here's how it works, step-by-step:

Step 1: The Emotional Setup

Scammers don’t begin with money—they begin with trust. Victims are approached through dating apps or social platforms, where the scammer builds a connection over time. The communication is consistent, supportive, and emotionally intimate - often referred to as love bombing.

They pretend to share the same values, future plans, and even financial interests, especially in cryptocurrency. This emotional grooming lays the foundation for financial exploitation later.

Step 2: The Investment Opportunity

Once trust is established, the scammer introduces the idea of investing together, often through fake crypto exchanges or unlicensed trading apps that appear professional and secure.

Victims are encouraged to deposit small amounts first, and they often see fake profits accumulate on the dashboard. This is part of the illusion. The returns appear real, creating confidence in the platform and in the scammer's financial guidance.

Step 3: The Fake Tax Fee Trap

When the victim tries to withdraw their funds, they’re told there’s a tax clearance fee, blockchain compliance charge, or a pre-withdrawal tax requirement, terms that sound legitimate but are completely fabricated.

These fake fees are usually explained as:

- Government-mandated crypto withdrawal tax

- Pre-withdrawal processing fee

- Anti-money laundering (AML) clearance fee

- Regulatory compliance cost for international transfers

Victims are often sent realistic-looking tax invoices, sometimes with government-style branding or blockchain references. These are meant to pressure the victim into paying immediately, often within 24–48 hours, or risk “forfeiting” their earnings.

Step 4: The Disappearance

Once the victim pays the fake tax, the scammer either:

- Demands more money under a new pretext (e.g., an additional fee or another regulatory hurdle)

- Cuts off all communication

- Shuts down or deletes the fake crypto platform

At this point, the funds are unrecoverable. Many victims report losses of tens of thousands of dollars, often believing until the very end that the relationship and investment were real.

Red Flags of a Crypto Romance Scam

It often starts with charm, attention, and promises of forever. But behind the screen, romance scammers are building something very different, a trap. These scams aren’t just about money; they exploit your emotions, trust, and deepest vulnerabilities.

Here are the biggest red flags to keep an eye on, and how they may be affecting you emotionally, even before a dollar is gone:

|

Red Flag |

What They Might Say |

Why It’s Suspicious |

How It Makes You Feel |

|

Fast-Forward Romance |

“You’re my soulmate. I’ve never felt this way before.” |

Love bombing is used to build fast trust and emotional dependence. |

Flattered, emotionally hooked, and maybe a little unsure. |

|

Avoid Video Calls or Meeting in Person |

“I’m overseas for work” / “My camera’s broken.” |

Avoiding face time is a red flag, they’re likely using fake identities. |

Confused, frustrated, but still hopeful. |

|

Talks About Crypto Profits Early |

“I’ve been making money easily. You should try it too.” |

Scammers introduce crypto to lure you into fake investments. |

Curious, tempted, but unsure. |

|

Shows Big Returns on Fake Dashboards |

“Your $1,000 is now $8,000. See how fast it grows?” |

Fake platforms are built to show false growth and bait more money. |

Excited, optimistic, but confused why you can’t access funds. |

|

Mentions a Tax or Withdrawal Fee |

“You just need to pay the tax before you can withdraw.” |

Legit platforms don’t ask for taxes upfront, this is fraud. |

Pressured, nervous, but already emotionally invested. |

|

Pushes Unknown Crypto Platforms |

“This exchange is more private, better than the big ones.” |

Scam platforms look real but are unregulated and unsafe. |

Skeptical, but you trust the person, so you go along. |

|

Asks You to Keep It Secret |

“No one will understand us. Don’t tell anyone.” |

Isolation is a classic scam tactic to prevent outside input. |

Lonely, dependent, afraid to lose the connection. |

|

Gets Defensive or Changes the Story |

“Why don’t you trust me? I thought we had something real.” |

They guilt-trip or gaslight when you ask questions. |

Conflicted, torn between red flags and emotional attachment. |

|

Applies Time Pressure |

“This offer closes today, don’t miss out.” |

Urgency is designed to stop you from thinking logically. |

Anxious, rushed, afraid of missing out. |

Scammers target your heart before your wallet. They play on trust, love, and hope. Spotting these red flags early isn’t being paranoid, it’s being smart.

Real Life Example of Crypto Romance Scam

Tom's $120,000 Loss in a Romance Crypto Scam

In early 2024, Tom Harris, a 48-year-old man from Chicago, was tricked into a crypto romance scam that cost him $120,000.

Tom had been chatting with a woman he met on a dating app. After talking for a few weeks, she told him she was an expert in cryptocurrency and encouraged him to invest in a crypto platform she was using. The woman promised huge returns and made Tom feel like they had a special connection.

Tom sent $50,000 to start, and soon after, the scammer told him that to withdraw his money, he needed to pay a tax fee of $70,000. She showed him a fake tax invoice that looked real, so Tom believed it was necessary to get his money back.

But after he paid the fee, the platform disappeared, and so did the scammer. Tom never got his money back.

This is a clear example of how romance scammers manipulate emotions to trick people into paying fake tax fees. They use fake crypto exchanges and convincing stories to make their victims believe they need to pay up to access their money.

For more real-life cases of crypto tax scams and how victims have recovered stolen funds, visitCrypto Tax Scam Case Studies.

How to Protect Yourself from Future Crypto Scams?

Crypto scams typically begin where you least expect them, in conversations that feel personal and sincere. Victims are initially contacted through social media or dating apps, where scammers establish a rapport before presenting a bogus investment opportunity. If somebody you've met on the internet begins discussing crypto gains or requiring assistance with "tax fees" to release funds, it's a huge red flag.

Legitimate sites never charge taxes or fees to free up your crypto. These so-called "tax clearance fees" or "unlocking charges" are fraudulent, intended to have you send money while the scammer gets away.

To be secure, avoid unregulated sites and research where you send money every time. Employ well-established wallets, activate two-factor authentication, and don't share your wallet keys or recovery phrases with anyone.

Stay informed, because crypto scams evolve fast. If something feels off, trust your instincts and verify before acting. And if you’ve been scammed, report it immediately to IC3.gov or reportfraud.ftc.gov.

Keep your crypto as you keep your heart cautiously, clearly, and with awareness.

What to Do If You’ve Been Scammed?

If you’ve been scammed, know this first, it’s not your fault. Romance scammers are skilled at emotional manipulation. They build trust, play on feelings, and make the lies feel real.

Start by saving every message, payment proof, and wallet address. These details matter for reporting and possible recovery. Report the scam right away to FTC.gov andIC3.gov, even if you’re unsure; it’ll help, and your report could stop the next scam.

You can also reach out to crypto recovery experts who use blockchain tracking to help trace stolen funds. And if you lost a large amount, speak with a tax professional about a possible crypto scam tax deduction.

Most importantly, take care of yourself. These scams hurt more than just your bank account, they shake your trust. But you're not alone, and you can move forward.

What Happens When You Know the Truth About Crypto Romance Scams?

Understanding how crypto romance scams really work isn’t just a defense, it’s a form of empowerment. These schemes thrive in silence and secrecy. But now that you know how they operate, what to look out for, and what steps to take, you’re no longer an easy target.

This blog wasn’t just a list of red flags. It’s a roadmap, showing how digital romance traps are set and how you can walk right past them without getting pulled in. You’ve gained insights that could protect not just your money but also your trust and peace of mind. Scammers count on confusion. But now you know the difference between real platforms and fake tax return tactics, between sincere connection and emotional manipulation.

You’re in a stronger position than before. Hold onto that. Protecting your wallet starts with knowledge, and protecting your heart starts with boundaries.

Conclusion: Protect Your Heart and Wallet

Understanding how crypto romance scams work isn’t just about spotting red flags, it’s about reclaiming control. When you know the tactics, the tricks, and the emotional hooks scammers use, you’re far less likely to fall for them. This knowledge turns vulnerability into awareness and fear into preparation.

This isn’t just about avoiding a fake tax return or a shady exchange, it’s about protecting your emotional well-being and financial future. Romance scams are designed to bypass logic and tap directly into trust. But when you see the patterns clearly, they lose their power.

By reading this blog, you’ve already taken a major step forward. You now know how crypto dating scams are structured, what emotional manipulation looks like, and how scammers turn affection into pressure. You’ve also learned how to respond, recover, and report, which is knowledge most victims only discover after it’s too late.

So, stay cautious. Stay connected to real, verifiable platforms. And most importantly, trust your instincts, not the digital romance traps disguised as love.

Your heart and your wallet both deserve protection, and now, you're equipped to guard both.

Need Help Recovering Stolen Crypto?

FAQs (Frequently Asked Questions)

Some last weeks, others drag on for months. These scams are often called “pig butchering” because the scammer slowly builds trust before the financial strike. The emotional grooming process is long, calculated, and convincing. Victims often don’t realize the truth until after multiple payments.

'Address Reuse' refers to using the same cryptocurrency address for multiple transactions, which can compromise privacy and security. It's advisable to use a new address for each transaction to enhance security.

Scammers use 'Peel Chains' by sending cryptocurrency through a series of small transactions to different addresses, making it challenging to trace the original source of the funds.

The 'Layering' phase in money laundering involves intricate transaction networks designed to conceal illegal fund origins, creating substantial challenges for authorities attempting to track financial movements.

'Common Spend' occurs when multiple inputs in a cryptocurrency transaction are used together, potentially revealing that the inputs belong to the same owner, thus compromising privacy.