- Cryptocurrency

- April 28, 2025

Table of Contents

Cryptocurrency has opened new doors for investment but has also attracted fraudsters. One of the most dangerous scams in the crypto world today is the pig butchering scam. Further, the scam, paired with fake tax fees, has become a growing threat.

These scams often begin with fraudsters posing as romantic partners, gaining the victim's trust, and later tricking them into paying fake tax fees or other withdrawal charges. The combination of romance scams and fake tax schemes continues to cause significant financial harm as well as mental harm to crypto investors.

According to Chainalysis, in 2024, crypto scam revenues reached approximately $9.9 billion, with pig butchering scams accounting for about 40% of this total, marking a 40% increase from the previous year.

This article will dive into how these scams work, common red flags, real-world examples, and practical steps to protect yourself from falling victim to these fraudulent schemes.

What is a Pig Butchering Scam?

A pig butchering scam is a form of online investment fraud where scammers spend weeks or even months cultivating a relationship with their targets, often posing as romantic interests, close friends, or trustworthy mentors.

The term “pig butchering” is derived from the Chinese phrase “shā zhū pán” (杀猪盘), which translates loosely to “pig-slaughter platform.” In this context, victims (the “pigs”) are metaphorically “fattened up” with promises of large profits or romantic connections before being “slaughtered” financially.

A pig butchering fraud is an investment scam that takes place over the long term in which scammers create false relationships in order to gain a victim's trust and then steal from them. The scammer, posing as a love interest, friend, or mentor, gradually lures the victim into what turns out to be an imaginary crypto investment.

Once the victim is emotionally committed, the scammer makes them go to a bogus platform that displays fake profits. Upon attempting to withdraw money, the scammer demands fake tax charges or fees and convinces them to send money again. Ultimately, the scammer vanishes, leaving the victim emotionally and financially drained.

How Scammers Use Fake Tax Fees to Steal Crypto?

During pig butchering scams, scammers usually bring in fake tax charges as part of the trickery. After scammers have established a connection with their victim and motivated them to invest in fake crypto schemes, they come up with fake tax notices to trick the victim into sending more money. The fake tax charges are presented to appear authentic and can be a major aspect of the scam that makes victims lose more money.

1. Establishing Trust through Romance

It usually starts with dating apps like Tinder, Bumble, or even WhatsApp. Scammers generally make profiles designed to appeal to emotionally vulnerable or innocent souls, using career photos and interactive bios. With a few days of chatting over the internet, they switch over to more personal messaging apps such as Instagram, Telegram, or WeChat to establish a close connection. Sweet messages, flattery, and even personal tales meant to impress you are some of the measures they take.

2. Introducing the Crypto Investment Opportunity

Once the scammer feels that trust has been established, they begin to introduce the idea of investing in cryptocurrency. They might say something like, "I’ve made a lot of money investing in crypto and thought you’d like to join me. It’s a great opportunity, and the returns are huge."

They often direct you to fake crypto investment platforms or apps that look legitimate but are designed to steal your funds. They will show off supposed screenshots of their gains, making it appear as though they’ve already earned significant profits.

3. The Fake Tax Fee Introduction

After you've invested at their request, they inform you that you must pay a "tax fee" before your earnings can be withdrawn. It's a clever strategy, usually facilitated by SMS messages, Telegram communications, or emails that appear to have originated from a credible body, such as the IRS or a tax collector.

The scammer may even include the line, "This is the final step to allow your withdrawal to be made. You have to pay the tax fee now, or you will lose all." The emails appear authentic, with identical logos, signatures, and terminology used by the IRS or other tax agencies.

4. Creating Urgency and Pressure

Scammers enjoy instilling a sense of urgency. On WhatsApp or Telegram messages, they may write, "If you don't pay this tax charge in the next 24 hours, your crypto account will be locked, and you'll never recover your funds." They lead you to believe that your access to all of your crypto investments is in jeopardy, and the fear of losing it all is an effective motivator.

5. You Pay the Fake Tax Fee

Panicking and under pressure, you agree to pay the fake tax fees. They may request you to transfer Bitcoin or other cryptocurrency to a wallet that they offer and claim it will be used to settle the taxes. Or, they may request personal bank account information or even wallet keys in the name of settling the fees. After you have sent the money, the scammer either goes out of contact or begins demanding more money, repeating the process.

6. The Scam Continues: They Ask for More Money

If you pay the initial "tax fee," they might come up with additional reasons to extract more money. They could say, "The tax fee wasn’t enough. You need to pay a withdrawal fee," or "There’s an extra charge for transaction processing." It’s all an elaborate ruse to keep getting you to send more money until you realize that you have nothing left and the scammer has disappeared.

Common Tactics Used by Scammers

Pig butchering scams are the art of an extremely skilled person who convinces his victim into paying some fraudulent tax fees or making an investment in so-called crypto scams. They play on human emotions and trust, often deploying schemes that copy even real financial institutions or tax agencies.

By understanding these tactics, you can better protect yourself and avoid becoming another victim. Here’s how they do it:

-

Romanticized Investment Opportunities

They usually start with a romance scam by forming a false online relationship with the victim. The scammer earns their trust with time, posing to them as someone seeking a real relationship. They then gradually introduce the possibility of investing in crypto, usually with the promise of high returns.

As the victim grows emotionally attached, they are lured into crypto investment schemes that seem too good to be true. The scammer eventually convinces the victim to send money or crypto to “grow” their investments.

-

Fake Crypto Tax Fees and Charges

Once the scammer has secured enough trust, they begin to introduce fake tax fees. They claim that for the victim to access their “earnings” or “crypto profits,” they must first pay taxes or cover a fake tax clearance fee. These charges are often framed as urgent and mandatory, preying on the victim’s fear of losing their investment. The scammer may use official-looking tax forms or IRS logos to make the demand appear legitimate.

-

Manipulation Through Fake Refund Offers

One of the usual tricks employed by pig butchering scams involves promising tax refunds that appear to be too good to be true. The victims are informed that they owe a tax refund due to their crypto investment or trading. To receive the refund, they are requested to pay a "small fee" or submit some personal details. Once the victim pays the fee or provides confidential information such as Social Security numbers or crypto wallet keys, the scammer vanishes with their money and personal information.

-

Creating a Sense of Urgency

The scammers try to build a false sense of urgency and compel victims to rush their decisions. Either it's a threat of taking them to court, freezing their account, or losing the investment, they try to make the victim take hurried decisions without knowing the outcomes. Such manipulation makes it more difficult for the victim to analyze rationally, causing them financial loss.

-

Mimicking Trusted Platforms and Tax Authorities

Fraudsters impersonate credible sites that have something to do with cryptocurrencies, tax collection, and tax agencies, of which the IRS is one of the examples. The phishing mail or the creation of imitation websites, almost similar to the original one, tricks the victims into providing important information like their login credentials, crypto wallet keys, or payment details.

Moreover, they may also use phone numbers or emails that, on the surface, look official but are discovered to be fake or spoofed when looked into more carefully.

Learn how to recognize such common scams so that you can actually protect your investments and also help yourself avoid pig butchering scams or any such fake tax frauds.

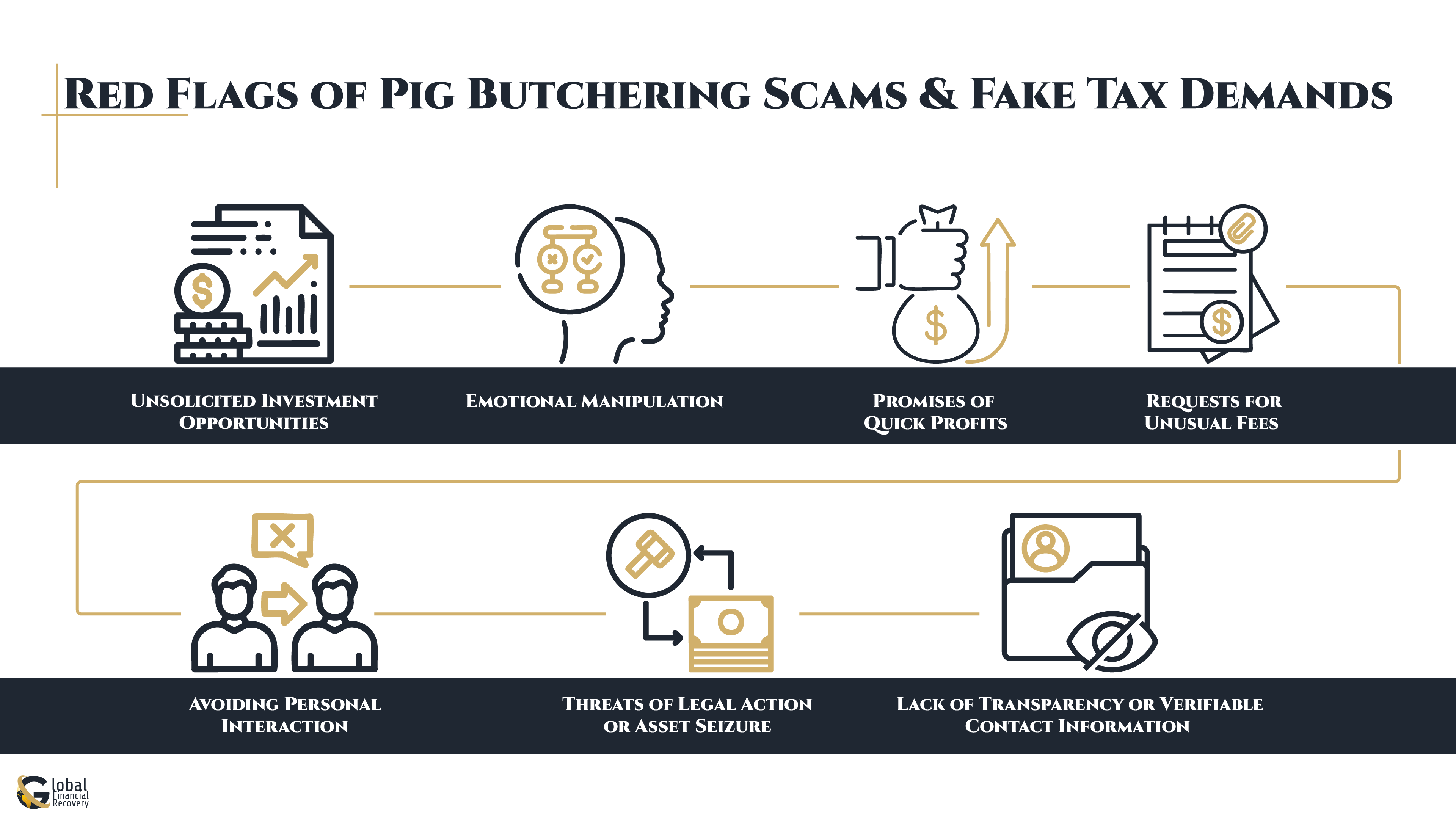

Red Flags of Pig Butchering Scams & Fake Tax Demands

Detecting pig butchering scams and fake tax fees early can prevent significant financial losses. These scams use psychological manipulation and urgency to deceive victims, making it crucial to be aware of the red flags. Below are common warning signs to look out for:

1. Unsolicited Investment Opportunities

Scammers often come in with unsolicited investment opportunities, particularly on social media or dating sites. They are represented as low-risk, high-reward, so they sound attractive.

Example: A victim gets a message from an online acquaintance stating that they can assist them in earning a significant amount of money in crypto investments. They are persuaded to transfer money urgently to "secure" their position. Eventually, the scammer takes the money and vanishes.

2. Emotional Manipulation

Scammers usually employ emotional manipulation as a means to establish trust from the victim, especially in romance scams. They cultivate a relationship with the victim and slowly roll out the possibility of investment. They emotionally oblige their victims.

Example: A woman starts an online relationship with someone she meets through a dating site. He persuades her to invest in cryptocurrency over time, assuring her that she can build wealth while "helping him out." The relationship ends when the money is depleted.

3. Promises of Quick Profits

One of the strongest red flags of pig butchering scams is the guarantee of high returns with low risk. Scammers tend to say that the crypto investments they are touting provide fast, guaranteed returns.

Example: A scam artist tricks a person into an investment scheme by promising returns that sound too good to be true, e.g., 100% gains in weeks. After the victim has invested money, he or she is informed that extra "fees" must be paid to access the returns.

4. Requests for Unusual Fees

They tend to create urgency through the demand for advance fees presented as requirements for unlocking funds or verifying that an investment is authentic. The fees usually involve phantom tax charges or crypto withdrawal charges.

Example: Once the victim has put money into an investment account, they are informed that a "tax clearance fee" must be paid in cryptocurrency to enable them to access their balance. Once paid, the scammer takes off with the money.

5. Avoiding Personal Interaction

Another warning sign of romance scams is when the scammer keeps avoiding in-person meetings or revealing any verifiable identity. This evasiveness is a method employed by scammers to preserve control over the situation and steer clear of scrutiny.

Example: A scammer comes up with all sorts of excuses not to meet face-to-face, e.g., they are away from the country or have personal problems. They finally say they require cash to "fix a problem" or invest in a venture, coercing the victim into sending money further.

6. Threats of Legal Action or Asset Seizure

Fake tax demands are frequently utilized to intimidate victims into paying extra funds. Thieves will indicate that the victim's account is being investigated or that their properties will be seized if they don't pay "tax fees" at once.

Example: A victim receives an email impersonating the IRS, warning that their crypto assets will be seized unless they pay a "tax penalty." The email pressures the victim to act immediately to avoid losing their assets.

7. Lack of Transparency or Verifiable Contact Information

Fraudsters usually decline to provide verifiable contact information, like official business addresses or numbers. They could also give generic email addresses or use messaging services, making verification nearly impossible.

Example: A victim is sent an email requesting them to invest urgently, but the email has a generic email address and an inconsistent website link that does not belong to any legitimate exchange.

Example of Pig Butchering & Fake Tax Fee Scams

This example shows how pig butchering scams can combine emotional manipulation and fake tax demands to cause devastating financial losses.

Romance Scam Leading to $100,000 Loss

One of the most notable pig butchering scams involved a victim named Sarah, a 45-year-old woman who met a man on a dating app. The man, who claimed to be an investment advisor, persuaded Sarah to invest in a "high-return crypto scheme." After several successful "investments" that seemed to generate profits, Sarah was then told she had to pay a "tax clearance fee" in order to withdraw her funds. This fake crypto tax fee was the scammer’s attempt to extract even more funds from her. Sarah, thinking she was complying with tax regulations, ended up sending thousands of dollars in cryptocurrency to the scammer.

For more real-life cases of crypto tax scams and how victims have recovered stolen funds, visit Crypto Tax Scam Case Studies.

What to Do If You've Fallen Victim to a Pig Butchering or Fake Tax Fee Scam

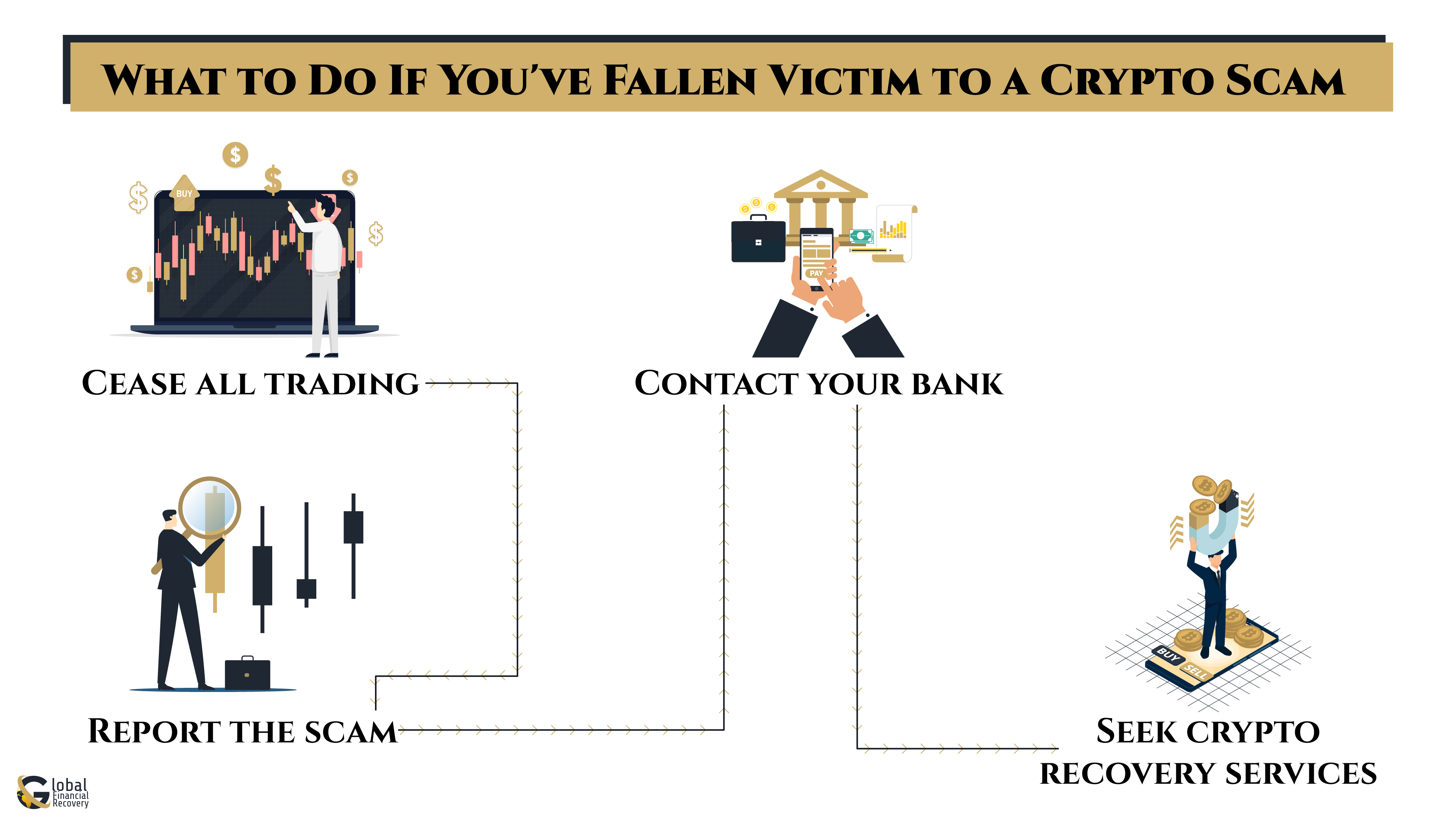

When you find yourself being a victim of a pig-butchering scam or a fake tax fee scam, surely, it is going to be a time when you feel distressed; however, it is important to act fast. Take immediate action by halting all further transactions.

The next step is to cease any communication with the scammer, as well as to stop further funding or providing personal details. Report this issue to your crypto exchange, the IRS, or the relevant tax authority in your country.

The sooner you report the incident, the higher the possibility that tracing will be done on the scammer. It would be wise, though, to get help from professional crypto fraud recovery specialists who would enable you to navigate through the whole fund recovery process. They would go further with guiding you through any legal proceedings needed.

Conclusion

Protecting your crypto investments from scams, especially pig butchering and fake tax fees, is about staying vigilant, informed, and prepared. By being proactive and understanding the scams, you can make better decisions and avoid falling victim to fraud.

Think about it: how many times have you rushed to respond to an email or text, only to regret it later?

Scammers know how to exploit emotions like fear and urgency. But when you're prepared and armed with knowledge, those feelings lose their power. You can stop, breathe, and take a moment to verify the authenticity of the message—whether it’s a crypto tax scam or a fake tax fee demand.

Need Help Recovering Stolen Crypto?

FAQs (Frequently Asked Questions)

Yes, there are clear red flags:

- Unsolicited romantic interest or financial advice.

- Overly persuasive behavior encouraging quick investments.

- Requests for crypto payments or fake tax fees.

- Too-good-to-be-true returns on investments or crypto tax refunds. Always be wary of such advances and verify any information before taking action.

Scammers using AI technology are developing increasingly complex methods. Advanced chatbots combined with deepfake technology enable scammers to masquerade as real people, including fake crypto platform agents or friends, to deceive victims into paying fraudulent fees or disclosing sensitive data. Cross-check information with official sources while maintaining vigilance against unexpected communications.

The financial damage from pig butchering scams escalates when victims are deceived into thinking they need to pay fraudulent taxes and fees to access their funds. The issuance of fraudulent allegations undermines confidence in cryptocurrency markets while simultaneously causing both major financial losses and identity theft.

Fake crypto tax fees do not have a direct effect on your credit score, but losing money to these scams can lead to indirect impacts if you depend on those funds for personal needs or investments. Reporting the scam becomes essential to stop additional financial damage from occurring.

The use of emotional manipulation stands as a primary strategy. Scammers exploit human feelings of isolation alongside trust and greed to achieve their goals. An unnatural romantic bond may form between a scammer and a victim while fraudsters promise exceptional crypto investment returns to manipulate emotional responses and secure financial transfers.