- Cryptocurrency

- April 7, 2025

Table of Contents

Crypto investment is booming, but so are crypto withdrawal scams. Fraudsters increasingly target investors with fake tax charges and crypto tax clearance fraud schemes. Reports show that global losses to cryptocurrency scams exceeded $1 billion in 2022 alone. Therefore, there is an increasing need for awareness around bitcoin fraud, crypto tax fraud, and deceptive practices like false tax returns.

The effects of crypto withdrawal fraud are devastating, resulting in considerable losses of funds for investors around the world. These scams not only deprive people of their incomes but also harm the overall trustworthiness of the ever-growing cryptocurrency market.

This article breaks down how these scams work, their red flags, real-world cases, and how to protect your investments.

What is a Crypto Withdrawal Scam?

A crypto withdrawal scam occurs when fraudsters claim investors must pay 'crypto tax fees” or ‘compliance charges' before withdrawing funds. These are completely fake and are designed to steal money. Crypto tax clearance fraud occurs when fraudsters trick investors into paying fake tax charges before withdrawing funds. These scams come in various forms, including:

- Fake crypto tax clearance fees claiming to be mandatory

- Phishing attacks where scammers impersonate tax authorities

- Fake exchange demands for “compliance verification” fees

Many victims believe they are following regulatory tax requirements but end up losing their funds.

How Fake Tax Charges Are Used to Steal Money?

Scammers manipulate victims through:

- Fake IRS/SEC emails demanding crypto tax payments

- Phishing websites mimicking government portals

- Urgent withdrawal requests that pressure users into paying quickly

If you receive an unexpected crypto tax demand, verify it directly with official tax agencies.

How Crypto Withdrawal Fee Scams Work?

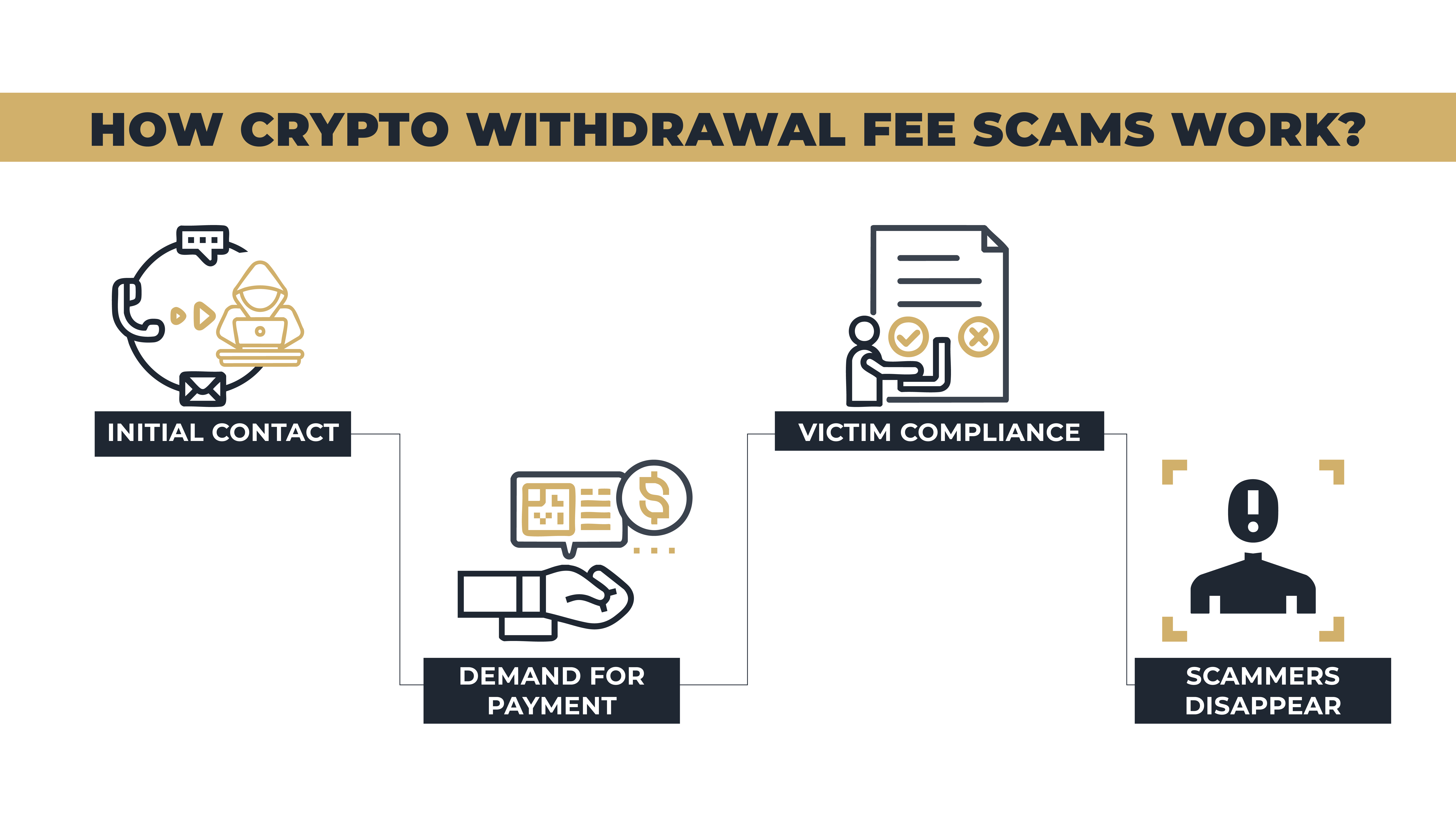

Crypto withdrawal fee scams typically unfold through a calculated step-by-step process:

- Initial Contact: Scammers first approach potential victims, typically crypto investors, pretending to represent tax agencies or cryptocurrency platforms. They might use official-looking emails or texts.

- Demand for Payment: Victims receive alarming messages claiming they owe taxes or "withdrawal fees" (fake tax returns). These communications often threaten legal action or asset freezing to create panic.

- Victim Compliance: Under pressure, investors comply and pay the demanded fees. Payments are usually made quickly to avoid further perceived legal trouble.

- Scammers Disappear: Once the payment is made, scammers vanish without a trace, leaving victims unable to retrieve their lost funds.

Common Platforms & Methods Used by Scammers

Scammers leverage various platforms and methods to make their schemes appear authentic.

- Fake cryptocurrency exchanges with high withdrawal fees

- Phishing emails pretending to be from Binance, Coinbase, or Kraken

- Telegram & WhatsApp scams urging “urgent compliance”

Stay alert and always verify withdrawal policies with legitimate exchanges. It is very important to protect your investments from fake crypto tax scams.

Red Flags: How to Identify a Fake Crypto Tax Charge

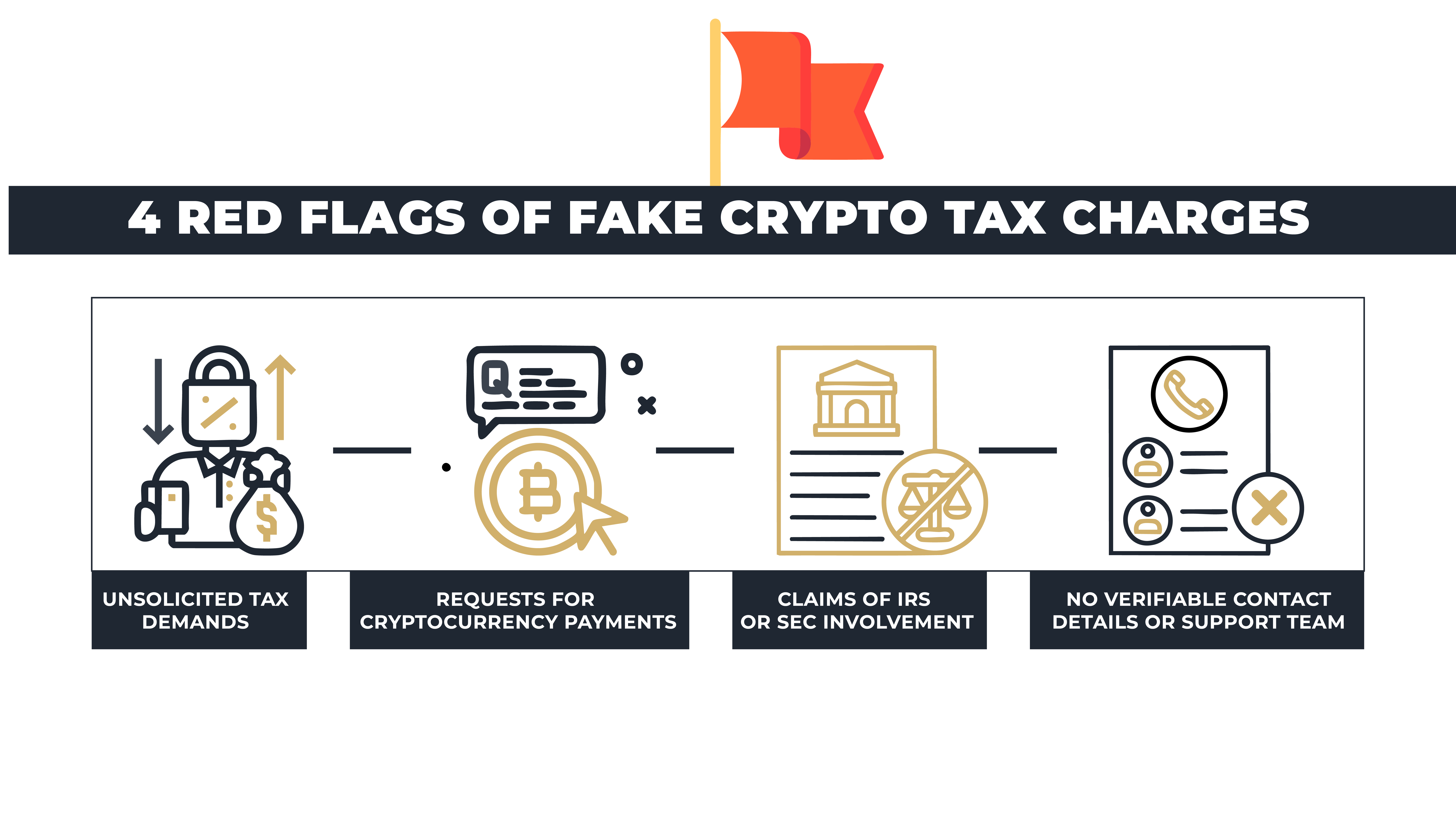

Recognize these key warning signs to know if you’re being targeted in a crypto withdrawal scam:

- Unsolicited Tax Demands via Email or Text

Scammers often send unexpected messages claiming you owe crypto withdrawal taxes. Legitimate tax agencies like the IRS do not demand payments through emails or texts.

- Requests for Cryptocurrency Payments

A clear sign of a scam is a request to pay taxes, specifically in cryptocurrency. Real tax authorities never accept crypto payments for taxes.

- Claims of IRS or SEC Involvement in Crypto Withdrawals

Scammers frequently pretend the IRS or SEC is involved in crypto withdrawals to pressure victims. Official government agencies do not directly handle or demand immediate cryptocurrency withdrawal taxes.

- No Verifiable Contact Details or Support Team

Scammers rarely provide genuine or verifiable contact details or customer support information. Legitimate organizations always offer clear, accessible ways to verify their contact information.

Stay vigilant by verifying suspicious claims with official sources to protect your crypto assets from scams.

Tabular Representation of Fake vs. Real Crypto Withdrawal Fees

|

Fake Crypto Withdrawal Fee |

Real Crypto Exchange Fee |

|

Sent via email, SMS, or social media |

Found only on official exchange platforms |

|

Requests crypto payments for tax clearance |

Deducted automatically from your trading account |

|

Uses threats and urgency to pressure users |

Fees are transparent and disclosed upfront |

|

Claims to be from the IRS, SEC, or tax agencies |

Legitimate tax fees never require crypto payments |

|

Requests wallet keys or login credentials |

Never ask for private keys or sensitive login info |

How to Verify a Legitimate Crypto Withdrawal Fee?

- Directly contact official tax authorities using known, verified channels.

- Avoid trusting sudden or unsolicited demands for payments.

- Immediately report any suspicious communication to the appropriate authorities.

Real-World Cases of Crypto Withdrawal Fee Scams

Case 1 — Fake Exchange Scam Steals $50,000

A trader attempted to withdraw Bitcoin from an unregistered crypto exchange but was asked to pay a 5% tax clearance fee. The victim paid the fee, but the platform blocked access and later disappeared.

Case 2 – Phishing Attack Through Fake Customer Support

A scammer posed as Binance customer support via Telegram, claiming the user needed to pay a tax fee to verify their withdrawal. Once the victim sends funds, the scammer cuts contact.

Case 3 — Scam Using Fake Tax Authorities

A victim received a fake IRS letter claiming they owed a crypto tax penalty. The letter provided a wallet address for payment. After verifying with the IRS, the victim realized it was a scam.

For more real-life cases of crypto tax scams and how victims have recovered stolen funds, visit Crypto Tax Scam Case Studies.

How to Protect Yourself from Crypto Withdrawal Scam?

Follow these steps to avoid falling for fake tax charges and protect your investments and mental peace.

- Verify fees on official crypto exchanges before paying any withdrawal tax.

- Never send cryptocurrency payments to an email request or an unknown wallet address.

- Check exchange regulations—licensed platforms do not charge separate tax clearance fees.

- Enable 2FA on all crypto accounts for extra security.

- Report scam attempts to authorities like the FTC, IRS, and SEC.

What to Do If You Were Scammed in a Crypto Withdrawal Fee Fraud?

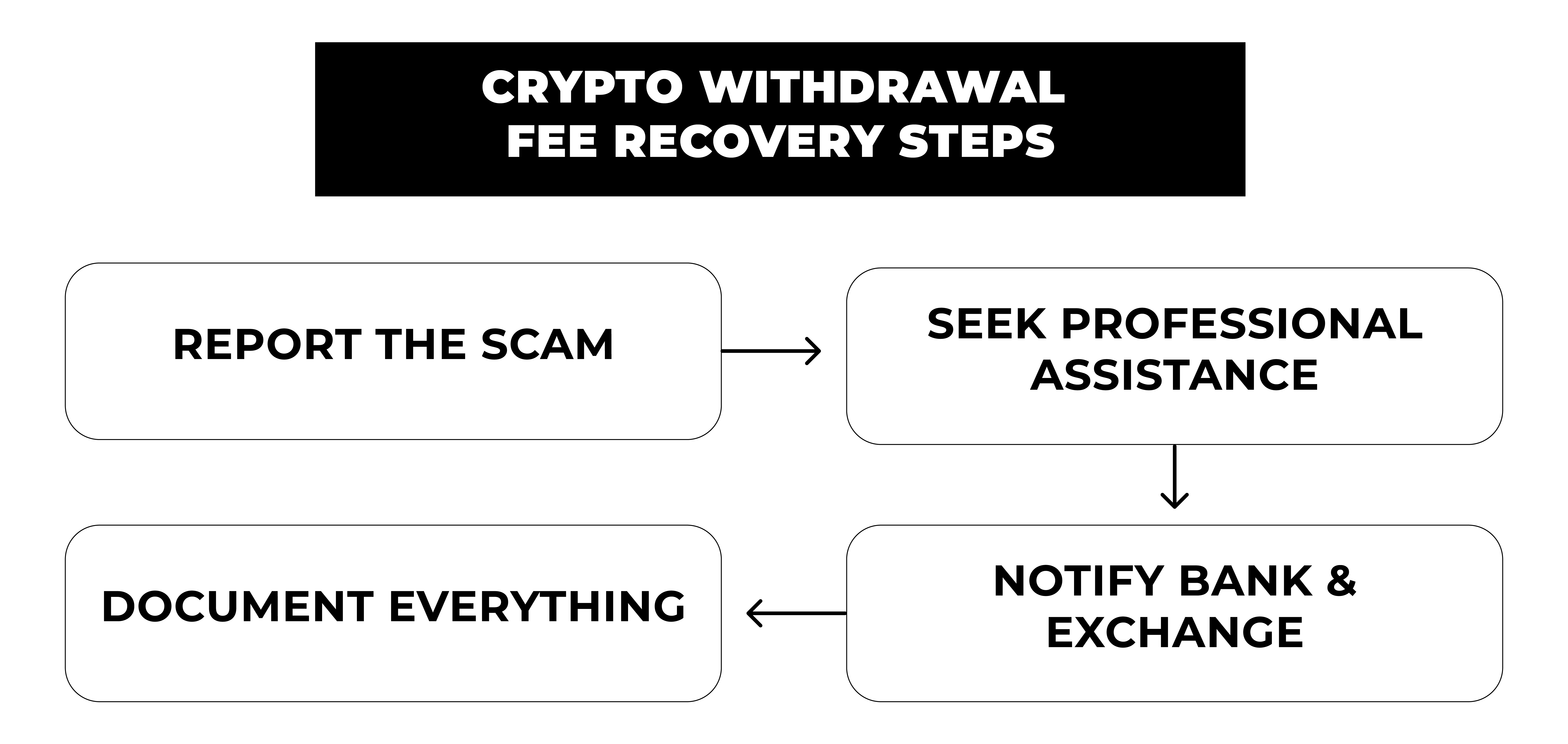

If you have been a victim of cryptocurrency withdrawal fee fraud, acting quickly can help you limit the damage and hopefully recover your funds. Follow the crypto scam recovery steps to safeguard your assets and prevent additional losses.

- Report the scam immediately to local authorities and financial institutions.

- Seek professional assistance from reputable crypto tax fraud recovery services.

- Keep detailed documentation of all communication and transactions related to the scam.

- Notify your bank and crypto exchange promptly to minimize further damage.

Conclusion

Crypto Scams are evolving and becoming increasingly sophisticated as the crypto market grows. Protecting your digital assets requires ongoing awareness, education, and proactive security measures.

Always independently verify tax-related charges or withdrawal fees, and never trust unsolicited communications without verification. Regularly update yourself on best cybersecurity practices and stay informed about the latest threats. Being proactive is the best strategy to avoid falling victim to crypto withdrawal scams.

Need Help Recovering Lost Crypto?

FAQs (Frequently Asked Questions)

Always verify with official tax agencies directly. Legitimate authorities do not typically ask for direct crypto payments.

No, legitimate exchanges never charge tax clearance fees directly; this indicates fraud.

Immediately report it to authorities, seek professional fraud recovery assistance, and document everything carefully.

Yes, they have become common as scammers exploit confusion about crypto taxes.

They exploit anxiety about taxes, creating urgency that compels victims to comply quickly.